Energy: oil, natural gas, coal, nuclear energy

“There is no project of more central importance to national security than energy security”

- Henry Kissinger

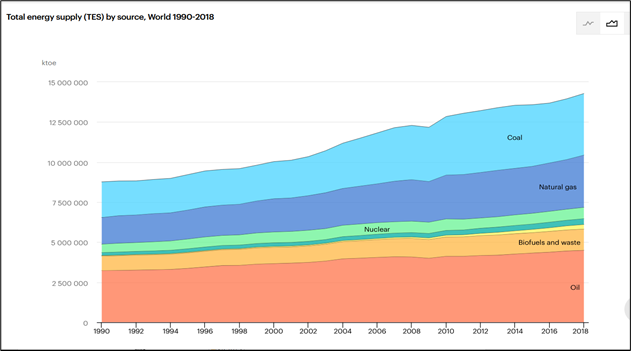

International Energy Agency: World Energy Balances 2020

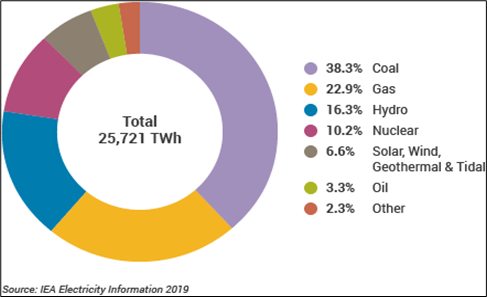

As clearly presented in the international energy statistics, world energy balance is still based on traditional primary energy sources: oil, coal and natural gas, nuclear energy being also important in electric production. At the same time, this energy background is an important framework for great power competition.

National energy management has been always a key strategic element of any sovereign country. Mental adaptation to the great power essence (gestalt) requires exceptionally robust grasp on the overall management of this sector. All great powers in the last 200 years have demonstrated and used “hard hand” in securing their national interests in the energy business.

The most important primary energy sources worldwide are and will be the same in the next 20 years: oil, natural gas, coal and nuclear. It will take at least 25-40 years before any other new energy source will step in to this picture on the worldwide bases (e.g. wind, direct use of sun energy, ocean waves etc).

Oil

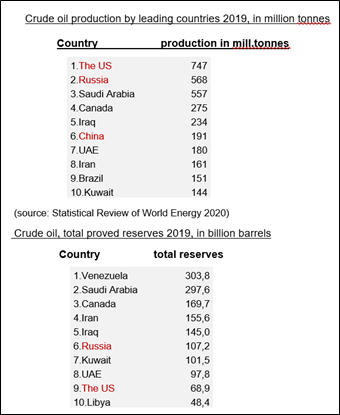

Crude oil production by leading countries 2019, in million tonnes

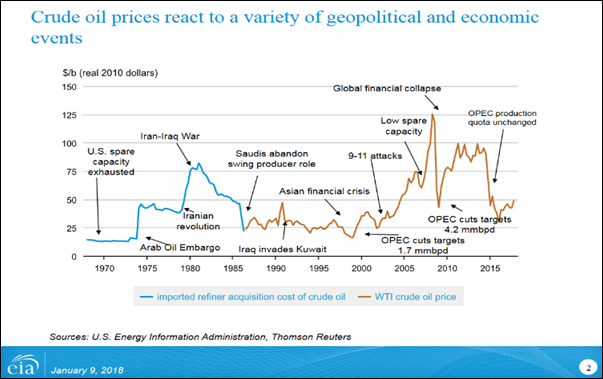

Oil business and oil price moves are very sensitive to the fluctuations of world political situation and especially to the great power relations indicating that important role the oil still plays in the world politics. Organization of the Petroleum Exporting Countries (OPEC) has been an important player/arena in this business since 1960. The founding members were Iran, Iraq, Kuwait, Saudi Arabia and Venezuela. Currently, OPEC comprises 15 member countries – namely Algeria, Angola, Congo, Ecuador, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab EmiratesandVenezuela.

OPEC’s leading country, Saudi Arabia, has organized cooperation with the leading outside producer, Russia, in several issues like production restrictions and price stabilization measures.

In last ten years the US shale oil and Canada’s tar sand oil production have changed the oil business significantly as well various turbulences and crises in traditional production countries like Algeria, Syria, Iraq, Libya, Iran and Venezuela. The extensive sanctions, imposed by the US on Iran, Libya, Syria, Russia and Venezuela have also distorted the oil business worldwide.

The oil business has changed since 2018 as the US oil production is rapidly growing (due to shale oil) and has reached 11.2 million barrels per day level in late 2018 and is expected to reach over 15 m/bpd in 2019 enabling the US to substantially increase its oil exports and compete with everybody else. With $60 – 80 prices being profitable for the US shale oil producers, this becomes the ceiling for oil prices. With the dramatic rise of US oil production, the oil market is now dominated by three players: The USA, Russia and Saudi Arabia who jointly represent nearly 40% of total world production, giving them control of oil prices.

The US posture: One of its primary goals is to shrink its balance of trade deficit and turn it into a surplus. One method is to cease importing oil and become a major exporter. This is evident in the US policy in support of shale oil extraction through fracking (hydraulic fracturing engineering in shale oil production) despite the consensus on its damaging effects on the environment. The US has supported and funded the research in fracking and continues to support fracking business financially, politically and taxwise. The US is powerfully increasing its oil and gas production and exports, is marketing aggressively and is systematically undermining the competition. Some examples are:

- Attempting to weaken the Russian economy through economic sanctions and to block Russian gas sales to Europe, thus opening the European market to US liquid gas LNG despite it being more expensive (than Russian gas via Nord Stream 1 and 2 pipeline)

- This is particularly important because of the large gas content of the US shale oil wells, which if not sold is burnt as waste. It also hampers the producers’ ability to increase production, which in turn delays the plan to increase exports. The US has been exerting huge efforts to sell its LNG to all possible clients and become a major LNG supplier worldwide. Concurrently, the US has attempted to reduce competitors’ supplies (Venezuela, Iran and Libyan).

- There are already early signs that the US shale industry is starting to show its age, with depletion rates on the rise. The shale industry consultant Wood Mackenzie and the investment bank Goldman Sachs, in their recent separate studies confirmed that the present shale production is suffering from decline rates at or above 15 percent after five years production while the expected rate is 6-8 percent. The average life span for the most promising areas of global oil supply is between 7 and 15 years and the majority of present American shale fields in use are now at seven years.

- The US shale oil business is entering the lower end of this range in next 7 years. While shale is still growing, there are signs that the “Shale Tail,” which Goldman says is “the phase when shale becomes a less meaningful driver of global oil supply,” may not be that far off. Although Goldman says the real trouble may be a few years off, there is evidence that some of those dynamics are beginning to occur.

Russia’s posture: Despite the economic and social destruction after the collapse of communism, Russia has been able to rebuild its oil and gas business again to the present top level. Rebuilding has been a difficult and costly exercise and requires huge capital investments and the support of business partners, first of all China. It is also hampered by Western economic sanctions and even threatened by NATO’s military operations. Russia relied on oil and gas revenues in rebuilding itself until the oil price crash of 2014 when it was forced to quickly redirect its efforts towards the other energy sectors, agriculture, armaments, mining and manufacturing sectors. From 2017 on the whole energy sector plays an essential part in Russian economic development. One would expect Russia to be extremely wary of entering any cooperation with the US in price or any issues of oil and is expected to carry out its own goals of developing and expanding oil & gas production and exports.

Saudi Arabia posture: the country and society deviates greatly from its two large producer colleagues (USA and Russia). It does not have a well-developed multi-sector economy to shield it from the disasters of oil price declines and, since 2014, has been suffering from persistent budget deficits. This has now been addressed by the ambitious ‘Vision 2030’ plan to transform the economy into multi sectors, industries and revenues. However, until that occurs, oil prices could remain below $60 – 80 and the ensuing budget deficits could erode the country’s financial reserves. More debt is not a viable solution. Based on the negative outlook for oil prices, Saudi may opt to increase its production and exports to halt or reduce its budgetary bleeding. Such a goal is implied in its determination to introduce alternative energy sources (Solar, wind, hydraulic and nuclear) to reduce local oil consumption freeing more for export. It is also rapidly increasing its investments in developing new and existing oil fields.

Natural gas

Natural gas, proved reserves 2019, trillion cubic meters

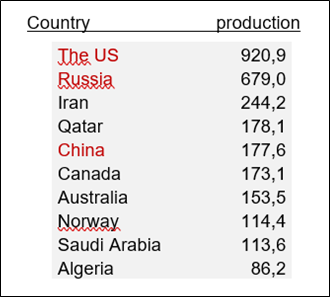

Natural gas production 2019, in billion cubic meters

It seems that all the gas pipelines both existing and planned from Russia to Europe are politically sensitive and have caused political disputes, even US sanctions: Nord Stream 2, pipelines via Ukraine, Turkey and Belarus-Poland. Quite similar situation exists with all other pipelines.

The pipeline dispute in Syria was one of the main causes for Syrian crisis set out nearly 10 years ago. Now the latest case will be the planned gas pipeline from Israel to Europe, which has caught heating up tensions already in the planning phase. In addition, new disputes regarding gas and pipelines have arisen in Eastern Mediterranean area between Turkey and Greece with also Cyprus, Malta, Libya and Egypt involved.

The US has put more pressure on Europe offering its gas in LNG-form, as a strategic alternative to Russian supply. If analyzed purely economically, the pipeline gas is always the cheaper one compared with the similar amount of gas in LNG-supply via ship transportation.

Pipelines of oil and gas locating in the Russian Far East and intended to Asian market, have been either made or partly under construction. Gazprom’s huge “Power of Siberia” gas pipeline from Yakutia to China border was taken in use in late 2019.

Another Russian gas producer, Novatek, reported that its Arctic project, Yamal LNG facility, started the third enlargement phase, with a total capacity of 16,5 million tons per annum. The full capacity was reached in 2019. Novatek and Italian SACE Export Credit Agency have sealed an agreement on strategic cooperation in Arctic LNG projects. Novatek is also developing the Arctic LNG 2 project on the Gydan Peninsula in Northern Siberia. With a production capacity of approximately 19.8 million tons per year, it will more than double the value of the Novatek LNG business in the Far East. These infrastructure investments were closely examined under Sino-Russian cooperation in the chapter 3.3.3. Below the picture of Russian gas pipelines to Europe by 2018

Russia’s main energy projects with Turkey involve natural gas. In November 2018, the two countries officially completed construction on the offshore section of the Turkish Stream pipeline. The section is 930km (578 miles) long and runs along the bottom of the Black Sea, is designed to deliver Russian gas to the Turkish market.

Nord Stream 2, the most geopolitically charged pipeline in the world.

In December 2018, The European Parliament called for the construction of the Nord Stream 2 pipeline to be cancelled. Some weeks earlier, US Congress’ resolution against the pipeline was another attempt to hinder project. The further US pressure continues hard and the situation in mid-2020 is still open.

The Nord Stream 2 project includes construction of two gas pipeline lines with a total capacity of 55 bln cubic meters of gas per year from the coast of Russia through the Baltic Sea to Germany. The cost of construction is estimated at 9.5 billion euro, the launch of the pipeline is expected before the end of 2019.Nord Stream 2 AG, a wholly owned subsidiary of Gazprom, is the project’s operator. Gazprom’s partners – Germany’s Wintershall and Uniper, Austria’s OMV, France’s Engie and Royal Dutch Shell (the UK Britain and the Netherlands) are to finance 50% of the project. The pipeline will go through the territorial waters of five countries – Russia, Finland, Sweden, Denmark and Germany.

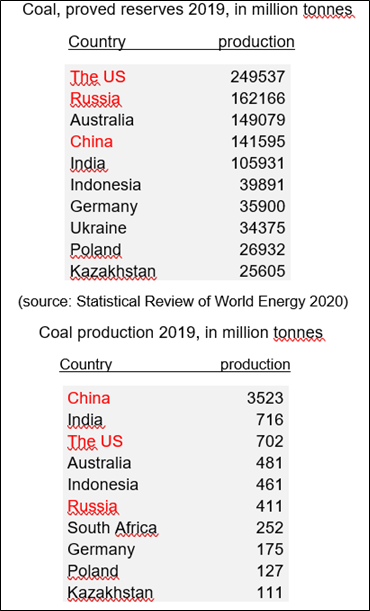

Coal

Proved reserves of coal have been stabile in the world as well as production, China being a superior producer worldwide. World coal consumption has fallen in six last years, displaced by natural gas and renewables, particularly in the power sector. As a result, coal’s share in the primary energy mix fell to 27.0%, its lowest level in 16 years.

Coal consumption continued to increase in some emerging economies, particularly in China, Indonesia, India and Vietnam. Coal is still a key energy source for electric production, especially in Asia.

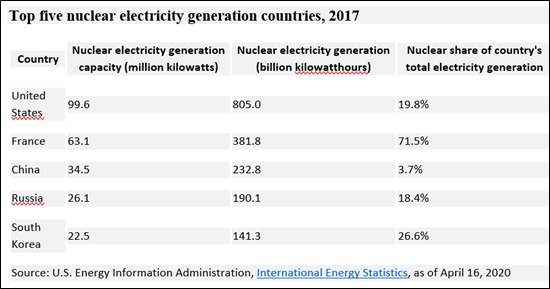

Nuclear energy

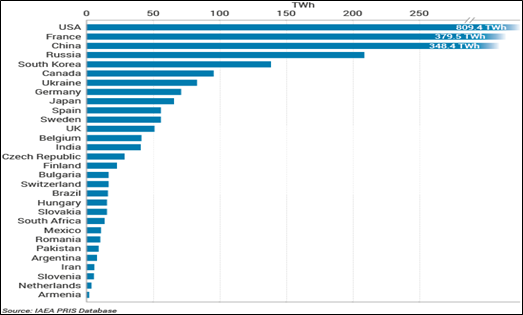

Nuclear power plants are operational in 30 countries worldwide. Around 11% of the world’s electricity is generated by about 450 nuclear power reactors about 60 more reactors are under construction, equivalent to 16% of existing capacity, while an additional 150-160 are planned, equivalent to nearly half of existing capacity. Leading countries in the nuclear reactor technology today are China, France and Russia.

World Electricity Production by Source 2017

Nuclear Generation by Country 2019

China is planning to triple its nuclear capacity in the next 20 years, ousting the US as number one nuclear-power producer, according to the International Energy Agency (IEA). Fatih Birol, the CEO of IEA, told that the US, which has been the leader in the industry since the 1960s, is facing two problems that will lead to losing its lead. First, America is not investing enough in nuclear power (neither does Europe). Second, it is not doing enough to extend the lifetime of existing plants.

Russia’s Rosatom has been very active in marketing NPP-operations abroad. One of Russia’s major energy projects in Turkey, the Akkuyu nuclear power plant (NPP), will become operational in 2023. It is expected to provide 17 percent of the country’s electricity needs. The date was chosen by Turkish President Erdogan, because the republic of Turkey will celebrate its centenary in 2023. The $20-billion project will be the first NPP in Turkey. The plant will have four reactors with a total capacity of 4,800 MW and a service life of 60 years.