Economic positions of great powers in Spring 2024

My previous overview on economies of great powers was on December 10, 2023, with the headline “Glimpses in economic dimension of current great power competition”. A lot of interesting new events and trajectories have emerged since then. So, let’s take a look at the current situation.

General characteristics

Gold

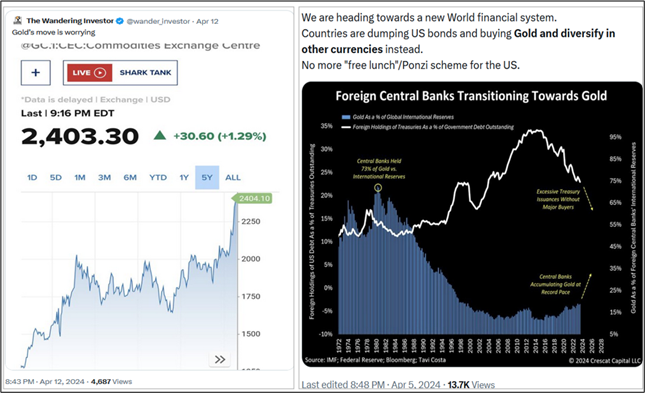

Record high gold price reflects growing global geopolitical risk but some other factors are driving the uptick too. The price is nearing the level of $2,400 and reached a new all-time high.

Gold is rising in price amid expectations for the US Federal Reserve to cut the rate in June and thus investments in the precious metal become more attractive at low interest rates. The demand of investors from China, where the real estate sector is experiencing difficulties, is another reason for the rise in gold prices. Gold’s price is also rising as global central banks buy it to diversify their reserve portfolios against the backdrop of geopolitical risks, domestic inflation and weakening dollar. There are market speculations that China, India and some Central Banks may be among those big buyers which are pushing demand and prices higher.

Precious metals will continue to escalate unless the Federal Reserve radically changes its interest rate policy to combat inflation as former Fed Chairman Paul Volcker once did, raising interest rates to double-digit levels which caused gold prices to fall. At the time, the US was still a creditor nation but the current Chair Jerome Powell cannot because of the enormity of public and private debt. Double-digit interest rates would collapse the economy and plunge millions of Americans into bankruptcy.

Since the end of last year, the central bank has indicated that it would be cutting interest rates. In addition, Powell is considering ending the Fed’s “Quantitative Tightening” (QT) program. Both are highly inflationary.

If the Fed continues to print dollars to sustain government spending at this rate, the dollar will continue to lose purchasing power and foreigners will no longer want to hold them. Foreign central banks will then turn to gold. In fact, central banks are already increasing their positions in gold, which has been a catalyst that has fueled the latest rally.

US dollar as a reserve currency

The US dollar is the first and only fiat reserve currency in the entirety of financial history. Sterling and any other reserve currencies derived their value from the ability to maintain their value to gold. After huge inflows of gold back to Europe in the 1960s, Nixon decided (1973) that higher interest rates needed to maintain the link to gold price was not worth the effort and cut the link to gold price. Ever since the world has been on a “dollar standard”, where bank reserves are held in Greenbacks.

Moving from a gold-based currency to a fiat currency has had enormous benefits for the US. First of all is that it no longer needs to ever run a current account surplus. That is, it never needs to reduce consumption or imports, which is a huge political benefit. The norm since 1980 has been for the US to have a current account deficit. The US also does not need to balance the budget. The budget was balanced in 2000 but this was probably now seen as a tactical error on the part of the Democrats.

I have examined this topic several times in my articles, especially “de-dollarization process” orchestrated by China & Russia and BRICS, here only some recent notes.

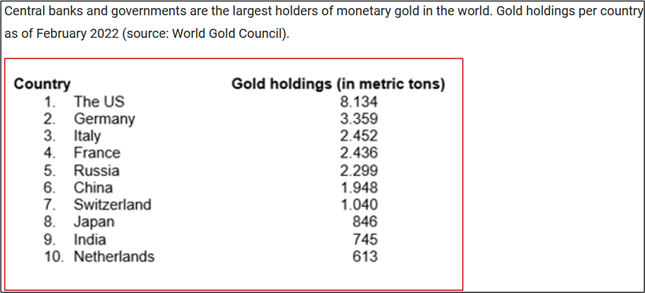

Not surprisingly, the Fed has not purchased much gold since it would be a bad look for the issuer of the world’s reserve currency to be abandoning its own currency for gold.

While commentators have focused on gold’s spectacular price rise, there is an underlying issue that is also taking place. The record setting gold price is signaling that the present fiat monetary order, which is based on the dollar as the world’s reserve currency, is coming to a financially unpleasant end.

Besides the severe financial implications, if the dollar is dethroned, there will be dramatic geopolitical repercussions from the loss of its hegemony. Just like the British pound was replaced as the dominant world currency, America will face a similar future when the dollar becomes just another money. Many will see it as a “blessing” if and when the US Empire comes to an end. While it would appear logical and morally sound to replace the present crumbling monetary order with one based on gold and silver, a far worse paradigm than even the present one is being planned.

The new system will be one of central bank digital currency (CBDC) which would give governments and bankers the power to monitor and control all aspects of economic and social life. This may open the door to the entire Orwellian society.

Hydrocarbons

Prices of hydrocarbon compounds (oil, gas etc.) have been very sensitive to fluctuations of international tension and also regional hotspots, which have potential to evolve wider conflagration. Especially now, when the crisis in the Middle East threatens to expand into a major war.

The video below shed light on this important issue:

Soaring Oil Prices: Economic Boon or Global Doom? Wealthion , March 12, 2024; discussion with Josh Young of Bison Interests and host Jimmy Connor of Bloor Street Capital

The latest US consumer price index revealed an increase of 3.5% for March on an annual basis.

The Federal Reserve’s decision to delay the start of rate cuts will hold for longer than many have hoped. If the ECB in Europe was reluctant to start cutting rates with an inflation rate of 2.4% in a month when energy prices fell, it is likely it would be even more reluctant to start cutting when energy inflation swells.

New world goes up by GDP PPP comparison, towards multipolarity

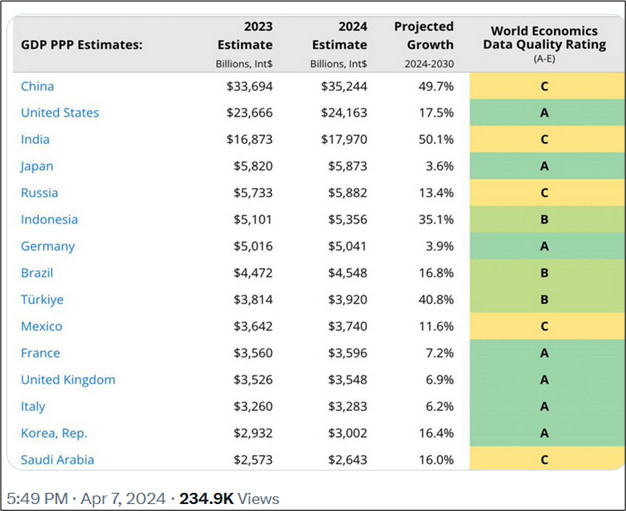

The World Bank published recently a new ranking of countries by Gross Domestic Product (GDP), valued by purchasing power parity (PPP), which gives better international comparability than direct market-price values.

China is number one and further pulled ahead of the US. India is keeping the third place. Russia has closely approached Japan in 2023 and this year is estimated to go by taking the fourth place, while Indonesia has overtaken Germany. France, Italy, and the UK have dropped down a few places. Mexico and Turkey have moved up.

Countries that have introduced sanctions against Russia are falling, while others are growing, a trend that has continued for the second year in a row. Russia in fifth place last year overtaking Germany. This year due to move into 4th largest economy in world overtaking Japan. Except the US you have to go down to 7th place to find another “western country” – Germany. All G7 economies are growing slower than G20 stars.

Recent IMF spring meeting

The International Monetary Fund at its spring meetings had sketched out a future in which the world economy achieves a “soft landing” as the Fed and the European Central Bank slowly but steadily bring interest rates down from restrictive levels.

In the short term, at least, the economic consequences of war and climate change might be manageable as long as central banks are able ease off the brakes to give the economy support when needed. But that becomes harder, if the US is having to hike rates ever higher to stop its economy overheating.

Higher interest rates would mean a higher dollar and a higher dollar generally means pain for the world economy. It certainly complicates the picture for Europe. Seven months after raising its deposit rate to a record-high 4 percent, the ECB has found its way to near-unanimity that it should start cutting rates in June.

Moreover, cutting rates while the Fed is talking about raising them is likely to push the euro lower, creating the optics of actively trying to steal a competitive advantage against US companies. That could provoke a response of import tariffs from a re-elected Donald Trump, or even from an incumbent president Joe Biden, in an effort not to be outflanked running up to the vote in November. So, what happens after June is anyone’s guess.

IMF predictions

In January 2024, The IMF predicted the US economy would grow at about 1.5% in 2023 but the US grew at 2.5%, largely due to high inflation. This year, the US will likely come in at about 1%. In the US case, GDP is growing as factor of shrinking middle class buying power.

China came in at about 5.2% GDP growth in 2023 but will likely beat expectations this year, due to a growing middle class consumer economy. In China’s case, GDP is growing as a factor of growing middle class buying power.

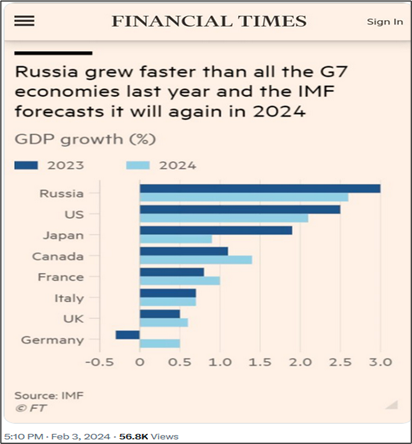

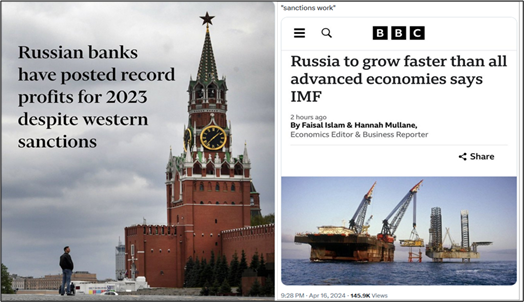

Russia’s former growth estimate was at about 0.3% range in 2023 but went up to 3% in 2023 and will likely be this year about 2.5%. Anyway Russia, under the most severe sanctions ever, beats all sanctioning G7 countries (chart below).

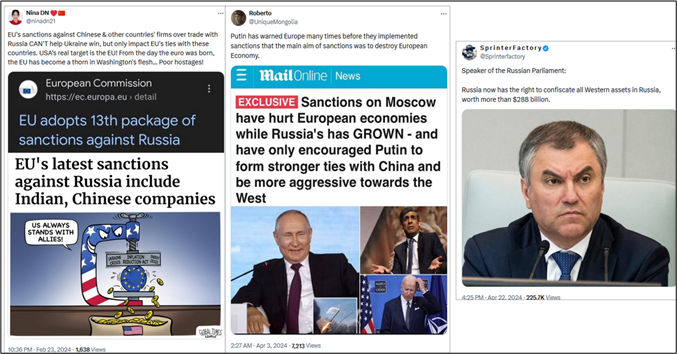

Insanity of sanctions regime

In his report “The Collapse of British Power” the famous military historian Correlli Barnett 1972 wrote: “To apply sanctions against another country is automatically to apply sanctions to oneself”.

This statement has proved to be a real fact also in the current sanctions regime, orchestrated by the West on Russia.

The surprising resilience of the Russian economy, Financial Time, February 2, 2024

U.S. Media ADMITS Russia’s Economy Booming Despite Western Sanctions!

March 3, 2024, The Jimmy Dore Show

The Financial Times is finally admitting that economic sanctions on Russia have been a complete failure.

It is without a doubt one of the most significant economic stories of the century, starkly demonstrating the West’s diminishing power. Despite Bruno Le Maire, France’s Minister of the Economy, claiming the West would “cause the collapse of the Russian economy,” Russia’s economic growth in 2023 surpassed that of all G7 countries—almost quadrupling France’s growth rate—and is projected to continue this trend in 2024 (see attached FT graph). It’s nothing short of extraordinary.

As Vladimir Putin is quoted as saying in the FT article, “Russia’s economy had not only withstood an onslaught of sanctions from western countries — but is now bigger than all but two of them.” It is also yet another proof of Western hubris. This proves the immense gap between what they believe and reality. It shows that whilst they think they inhabit a world, in which they lead, we’ve in fact fully entered the multipolar era.

It also obviously raises the question of China, whose economy is six times the size of Russia’s in PPP terms and 20% larger than that of the US. What happened with Russia demonstrates that they now command more economic power than the West. It was a form of tug of war with the West saying we’ll “cause the collapse of the Russian economy” and China saying “we don’t want to.” And the result is the Russian economy didn’t collapse, it grew faster than the West (and so did China’s).

In conclusion, it is imperative for the West to confront reality and shed its old colonialist worldview. Time and time again now, the West emerges as the principal victim of its own delusions. When reality keeps punching you in the face, at some point you need to wake up.

American magazine Newsweek told in the article of January 17, 2024: “How Russia Won the Sanctions War With the West”.

It is now abundantly clear that Russia has defeated the Western sanctions regime that was intended to cripple its economy and force its withdrawal from Ukraine. Instead of collapsing, the Russian economy is growing rapidly. Russia’s GDP grew by an impressive 5.5 percent in the third quarter of 2023. Final figures for the year are not yet in, but Russian GDP growth for all of 2023 should exceed 3 percent. Ironically, the Russians are doing rather better than those who imposed sanctions on them. In 2023, the U.S. economy grew by 2.4 percent while the German economy shrank, and the EU as a whole grew by less than 1 percent.

Representatives of China, Saudi Arabia and Indonesia are demanding the EU drop any notion it might have about a wholesale confiscation of Moscow’s state assets. They are privately pushing the EU to continue resisting pressure from the US and UK to seize more than €200 billion of Russian state assets it immobilized after February 2022’s invasion of Ukraine to help Kyiv’s reconstruction efforts. These countries are very skeptical about the idea. The concern is, “this would create a precedent” ― in other words, these countries would fear they could be next to lose out.

For the time being, any plan to seize Europe’s frozen Russian assets and use the money to help Ukraine is on the back burner. Western EU countries in particular are fierce in their opposition for fear of legal ramifications and the potential destabilization of the eurozone. Meanwhile, Russia has clearly stated that they, as compensation measure, can confiscate a similar amount of western assets located in Russia.

Based on market speculations, Bloomberg reports that US confiscation of Russian assets will accelerate the abandonment of the dollar. “Confiscation of assets will not only lead to a sharp decline in foreign demand for US Treasury bonds but will also undermine the role of the dollar in the global financial system”, Bloomberg said.

On April 26, interesting news from Russia tells Russian state bank VTB has seized JP Morgan’s money and shares in Russia for $439.5 million. The American bank is shocked but the Russian bank doesn’t care. So, according to the decision of the Russian court, the losses will be compensated by American money. It turns out that the game “freezing and confiscating assets” can be played by two parties.

The United States

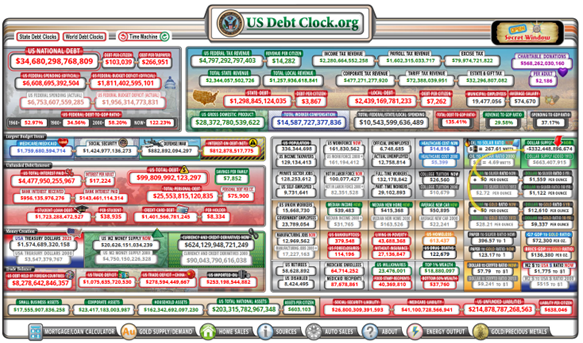

US Debt Clock is the service, where you can follow the progress of US national debt in real time.

It is available in this link: U.S. National Debt Clock : Real Time

Not only the national debt is getting out of control, annual interest payments are soon exceeding a trillion-dollar border and the trajectory is more than dangerous.

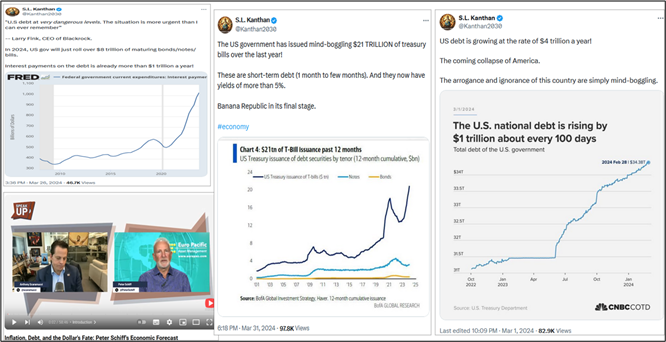

Inflation, Debt, and the Dollar’s Fate: Peter Schiff’s Economic Forecast

Wealthion , March 22, 2024

It’s barely six months into the US government’s ‘fiscal year’ (which started on October 1, 2023) and the federal budget deficit is already $1.1 trillion. This number is utterly astonishing. Moreover, anyone paying attention to the rapidly dwindling US financial condition knows that the national debt is now hovering around $35 trillion. That’s up $2 trillion in the last year alone and up nearly $20 trillion over the last decade. Those numbers are obviously horrendous, really.

But what’s even worse is how much NEW debt the government actually needs to sell each year just to repay its OLD debt.

Remember, whenever the government borrows money, they issue bonds in various denominations; these bonds can be as short as 28 days, all the way up to 30 years. Whenever these bonds mature, the Treasury Department is obviously supposed to pay them back in full. Of course, the federal government doesn’t actually have money to repay its debts. So, instead they issue new debt to pay back the old debt and the amount of money they have to raise just to repay old debts is staggering. Last year alone the Treasury Department had to raise nearly $20 trillion to repay maturing bonds. Plus, they borrowed an additional $2.4 trillion in brand new debt on top of the $20 trillion. Unbelievable.

The US national debt is now growing by $1 trillion every 100 days since 2023. The uncontrolled debt could lead to a financial disaster wreaking havoc not only in the US but across the world. BRICS and other developing countries are worried that a US dollar debt could make their native economies crash. Keeping the US dollar in reserves is now seen as a threat that could undo years of financial stability.

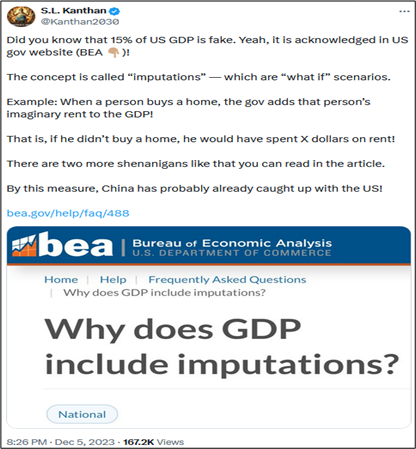

Furthermore, an extra American shenanigan: imputations!

China

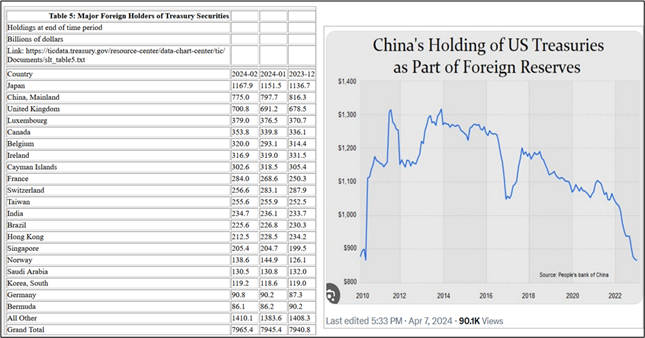

China has systematically reduced the holdings of US Treasury bonds, being number one for years but now on the second place among foreign investors. Russia has sold out nearly all Treasury bonds. The majority of all treasury bonds is held by the Fed.

China’s GDP growth rate beat market expectations to reach 5.3 percent year-on-year in the first quarter, kicking off a good start to the year and laying a strong foundation for achieving the annual development targets. China’s 5.3-percent growth in the first quarter is much higher than what the US, EU or Japan will achieve in 2024.

The strong momentum of the world’s second-largest economy has debunked the “Peak China” theory and other fallacies, Chinese analysts said. They said the US-led ideological prejudice against China and a zero-sum mentality will neither disrupt China’s economic development nor shake the confidence in China’s economy. The country has targeted its economic growth at around 5 percent for 2024, a goal that experts believe is well within reach considering the country’s sound economic fundamentals and policy measures.

In the following video, political economists Radhika Desai and Michael Hudson are joined by Beijing-based scholar Mick Dunford to discuss China’s economy and debunk Western media myths.

The truth about China’s economy: Debunking Western media myths

Geopolitical Economy Report , March 21, 2024

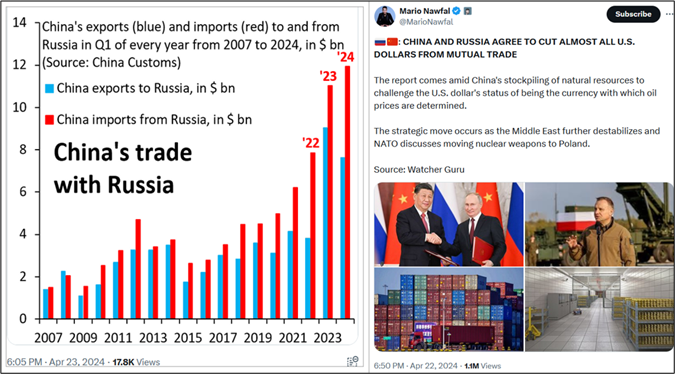

China-Russia cooperation in economic sphere is taking big leaps ahead. The bilateral trade is going up to $260 billion worth of this year… but almost no US dollar will be used! It will be 95% Chinese yuan and Russian ruble, maybe some Euros involved. This de-dollarization will soon be replicated among all BRICS+ members.

In the video of Live from the Vault, Andrew Maguire delivers crucial updates on the accelerating de-dollarization process and the impending gold price reevaluation – and explains how it will also impact silver. Russia & China’s de-dollarization tactics exposed – LFTV Ep 157 , Kinesis Money , January 26, 2024

China’s pursuit of internationalizing the yuan, currency swaps, e-currency, cross-border deals and digitalized currency have recently made international news. These efforts are mainly on the rise with Gulf states. In November 2023, the People’s Bank of China and the Central Bank of the United Arab Emirates renewed their currency swap agreement worth US$4.89 billion for five years. Both banks also signed a memorandum of understanding to enhance collaboration in digital currency development.

A China-UAE currency swap started in 2012 and in March 2023, the two sides made the first-ever purchase of liquified natural gas in yuan. In November 2023, the People’s Bank of China and the Saudi Arabian Monetary Authority signed a currency swap for three years. China also has a currency swap agreement with Qatar. In addition to currency swaps, China has signed cross-border trade settlement arrangements with all six members of the Gulf Cooperation Council and has established yuan clearing centers in different cities.

The growing financial cooperation between China and Gulf Cooperation Council states is not unexpected. It is the result of steady, systematic growth over a decade and confirms deepening bilateral relations. Both sides have placed a significant premium on the digitalization of their finances. They are taking measures to create greater space and avoid US sanctions.

From the Chinese side, the Belt and Road Initiative and its energy needs pushed it towards the Gulf Cooperation Council. The Belt and Road Initiative’s Action Plan stresses financial connectivity, the internationalization of the yuan, cross-border payment agreements, financial integration and the incorporation of the yuan in the International Monetary Fund’s Special Drawing Rights basket of currencies.

Saudi Arabia and the United Arab Emirates are set to join the China-and-Russia-led BRICS in early 2024. They are also dialogue partners of the Shanghai Cooperation Organization, with the possibility of achieving full member status in the future.

These financial agreements between China and the Gulf Cooperation Council hold great potential. They could reduce the duration and cost of transactions, mitigate risks, enhance resilience against financial crises, expand market access, promote bilateral trade and facilitate regional integration. They may serve as catalysts, encouraging other Middle Eastern countries to engage in similar deals with China. Saudi Arabia may consider adopting the yuan for oil trade in the long term, reducing dependence on the dollar. These deals will strengthen bilateral relations and indicate a shift from the petrodollar to the “petroyuan”.

Russia

Russia’s gross domestic product (GDP) growth in the third quarter of 2023 was confirmed at 5.5% compared with the same period last year, when it shrunk 3.5%, the state statistics service Rosstat said. Russia’s economy is on course to recover in 2023, 2024 and 2025 while a drop of 2.1% in 2022, as the West imposed sweeping sanctions against Russia over its invasion of Ukraine. Western sanctions regime includes up to 18,000 single sanctions.

In mid-April 2024,The International Monetary Fund has revised upward its estimates of economic development of Russia and forecasts the country’s GDP. According to data presented in the IMF’s report, Russian GDP increased by 3% in 2023, 3.2% in 2024 and over 2% in 2025. Russia’s Central Bank kept interest rates unchanged last month, as Governor Elvira Nabiullina warned that the economy continued to show signs of overheating.

Financial Times told in its article of January 30, 2024, “The record profits are another sign of the relative resilience of the Russian economy despite US and European efforts to hurt it” https://on.ft.com/3w2Yc1O

Relatively few understand that the US has tried to defend the status of dollar militarily via a proxy war with Russia using Ukraine as a proxy but has already failed. Russia has demonstrated, how beneficial it is to function outside the US dollar complex. The Global South has taken note of this and is taking its own appropriate measures to do likewise.

Russia’s federal budget revenues from the oil and gas sector amounted to 2.9 trillion rubles ($31.3 bln) in Q1 2024, which is 79.1% higher than in the same period last year, the Finance Ministry reported on its website. Russia’s non-oil and gas budget revenues rose by 43.2% in Q1 to 5.8 trillion rubles ($62.6 bln).

Russian foreign trade reveals the economic upturn

Russia’s foreign trade surplus added 2.3% in Q1 2024 to $31.1 bln, according to estimated data published by the Bank of Russia. Meanwhile, current account surplus rose to $22 bln in Q1 2024 from $15.4 bln in Q1 2023.

Russia’s flagship crude grade, Urals, is currently being exported at a price of around $75 per barrel, a price that’s $15 a barrel above the $60 price cap set by the G7 and partners, if the oil is to be moved with the help of Western shippers, insurers, and financiers. At the end of 2023, nearly all of Russia’s crude was being sold above the price cap. Western officials have since moved to tighten sanctions enforcement as they seek to reduce oil revenues for Russia without depriving the world of Russia’s oil exports. The US believes broader market trends and geopolitics are driving the higher price. Tighter sanctions enforcement may be causing delays in Russian oil payments and increasing shipping costs.

Russia exported the highest level of oil from its ports in 11 months in the week to April 14, as export terminals likely shipped more crude that couldn’t be processed at refineries knocked offline by Ukrainian drone attacks, tanker-tracking data monitored by Bloomberg told. Russia has brought back online some oil refining units in recent weeks.

Russia has become the fourth country in the world in terms of agricultural exports with revenues reaching $43.5 bln, Russian President Vladimir Putin said in early March 2024.”We have become the fourth country in the world in terms of exports of agricultural products and the first country in the world in terms of wheat. Putin also added that Russia’s revenues from exports of agricultural products increased 30 times during the last 20 years. He said that Russia has almost no dependence on food imports any more. The dependence in early 2000 was almost on all main components and directions in respect of providing the country with foods.

Wheat exports from Russia since the start of the current crop season to March 2024 totaled 40.85 mln tons, which is an 11% increase over the previous season, Rusagrotrans analytical center told. At the same time, the analytical center revised its projection of wheat exports for the entire 2023-2024 season from 52.5 mln tons to 53 mln tons, with grain exports potentially reaching nearly 70 mln tons.

Russia’s “grain diplomacy” continues to cause headaches for the European Union while potentially reshaping global trade dynamics and markets more in Moscow’s favor. Significantly, the European Commission has recently proposed to increase tariffs on certain Russian and Belarusian agricultural goods, including cereals and oilseeds, to discourage the current level of EU imports.

Farmers across Europe have taken to the streets this year, not only for “climate hoax” but convinced that cheap Ukrainian agriculture production spilling over the border is to blame for their financial distress. The mass protests have forced EU governments from Warsaw to Paris to make huge concessions to farmers and have sent Kyiv’s political ties with its Western allies spiraling to their weakest since Russia’s full-scale invasion over two years ago.

The corporate exodus from Russia since February 2022 has cost foreign companies more than $107 billion in write-downs and lost revenue, Reuters reported citing an analysis of company filings and statements. About 1,000 companies exited the Russian market over the past two years, according to a report by Yale School of Management.

Closing words

Many western observers have noticed, to their disappointment, that Russia did not collapse under sanctions and are asking “Why so?”. Maybe a good explanation is found in the article below, which examines Russia’s gold and currency strategy.

Putin’s gold strategy explains why sanctions failed

Asia Times, article by Robert Huish, March 19, 2024

Russia had been preparing for western sanctions since 2013 and managed to isolate its economy from transactions requiring American dollars. In early 2022, Russia pegged its currency, the ruble, to gold, and 5,000 rubles will now buy an ounce of pure gold. The plan was to shift the currency away from a pegged value to dollar into the gold standard itself so the ruble would become a credible gold substitute at a fixed rate. Based on the text above, it appears that the Russian strategy has been quite successful.