Economic capability of the US

Economic outlook and debt position of the United States

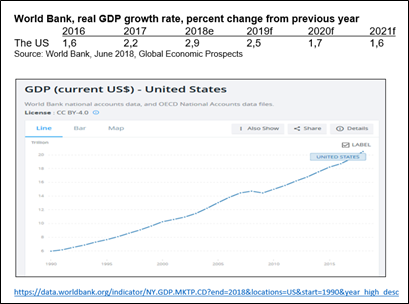

The economic growth has continued ten years, supported by broad-based strength in domestic demand, especially in consumer consumption. The economy may be near its productive potential as both capacity utilization and the employment rate are moving toward peaks attained prior the financial crisis. Wage growth is still weak compared with previous recoveries. According to CBO, the tax cut stimulus, imposed by President Trump, adds just over 1% to the growth forecast over the couple of years but is expected to lead to budget deficits of around 5% of GDP or the next decade.

The longest expansion in US history lasted ten years (from March 1991 to March 2001). The current economic expansion matched that milestone in mid-2019.

National indebtedness

US Debt Clock (https://www.usdebtclock.org/ ) tells the federal debt of the US in real time. In October 2020 the debt exceeded the all- time high amounting to $ 27 trillion.

The US economy and its financial structures have never recovered properly from the great financial meltdown of 2008. The crisis now looming over, not just the US economy but also the global financial system, could spell the end of the dollar system. So long as the world needs US dollars, Washington can run government deficits without end. Foreign central banks would have little choice but to reinvest their surplus trade dollar earnings in interest-bearing US Treasury securities.

This recycling dollar system as well as the sole privileged, unrestricted access to SWIFT data, has allowed Washington to finance its wars around the world and impose all kind of sanctions and other punitive measures against any country according to the US political will.

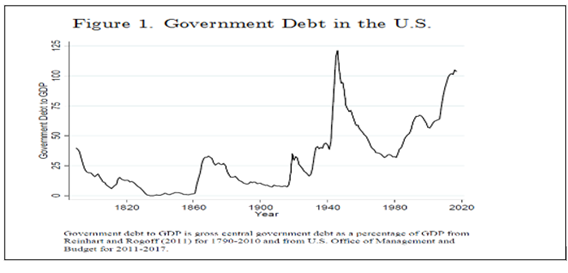

The US Office of Government Accountability (GAO) warned the US Congress on June 21, 2018, that the Government is finding itself amidst serious economic troubles with a steadily increasing federal deficit and national debt, exceeding well over 100 percent of GDP. The US economy may find itself in dire straits, unless measures are taken as soon as possible. Earlier the Congressional Budget Office (CBO) revealed that the nation’s growing federal deficit is projected to reach $1 trillion by 2020 and average $1.2 trillion per year from 2020 to 2028, by warning that “the longer correcting action is delayed the greater and more drastic the changes will have to be.”

One of the probable causes of looming economic hardships is the country’s overblown military budget. The budget deficit leaped up following the attacks of September 11, 2001, when Washington declared war on terrorism. From 2003 to 2011, the budget deficit doubled: from $437 billion to $855 billion. Simultaneously defense spending increased by 50 percent. The US has colossal military expenditures exceeding $700 billion a year and will increase in the near future.

The US government’s huge and growing budget deficits have become gargantuan enough to threaten the whole American growth machine. Trump’s policies to date, a combination of deep tax cuts and sharp spending increases, are shortening the fuse on that fiscal time bomb, by dramatically widening the already unsustainable gap between revenues and outlays.

By 2028, America’s government debt burden could explode to a staggering $33 trillion—more than 20% bigger than it would have been had Trump’s agenda not passed. At that point, interest payments would absorb more than 20% of federal revenue.

The breakdown of total US indebtedness in 2018 is summarized here below:

- The federal debt is closing in on $22 trillion (over $ 27 trillion in late 2020), with over $1 trillion a year current federal budget deficit

- US Government Agency Debt is estimated up to $ 9,3 trillion

- State & Local Government and Administration Debt is estimated up to $ 3,1 trillion

- Corporate debt is at historic highs not seen since 2008, with S&P Global reporting over $6.3 trillion in total debts and the largest companies holding only $2.1 trillion in cash as a hedge

- US household debt currently stands at around $13.3 trillion, which is $618 billion higher than the last peak back in 2008

- US household credit card debt surpassed $1 trillion for the first time in 2018, the highest single year amount since 2007

- Unfunded liabilities of social security, medicare, general pensions, veteran pensions etc. form a special hidden sector, where the required sums of necessary finances in the next twenty years amount to “astronomical levels” (several hundreds of trillion dollars)

By incorporating all levels of debt, the total US Public debt to GDP ratio is near to 166%, which makes the US financial ratio belonging to the same category of crisis countries like Greece and Italy.

The US Debt Bomb is much higher than most American or European economists realize and are willing to admit.

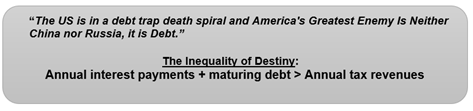

In 2023, the US government’s annual tax revenue will not be enough to cover annual interest payments and its maturing debt, thus touching the fatal debt ceiling. As many strategic analysts have expressed the situation:

The US will face this dangerous situation in 2023 at the latest, according to the recent Report of US Congressional Budget Office. What actually will happen, when approaching this moment, remains to be seen. When the US economy finally starts to implode, investors need to understand that ASSET values will evaporate while DEBTS stay the same. That is a recipe for disaster.

The present US financial system is a Ponzi-scheme, that is, in order to continue to reflate it, you have to have exponentially more and more debt and month by month the US is approaching to the point of debt saturation.

In September 2019, AB Bernstein, a global asset management firm based on Wall Street, chocked the economists worldwide by publishing the report with detailed calculations where the total indebtedness of the entire America went up to a staggering level of 1832% of GDP.

The way out of this debt spiral would be either cutting mandatory outlays (e.g. military spending) or hiking tax revenues (both highly unlikely due to the toxic political climate in the Congress) or restructuring sovereign debt with the major creditors like China and Japan. They might be willing to restructure the debt butpolitically, however, the United States would unquestionably come out as a big loser from those talks.

Other strategic vulnerabilities of the US

- production globally outsourced, causing problems and failures in military-industrial complex

- dependence of REE and other key materials and products on importing abroad (from China and Russia)

- fierce competition in AI with China and Russia

Production globally outsourced and lack of key materials.

In September 2018, the US Government inter-agency Task Force, headed by the Department of Defense (DoD) released the unclassified document “Report Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States”. It was a year-long study on the domestic industrial base required to provide vital components and raw materials for the US military. The document was commissioned a year ago by President Donald Trump. The report is the most thorough critical look at the military industrial base undertaken since the early years of the 1950’s Cold War buildup.

The declassified version of the report is quite shocking, citing a laundry list of 300 “gaps” or vulnerabilities in the US military industrial base. The US defense industry is dependent on China for virtually all its rare earth metals. The main conclusion of the report is that, “China represents a significant and growing risk to the supply of materials deemed strategic and critical to the US national security.” This explains why the focus of the ongoing Trump Administration trade war against China in fact concentrates on pressuring China to abandon its Made in China 2025 agenda. More information of this subject is available here.

Competition in AI with China and Russia.

Information technology has already transformed virtually every aspect of modern civilization. The rise of artificial intelligence (AI) and the ability of systems to train themselves rather than be programmed, allowing them to perform tasks no human could, is expected to have as much, if not more, an impact than the proliferation of computers and the Internet. The future position of any great power will be largely based on the digitalization and effectively utilized AI-applications as well as scientific breakthroughs both in economic and military capabilities. A recent study by McKinsey Global Institute suggested that artificial intelligence could boost annual GDP growth by 1.2 percent for at least the next decade.

So far, the US has been the leading country in AI development and applications.

In the US, Center for a New American Security (CNAS) has recently rolled out its Artificial Intelligence and Global Security Initiative. The initiative seeks to bring together technology experts, policymakers and the media to explore the impact AI will have on all aspects of security from more indirect threats to infrastructure, the flow of information and economics, to AI deployed directly on the battlefield in the form of autonomous weapon systems.

CNAS organized in November 2017 Artificial Intelligence and Global Security Summit, where discussed the current state of AI, the potential benefits and threats the technology presents and the best way to remain competitive as other nations adopt and develop the technology further. The military and security experts called this development option as “the US Military’s Third Offset”. AI is included among the list of potential technologies that may offer the US military the third offset.

The year 2018 seems to be a watershed year regarding the comprehension of AI’s value as a geopolitical factor. Technological inequality has always had a major impact on global politics and the world economy. The most technologically advanced states became the most successful, gained undisputed military superiority and begin to impose their will onto less developed countries.