Collapsing of empires / unipoles

“If something cannot go on forever, it will stop”

–Stein’s Law

Great powers are the key players both in the theoretical context and in the reality of international relations. Therefore, the destinies of empires / unipoles are so important to follow up and examine in details.

Collapsism

In order to systematize and streamline the theoretical approach to the issue of “rise and fall of great powers”, a new concept or “ism” may be relevant to be taken in use, collapsism:

- a way of thinking that “collapsing empires” can and will take place also in our modern time and therefore this issue can and shall be elaborated and analyzed carefully

- collapse and other discontinuities are “normal” historical events among others and they can and shall be taken under serious research

- they can be analyzed and possibly even forecast or at least take into account in plans or scenarios

- there are plenty of ways and means, tools and techniques available like historical comparisons, seeking of analogies, use of the concept Seneca Cliff, utilization of, among others, Kennedy’s and Tainter’s findings as well as Christopher Layne’s (2012) and Robert Pape’s (2009)

In this study, a systematic approach to collapsism is taken now, when analyzing the present situation and designing scenarios of great power triangle game.

Two classical documents on the subject “collapsing of great power” (Paul Kennedy 1989 and Joseph Tainter 1988), among others, form a theoretical base and comparable “benchmark” in assessing the prevailing situation. Some recent researches, like Robert Pape in his article “Empire Falls” (2009) and Christopher Layne (2012), have forecasted the decline of unipolarity taking place soon. More info is found here (IR Theory / collapsism).

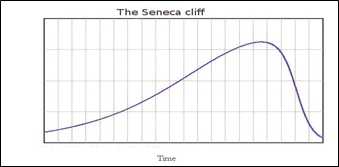

The Roman philosopher Lucius Annaeus Seneca once wrote that “increases are of sluggish growth, but the way to ruin is rapid.” Later this concept was coined as Seneca Cliff or Seneca Trap which graphically is presented below:

This concept is worth to keep in mind when various vicious circles of today are becoming visible in modern complex societies and all kinds of bubbles are going to be burst in the near future.

However, enigma of human inability in understanding historical discontinuities seems to be valid with today’s research society as well.

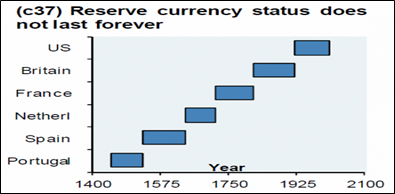

Overwhelming majority of present Western economists and other economic pundits are not able or willing to understand or accept such a possibility that the present position of international reserve currency (the US dollar) could somehow downfall, not to mention the collapse. Consequently, the life of any fiat money, including reserve currencies, has not been so long as seen in the picture below.

In the history of the humankind, empires are built through the creation or acquisition of wealth. The Roman Empire came about through the productivity of its people and its subsequent acquisition of wealth from those regions that it invaded. The Spanish Empire began with productivity and expanded through the use of its large armada of naval force, looting the gold worldwide. The British Empire began through localized productivity, industrial revolution, and grew through its creation of colonies worldwide – colonies that it exploited, bringing the wealth back to England to make it the wealthiest country in the world. In the Victorian Age, the Brits could say “The sun never sets on my flag.” Even the “eternal” Soviet Union with the communism faced the final destiny after seventy years with iron ruling.

Now coming to the present empire, the United States of America, the issue of the destiny does not deviate from those historical examples mentioned above. The overall historical continuum of empires and the basic conformities to law, dictate the demise of the US as well.

The analysis can be carried out by two key drivers – external and internal drivers.

The external collapse-drivers of the US position

- China-Russia political-military partnership has formed a peer competitor to the US unipole, thus decreasing its position, which finally transformed the polarity from unipolarity to twinpolarity, in 2014-2016

- dramatic changes in power balance regarding new state-of-the-art weapons development for the benefit of Russia-China partnership (as stated before in ASAT, EW, hypersonics, air defense), in 2015-2019

- geopolitical imbalances have caused large range of hard balancing activities in 2014-2019 (China, Russia, North Korea, Iran, Cuba, Venezuela, Turkey etc.)

- game of geopolitics has moved from a slow-moving, relatively predictable chess match (Cold War era and first 15 years of the US unipolarity) to rapidly evolving multidimensional chess in which the rules keep changing in unpredictable ways

- wrong and malfunctioning grand strategy of the US vs. other great powers and other major powers since 2010

- large scale sanction policy of the US has declined and eroded the prestige and position both among adversaries and allies (now the US being at odds with the majority of humanity)

- military failures of the US (e.g. in Afghanistan, Iraq, Iran, Syria) as well as unsuccessful regime changes and other coupes efforts (e.g. in Venezuela, Iran, Ukraine, Cuba) have all eroded the image of American military might

- Sino-Russian joint scheme of de-dollarization has eroded the position of the US dollar as a reserve currency and this trend is now accelerating covering more and more states and international trade volumes; US dollar’s reserve currency status has been the most important factor behind the unlimited indebtedness of the US and its military power

The internal collapse-drivers of the US position

- the astronomical indebtedness of the US at all possible levels and sectors (federal, state, municipal, governmental agencies, students, households, credit cards, business etc.), according to Wall Street Report in 2019 the US total debt-ratio to GDP exceeds 1800%

- the present federal budget deficit exceeds 1 trillion this year and the deficit will explode in the near future

- the present COVID-19 pandemic, which is just the external shock agent, will skyrocket the federal debt at least by 10 trillion dollars up to 33 trillion dollars in next two years; by the same it has disclosed the fragility of the American economy, which cannot be cured with limitless money printing by Fed finally ending in “hyperinflation of Weimar America”

- due to this enormous debt burden, it will be highly likely that foreign investors begin eschew the US federal bonds, thus the US Federal Reserve being the only main lender to the US federal system; the biggest foreign creditors today are Japan, China, UK and Brazil

- the US industrial base has eroded remarkably during last fifty years, as well as the US deteriorating infrastructure, nowadays the dependence on imports of raw materials and intermediate products is very high; the service sector and private consumption form about 70% of the total GDP; the finance sector being in a superior position compared with real economy

- all these features mean that drastic falls and ups are possible in the US economy and society within a short time period

- in addition, both in the US and globally, the trade of derivatives in the finance sector amounting up to $ 1.500 trillion dollars (global summary of real GDP is about $ 80 trillion in 2018) is so enormous that any fault / mistake in the stock market causes global domino-effect and total collapse of the global finance sector and finally the whole world economy; especially all the deeply indebted countries are in the frontline of collapsing

- the wealth distribution in the American society has become extremely uneven, the backbone of the American society, the middle class, sees its relative position deteriorating continuously getting more in debt and having less of wealth assets; the US statistics tells “cold facts” on this disastrous trend during last twenty five years

- societal cohesion in the American society has eroded dangerously

- the US shale oil business needs high oil price level (about 50 dollars per barrel) for profitable production, the present low-price level (20-30 dollars per barrel) may turn to be fatal to the whole industry, weakening further the industrial base of the whole nation and especially its strategic assets

- high burden of continuous wars and other armed conflicts with the US engagement, total costs of the US wars during last 20 years exceed 5 trillion dollars

- total burden of all military related expenditures has been heavy, at 6% level from GDP, during last ten years. In addition, the impacts of several prolonged wars (Afghanistan, Iraq, Syria) to the American society and politics, the growing number of war victims (Americans and others), veterans and their healthcare costs, unfunded liabilities of veteran pensions and other military related issues, they all are causing growing stress to the American society.

The interactions and dynamic of the collapsing process

An interesting and “double-weakening” phenomenon is the collapsing process of the dollar from its reserve currency status:

- on the other hand increasing debt burden of the US presses dollar down and

- on the other hand the de-dollarization process undermines it at the same time, creating a combined double – weakening

When the US debt burden gets too heavy becoming unbearable and de-dollarization process has reached a critical level, the dollar’s reserve status disappears, foreign credit taps go off and this collapses the US economy and military power and the great power status causing gigantic transformation process in the international politics and system.

The result: collapsing of the US position transforms the polarity of the international system from twinpolarity to dualpolarity

In the case that the unipole, for some unspecified reason, will collapse or loose critically its strength and the rest of polarity – a twinpole – continue its life, it will turn to some new polarity form.

Assuming that those two states continue their cooperative performance, they form dualpolarity, where those two states conduct the world order in tandem, in some cooperation format – alliance, entente, strategic partnership etc.

Assuming that, sooner or later over time, they begin to compete with each other, the system will turn to the usual bipolarity again.