National economy

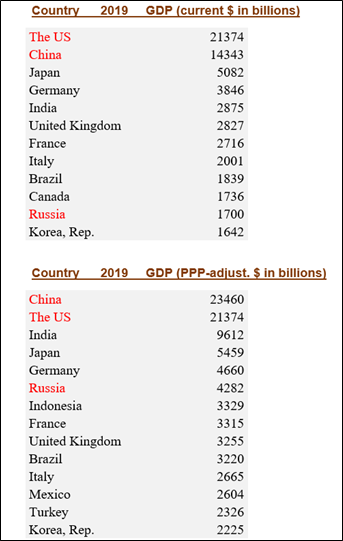

Biggest national economies in the world in 2019, according to World Bank statistics:

The statistics above tell many interesting things, especially how much two different views change the picture in international comparisons: current versus purchasing power parity. China, India and Russia rise significantly in all such comparisons and “traditional” Western countries like France, UK and Italy will fall down.

Purchasing power parity (PPP) is a measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries’ currencies. Purchasing power parity is an economic term for measuring prices at different locations. It is based on the law of one price, which says that, if there are no transaction costs nor trade barriers for a particular good, then the price for that good should be the same at every location.

Purchasing power parity exchange rate is used when comparing national production and consumption and other places where the prices of non-traded goods are considered important. (Market exchange rates are used for individual goods that are traded). PPP rates are more stable over time and can be used when comparing different countries and their different important attributes.

Second key driver, besides GDP of the state, is the size of the population. According to UN (World Population Prospects, the 2019 Revision), the population statistics seem to be the following:

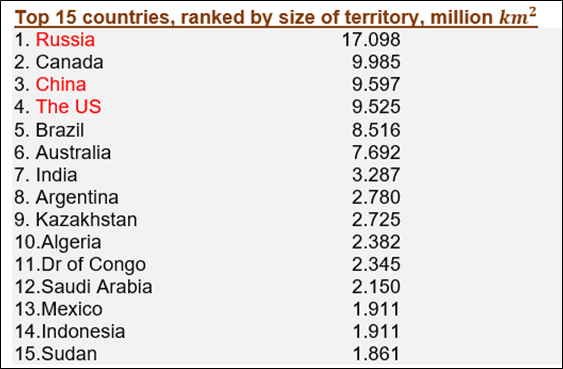

Third key driver is the size of the territory possessed by the state. (UN Statistics)

What economists know or assume to know about the factors that contribute to economic growth and poverty of the nation state?

Three proximate determinants have been usually reviewed in this connection:

- physical capital accumulation

- human capital building through education and skill-enhancing work

- productivity growth through technological progress

The other way of expressing the determinants of economic growth are:

- institutions and incentives

- openness to international trade and capital movements

- geography

The conceptual research on economic growth has relied largely on two simplified frameworks:

- the Harrod-Domar model, where the expansion of output is linearly related to the increase in the stock of physical capital

- the Solow model, where the output growth depends on three factors: expansion of physical capital, growth of effective labor force and the rate of technological progress (increase in factor productivity)

Each of these models has played an important role in empirical econometric studies, which indicate that some deeper understanding shall be found to clarify the essential factors behind growth and poverty.

With regard to proximate determinants, there is now a broad consensus among economists that technological change not only holds the key to economic growth in theoretical models but also is fundamental to an understanding of historically observed growth experiences.

The recognition that technological change (increasing productivity) contributes importantly to the growth of per capita output, emphasizes the role of incentives for entrepreneurship and innovation, along with the institutions that define and protect property rights and shape economic incentives as deeper determinants of economic growth. The perception that countries that have pursued export-oriented development strategies have fared relatively well, suggests that trade openness is another deeper determinant of economic growth.

Economists have long emphasized the allocative efficiency associated with market system. Decision making based on the prices that equilibrate supply and demand in competitive market can provide an efficient way of allocating resources in economies composed of many heterogeneous individuals and firms.

Experience has also demonstrated that market systems in which many economic agents have opportunities and incentives to innovate provide a relatively high degree of adaptive efficiency. This was proved by events and processes in the former Soviet Union and in other Eastern European countries when the central planning systems broke down in late 1980s, after decades of relatively poor economic performances

Most economists believe that growth can be promoted by opening economies to international trade and foreign direct investments.

However, the most relevant institution-building priorities and forms seem to be country-specific. Because countries have historically different informal norms and enforcement mechanisms, the factual formal institutional structures that work well for one country may not adapt very well to others. Kenwood and Lougheed have carried out a comprehensive and detailed study of international economic growth covering nearly 200 years. Acemoglu and Robinson examined thoroughly the theme in their famous book (2012), “Why Nations Fail, the origins of power, prosperity and poverty”.

Although the general equilibrium theory provides a scientific support for the idea of stable and self-correcting economic mechanism, it does not prevent “bubbles” evolve here and there.

During the decade 1997 – 2007 there were three separate bubbles – in technology stocks, in real estates and oil. In each cases the prices rose vertiginously before crashing. Different bubbles were widely regarded as certain aberrations but nowadays even economists have accepted more or less regularly evolving of bubbles.

A common reaction to extreme events is to say they could not have been predicted, like Japan’s assault on Pearl Harbor, terrorist strike 9/11 in New York or hurricane Katrina. But lack of exact knowledge rarely equates with complete ignorance. What prevented the authorities from averting these disasters was not so much a lack of timely warnings as a lack of imagination and comprehension.

In August 2007, shortly after the beginning of the subprime crisis, a frontpage story in the Wall Street Journal said: “the recent market turmoil is rocking investors around the globe but it is raising the stock of one person, a little-known economist whose views have suddenly become very popular”.

He was Hyman Minsky, an avowed Keynesian who taught for many years at Washington University in St. Louis. Minsky elevated the view that free market capitalism is inherently unstable and that the primary source of this instability is the irresponsible actions of bankers, traders and other financial types. Should the government fail to regulate the financial sector effectively, Minsky warned, it would be subject to periodic blowups, some of which could plunge the entire economy into lengthy recessions.

Minsky invented the term “Ponzi finance”, where the borrower’s ability to repay its loans depends on how the borrower gets access to a new source of loan finance. If such a source does not materialize, the borrower will be forced to default.

In an interview of Ben Bernanke, Chairman of Fed during the crisis time 2008 and thereafter told that the playbook he relied on the days of crisis was written by a British economist in the 1860s, Walter Bagehot. The dictum of Bagehot was that in a financial crisis, the central bank should lend unlimited amounts to solvent institutions against good collateral at the penalty rate. Bernanke has followed that advice also afterwards.

Very low interest rate or even zero lower bound interests, massive and long-term quantitative easing (QE) and other measures have created in the last five years the “unknown waters” of various bubbles and other economic peculiarities with which no one knows the right and secure procedures to solve them.

Speculative bubbles present an extreme case of the financially driven boom and bust cycle that Minsky identified. Charles P. Kindleberger divided the evolution of a typical bubble into five stages: displacement, boom, euphoria, peak and bust.

The displacement is what gets the speculative process started: the beginning or end of the war, the invention of a transformative technology or a change in economic policy. It is sufficiently important to alter how investors and other financial players conceive of the future.

All these phases were clearly seen when analyzing some previous years before 2008 crash, like peaks of indebtedness in finance and household sectors as well as the rapid expansion of the financial sector amounting to a giant credit bubble. For a long time, however, it passed largely unnoticed. There was nobody at the national level to raise the alarm about the lending standards and confront the Fed’s policy of laissez-faire and finally the unavoidable finance crash burst.

When looking at the present situation (in 2020), it is in a way something tragic – comic in Minsky’s writing

“As a previous financial crisis recedes in time, it is quite natural for central bankers, government officials, bankers, businessmen and even economists to believe that a new era has arrived”.

It may be worth to recall Cassandra’s legacy: “Always plan for the worst-case hypothesis”. Cassandra was an ancient Greek prophetess whose prophecies (warnings, pessimistic predictions) were usually so “bad” that the contemporary people tended to ignore them.

Obviously, to the same category belongs the Roman philosopher Lucius Annaeus Seneca. He once wrote that “increases are of sluggish growth, but the way to ruin is rapid.” Later this concept was coined as Seneca Cliff or Seneca Trap.

It is worth to keep in mind these concepts, when the vicious circle of today is becoming visible and the “Everything Bubble” is going to be burst in the (near/not so far) future.