Foreign exchange reserves and national debt

Foreign exchange (or forex) reserves are a key indicator of economic health.

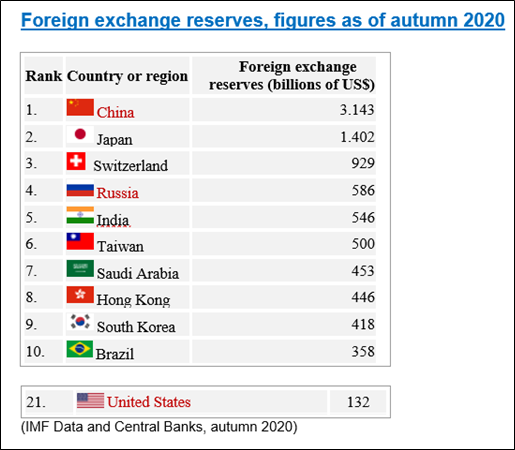

China leads by a longshot with $3.143 billion, over two times as much as second place Japan at $1.402 bl. Switzerland stands out in third place with $929 billion as the only European country in the top 10. Russia is number 4 on the list with forex reserves up to nearly $ 590 billion.

The US can be found in the 21st place with forex reserves only up to $ 132 billion, which partly can be explained as the reserve currency status of US dollar.

What does this statistic tell about the world’s economies? Countries that have a lot of exports tend to stockpile the most forex reserves. Having a large reserve of foreign currency, means countries like China and Japan or today also Russia, can better handle unexpected economic surprises.

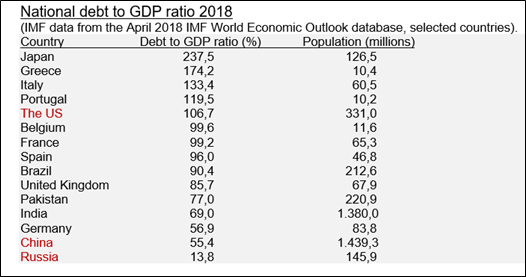

National debt

Debt to GDP ratios by country have changed significantly in 2019-2020, mainly due to worldwide COVID-19 pandemic and consequent bail-out packages. Especially Western countries (The US and Europe) have drifted into unprecedented debt spiral. These data will be later updated by following blogs.

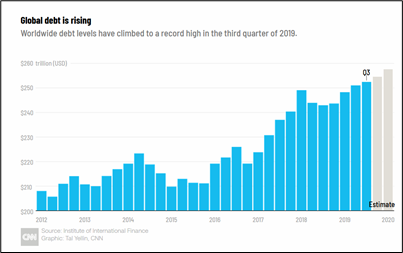

The world’s already huge debt load smashed the record for the highest debt-to-GDP ratio before 2019 was even over. Global debt, which comprises borrowings from households, governments and companies, grew by $9 trillion to nearly $253 trillion during that period, according to the Institute of International Finance. That puts the global debt-to-GDP ratio at 322%, narrowly surpassing 2016 as the highest level on record.

More than half of this enormous amount was accumulated in developed markets, such as the United States and Europe, bringing their debt-to-GDP ratio to 383% overall. There are plenty of culprits. Countries like New Zealand, Switzerland and Norway all have rising household debt levels, while the government debt-to-GDP ratios in the United States and Australia are at all-time highs. Such massive worldwide debt is a real risk for the global economy, especially because the IIF expects levels to rise even further in 2020.