Economic capability of China

Economic outlook and debt position of China

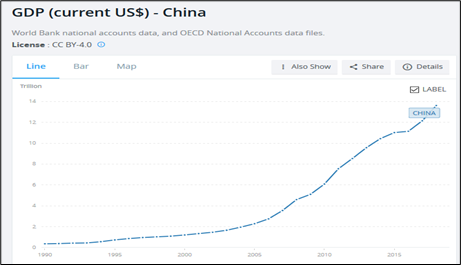

China has enjoyed a continuous economic growth during the whole period since the end of the Cold War.

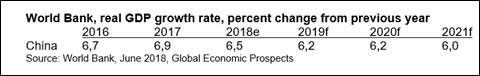

Economic growth in China reached over 6% level and has remained on that solid level. Activity continues to shift to consumption, while investment growth rates remain well below those in recent years. Industrial production has stabilized following significant cuts in overcapacity sectors implemented over the past years.

China’s growth is projected to edge down to 6,5% in 2018 and slow further to 6,3% on average in 2019-2020, as export growth moderates and deleveraging takes hold. Downside risks to the outlook stem from financial sector vulnerabilities and an intensification of trade tensions amid increased protectionism in key trading partners.

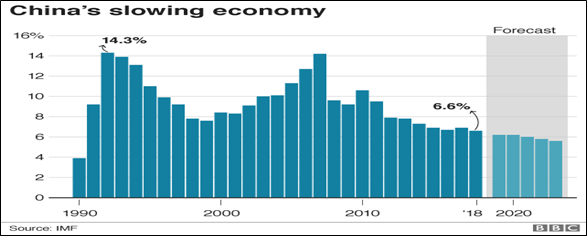

China’s slowing rate of expansion has raised worries about the potential knock-on effect on the global economy. The trade war with the US has added to the gloomy outlook. China’s economic slowdown is not news in itself. Beijing has broadcast this for several years. Slower growth in China means slower growth for the rest of the world. However, China’s economic growth will remain within reasonable scope in 2019.

Chinese economists warn that escalating trade disputes may trigger a financial instability in China too. Obviously, China’s economy will face a slowing economic pace during next few years, shadow-banking may face bigger volatile ups and downs as well as stock and bond markets, declining consumer confidence etc.

However, being centrally-led and –planned big national market economy and society with huge natural and mental resources and an extensive international cooperation network, China seems to have, per se, necessary preconditions to tackle the present and coming economic problems.

China’s ambitious and massive global BRI-project, “Made in China 2025”-national development project and especially high-ambitious national AI plan are just examples of China’s resilient and extensive capabilities.

The debt landscape

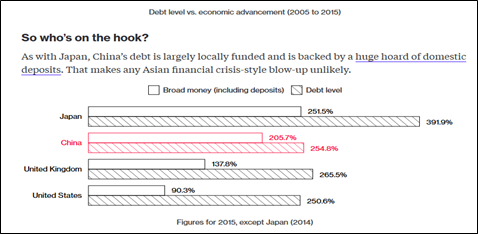

China’s debt pile is huge and growing fast but credit is not delivering the same kind of economic boost it once did. Most debt is in local hands in a largely closed financial system, giving China’s leaders some breathing space to fix the mess. Corporations are by far the biggest debtors, especially state-owned enterprises. While China’s total debt does not look so scary when compared with economies such as those of the United States or Japan, the speed of debt growth has alarmed investors.

As with Japan, China’s debt is largely locally funded and is backed by a huge hoard of domestic deposits. That makes any Asian financial crisis-style blow-up unlikely.

Often overlooked, too, is the other side of the balance sheet: assets. China’s state companies – which are responsible for so much of the debt – also own assets that can be sold, with proceeds going to repay loans, if needed.

China’s Belt and Road Initiative (BRI) and Asian Infrastructure Investment Bank AIIB

The Chinese initiative, which was announced by President Xi Jinping in 2013, aims to boost connectivity and cooperation between East Asia, Europe and East Africa. China will expand the use of the Chinese currency (renminbi / yuan) in countries and regions related to the Belt and Road Initiative by improving cross-border payment and settlement facilities for the currency. Some Chinese thinkers have stated that “Belt and Road Initiative is the project that will change the world”

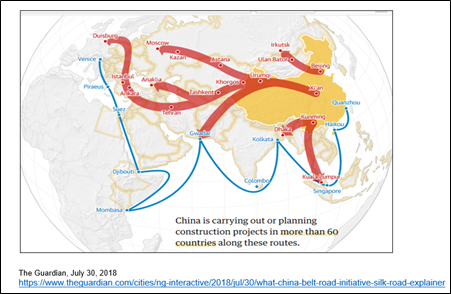

China’s Belt and Road Initiative project is often described as a 21st century’s Silk Road made up of a “belt” of overland corridors and a maritime “road” of shipping lanes.

At the center of the plan are two physical routes. The Silk Road Economic Belt, stretching from Asia to Europe, and the Maritime Silk Road that begins in China and passes along the Indian Ocean littoral to East Africa and then Europe. Over the five last years, since 2013 this grand plan has transformed almost all aspects of Chinese engagement abroad. From Southeast Asia to Eastern Europe and Africa, Belt and Road includes 71 countries that account for half the world’s population and a quarter of global GDP. The Belt and Road Initiative is expected to cost well over $ 1 trillion, China alone has invested so far more than $210bn, the majority in Asia and the total sum may amount up to several hundred billion US dollars.

The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank that aims to support the building of infrastructure in the Asia-Pacific region. The bank currently has 87 member states from around the world. The bank started operation after the agreement entered into force on 25 December 2015. The founding of Asian Infrastructure Investment Bank (AIIB) is closely tied with the Chinese BRI. China, with the greatest voting power, was naturally one of the founding partners in the bank, Russia became a member partner in April 2015 having a second biggest voting power.