Trump’s Great Monetary Reset

I have studied American economy and economic politics in the base text and numerous articles on my website. Here below some links

Base text: Key drivers of economic capabilities , Economic capability of the US

Articles: Economic sphere in the boiling great power relations, September 26, 2024

Economic positions of great powers in Spring 2024, April 26, 2024

Glimpses in economic dimension of current great power competition , December 10, 2023

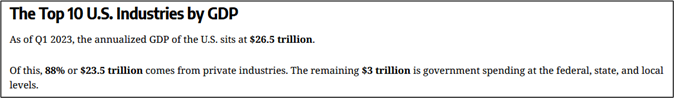

Now, key drivers in current American economy can be wrap up in the following way:

- massive and constantly growing debt in all sectors of the American society

- significant decline in the US manufacturing, supply chain distortions

- issue of gold and other metals and minerals

- position of the US dollar as the only reserve currency

- Trump’s “Great Monetary Reset”

MASSIVE AND CONSTANTLY GROWING DEBT IN ALL SECTORS

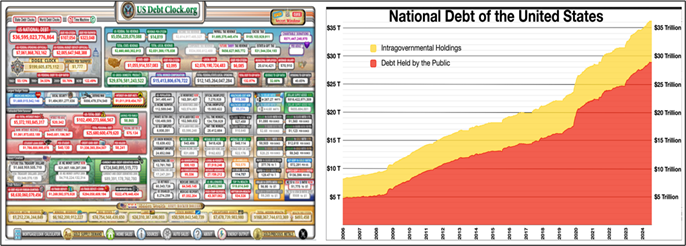

This topic has been analyzed so many times that here I am just referring to some illustrative examples and graphics.

US National Debt Clock is in full throttle: https://www.usdebtclock.org/ and the federal debt exceeds $36 trillion.

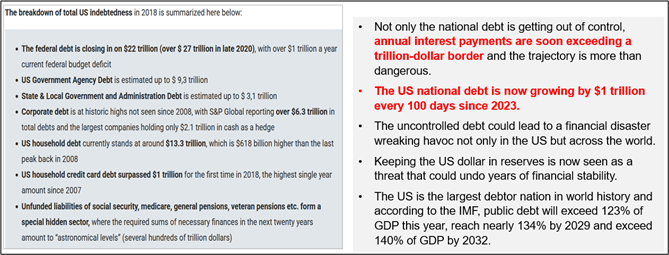

Not only the federal debt is at “astronomical” level, the debt levels are growing in Government Agencies, State & Local Governments, Corporates, US Households and Credit card debts. Unfunded liabilities of social security, medicare, general pensions, veteran pensions etc. form a special hidden sector, where the required necessary finances will be over $150 trillion in early 2030s.

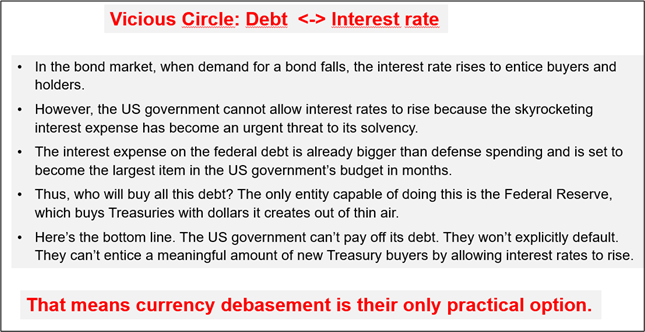

This year, annual interest payments of the national debt exceed a trillion-dollar border and the national debt is growing by $1 trillion every 100 days since 2023. This trajectory is very dangerous and absolutely unsustainable.

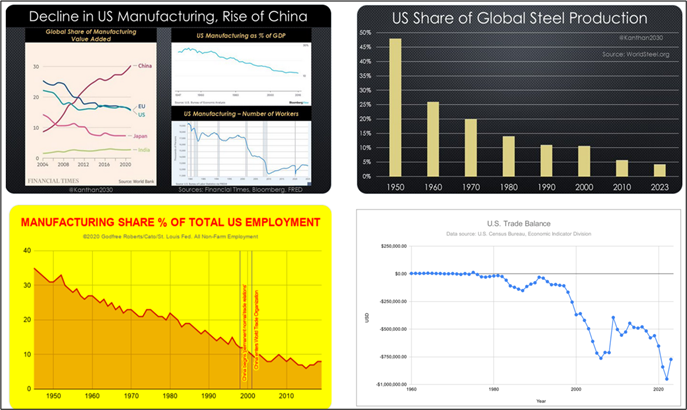

SIGNIFICANT DECLINE IN US MANUFACTURING

Declining US manufacturing, lack of real investments and lowering realproduction have been a typical trajectory of the US economy for years, which has distorted industrial supply chains. Here below some illustrative charts and data.

The US has offshored its industrial and manufacturing economy to Asia and Mexico. When the goods and services come into the US to be marketed, they come in as imports, thus enlarging the US trade deficit.

ISSUE OF GOLD AND OTHER METALS AND MINERALS

Golden Rule of Geopolitics: “Who holds the gold, makes the rules”

Today the major precious metals in the market, having also with strategic value and use, are gold, silver, platinum and palladium. Among other minerals, the diamonds are the most valuable.

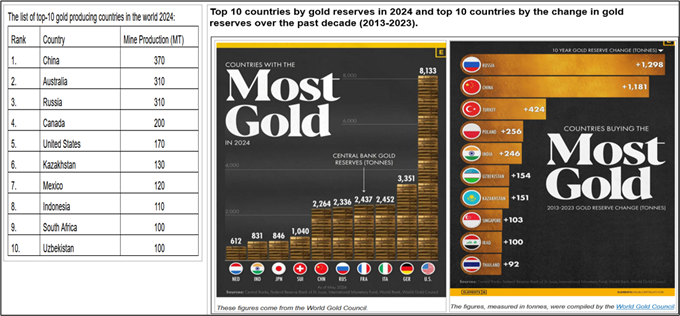

Top-5 gold producers in the world are China, Australia, Russia, Canada and the US. Monetary gold is still one of the most important parts of the national reserve assets of any sovereign country and obviously one of the key investment assets. Top-6 holders of monetary gold are the US, Germany, Italy, France, Russia and China. The biggest buyers of gold in ten last years have been Russia and China.

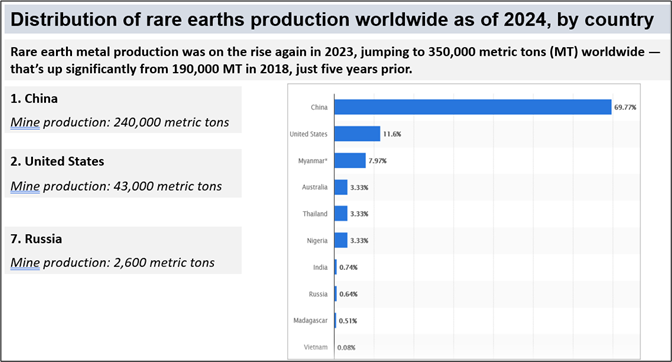

Rare earth elements (REEs) are a group of seventeen chemical elements that occur together in the periodic table of chemical elements. The group consists of yttrium and the 15 lanthanide elements (lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium). Scandium is found in most rare earth element deposits and is sometimes classified as a rare earth element.

Critical and strategic defense use REEs.

Rare earth elements play an essential role in the defense industry. The military uses precision-guided weapons, communications equipment, GPS equipment, batteries, night-vision goggles and other defense electronics.

Rare earth metals are key ingredients for making the very hard alloys used in armored vehicles and projectiles that shatter upon impact. Substitutes can be used for rare earth elements in some defense applications; however, those substitutes are usually not as effective and that diminishes military superiority.

Key strategic metals and minerals

The US House Committee defined those materials in the following way: “Strategic and critical metals/minerals are vital to our everyday lives. They are essential components of renewable energy, national defense equipment, medical devices, electronics, agricultural production and common household items.”

Metals/minerals for military use are always both strategic and critical. Such metals and minerals: aluminium, cobalt, copper, gallium and germanium, magnesium, nickel, titanium, uranium and vanadium. In most of these groups, major producers are China and Russia, only in few cases the US is within top ten producer.

POSITION OF THE US DOLLAR AS THE ONLY RESERVE CURRENCY

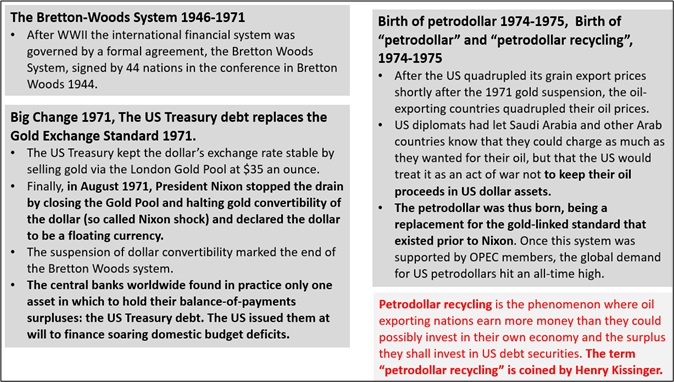

To be the reserve currency means that the country’s debt is the reserves of all other countries’ central banks. Therefore, an increase in US government debt was not a problem, because it meant an increase in reserves of the world’s central banks. This is why financing the US debt was never a problem.

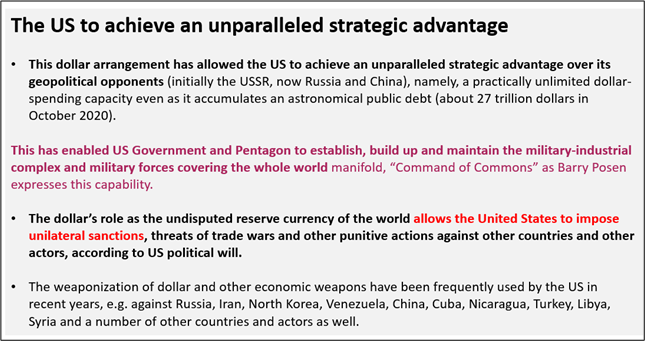

The status of US dollar as the main international reserve currency, after WWII, has been and is today the most important single factor behind the great power game and the changes in the polarity of the international system.

WHAT IS TRUMP’S” GREAT MONETARY RESET”

The US is inching closer to an economic and monetary Abyss. Team Trump knows it and radical new ideas are about to go into effect, the kind that bring massive changes to the existing order. Team Trump – is rolling out a radical plan to fix what’s wrong with US monetary policy.

Trump has surrounded himself with his own cadre of wealthy, successful billionaires. Trump’s team really does have a workable plan to avoid The Abyss and bring about a new golden age for America. Trump understands debt and how to restructure his way out of bankruptcy. He’s done it half a dozen times in his own life. He knows what’s coming.

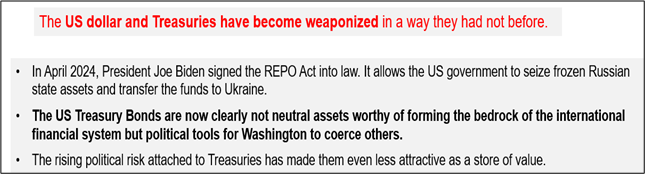

Trump has a plan to overhaul the role of the US dollar in world trade. This will be by far the biggest thing to happen to the monetary system since August 15, 1971 – the day Nixon severed the dollar from gold. Starting in November, right after Trump’s victory, gold began fleeing London (LBMA) for the US. The sheer quantity of gold purchased caused delivery delays went from two days to two months. That’s why the panic in London is so significant.

Gold is coming home to the US because its historical role as an anchor of sanity in the monetary system. Team Trump is preparing for a gold audit. China, Russia and the BRICS nations want to know just how solvent (or insolvent) the US really is, because they want out of the current US-led monetary order.

Trump isn’t just remonetizing gold because of other Central Banks buying. He has a plan to monetize everything – “monetize the asset side of the US balance sheet” – and put the US back on a path of real wealth through productivity.

Team Trump is to fix all flawed issues in one bold stroke, proposing the biggest change to the monetary system in over 50 years:

- Unsustainable US debt

- Strategic wealth of the US

- Lack of good manufacturing jobs in the US

- High trade imbalances and…

- The fatal flaw in the US dollar that keeps it artificially strong and forces the US to keep printing and bailing out Wall Street

- Revaluing gold to current market prices is just the first move.

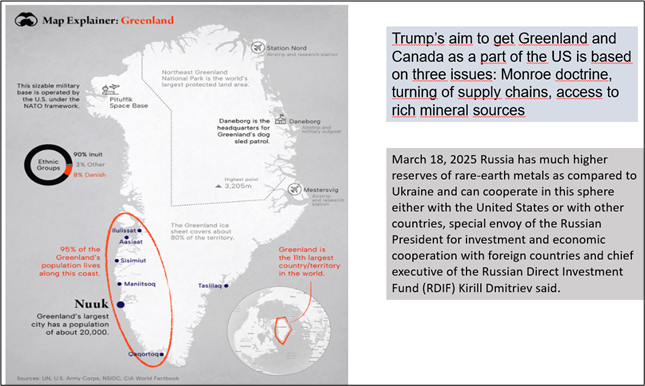

Trump’s plan is breathtaking in its scope, ambitious plan to keep the US on top in the coming multipolar world, aiming is to redraw the map of US supply chains.

But this is not just about bringing back jobs and productive capacity. Trump’s plan also gives the US newfound wealth in the realm of raw materials – i.e. the resources required to rebuild US supply chains. That’s what all the Greenland talk is about.If that doesn’t happen, nothing else matters – because the US will be in the Abyss.

But there are the consequences to Trump’s plan – one of which is a guaranteed period of painful adjustment. Trump’s plan will devalue the dollar and revalue gold in a very delicate and specific way.