Glimpses in economic dimension of current great power competition

This cartoon is telling, in quite shocking way, the core of the policy of Biden administration regarding Ukraine of today. The leaders and people of Ukraine were manipulated to believe in American “forever support” but the failed counteroffensive of the summer 2023 put it upside down.

Now American authorities and western mainstream media (MDM) are seeking scapegoats of failed offensive, “blame game” is going in full speed both in America and in Ukraine. And what’s funniest, when before Russia was considered a misery, now it is a dangerous threat worldwide. All these crazy events and processes have fundamental impacts on the world affairs.

As Albert Einstein has said “stupidity is the endless natural resource in the humanity”.

Sanctions backfire in Europe

EU sanctions against Russia boomerang back on member countries. European Union has officially acknowledged its member economies face a significant economic downturn: by year-end, GDP will decrease in ten EU member states. These include not only “lagging behind” nations, such as Poland, Lithuania and Latvia but also some of the leading economies like Germany and France. Conversely, predictions for the Russian economy are optimistic. The UN believes that Russia will substantially recover losses incurred from sanctions this year.

The eurozone economy is displaying indications of an imminent recession as GDP decreased by 0.1% in the third quarter. In terms of the whole year, there may be still a marginal increase. Despite rigorous monetary policies, the US economy experienced growth of 2.9% in the same quarter.

Germany from being a driving force and the so-called locomotive of European economy, has now become a weak link. The German economy fell into recession during the first quarter of the year, with GDP declining by 0.3 percent. The second quarter also saw a contraction of – 0.2%, which continues in the third quarter due to stagnant industrial growth and negligible impact of private consumption.

In France, the atmosphere is even bleaker with the European authorities being held responsible for the situation. As the leader of the Patriots party, Florian Philippot recollected that not long ago, Finance Minister Bruno Le Maire pledged the downfall of the Russian economy; however, it was the French one that suffered collapse.

As per the European Commission’s report, ten EU countries, including Germany, will experience an economic downturn in 2023, while Estonia is predicted to set a record low. The German economy will shrink by 0.3% by the end of the year. The greatest decline is anticipated in Estonia at 2.6%, accompanied by Ireland at 0.9%. Estonia was in December 2022, the first country in the world to give to Ukraine more than a percent of its GDP and now a year later in November 2023, Estonia has fallen into bad recession. Recovery will be long and difficult.

Despite an €800 billion stimulus package being implemented across the bloc, economic growth has stagnated. The Financial Times reports, “The Commission’s pressing challenge is to revitalize the EU’s stagnant economy and dwindling international competitiveness.” So far, none of the measures taken thus far have proved successful. The European regulator acknowledges that elevated inflation and lackluster business activity are exerting significant pressure on the markets within the bloc.

This decline can be attributed to the escalating energy costs, surging inflation and ECB interest rates. The purchases of relative cheap and stable Russian energy have been replaced by four times more expensive American LNG-gas and spot purchases of oil.

It’s intriguing that the European Commission doesn’t consider sanctions against Russia as a factor contributing to the decline of European economies. However, the current state of affairs is a direct consequence of them.

The decision to abstain from purchasing energy resources from Moscow pushed up inflation figures in the EU, which had a negative impact on local businesses’ competitiveness. In order to bring prices under control, authorities had to increase interest rates actively, which further weakened the business climate. The dismal outlook for the region is supported by current macroeconomic data: the bloc’s industrial output keeps decreasing.

Russian economy under “world record” sanctions

In Russia, business activity has been growing for the eighth consecutive month, breaking records for production growth. S&P Global reports that business activity figures were 54.7 at the end of September and 53.8 in October, due to domestic demand. Employment in the real sector is increasing at its fastest rate in 23 years. S&P Global has also observed a significant improvement in operational conditions.

This trend is a result of a confident adjustment to external restrictions and the process is progressing more rapidly than anticipated. The manufacturing, construction, wholesale and retail trade sectors are all experiencing growth. During Q2 2023, the production capacity utilization in Russian factories hit a new all-time high of 81 percent, surpassing the former record set in Q1 of the same year (80.3 percent).

The Central Bank of Russia (CBR) cited that “factories are augmenting their output and upgrading production, in the context of refocusing on domestic demand and intensifying import substitution programs with a corresponding increase in investment activity.” The production of paper and paper products leads with an 83.6 percent utilization rate, followed by textiles and clothing at 81.5 percent.

The OECD anticipated a 0.8 percent economic growth for Russia in 2023 and 0.9 percent for 2024. The International Monetary Fund (IMF) has revised its estimates three times this year. In January, they predicted a growth of 0.3 percent but now the projection is 1,5%, by 2024, the predicted growth is 1.3%. As per UN reports, Russia is one of the few G20 countries expected to accelerate its economic development in 2023. UNCTAD reported this development and stated that GDP is expected to increase by 2.2% this year and 2% the next.

Factually, in the nine months of 2023, Russia’s gross domestic product has risen by 2.8% in comparison to the corresponding period in the previous year. The progress is noteworthy. In November, the Russian Finance Minister Anton Siluanov mentioned that 2023’s economic surge might surpass three percent and the latest estimate of CBR for GDP 2023 is +3,2%. During the third quarter of 2023, growth hits 5,5 %.

The Russian Federation Council approved the law on the federal budget for 2024 and the planning period 2025-2026 at a plenary meeting on November 22. GDP is expected to grow by 2.3% in 2024 to 180 trillion rubles ($2 trillion), by 2.3% in 2025 to 191 trillion rubles ($2.1 trillion), by 2.2% in 2026 to 202 trillion rubles ($2.3 trillion).

Bilateral trade Russia-China has in November 2023 exceeded a “historical stage” $200 billion, from which majority is today settled in national currencies. By 2030, the bilateral trade is expected to rise up to $500 billion.

Russian economy investment boom, industrial surge

The Duran, November 11, 2023

Chinese assessment

The academic conference Crisis and Global Transformation: China and Russia Facing the Challenges of a Changing World Order was held in Shanghai on November 16-17 with leading experts from Russia and China taking part. The Valdai Discussion Club in cooperation with the ECNU has been organizing such conferences on a regular basis since 2010. This year’s conference was the first in-person event in the last four years after a forced pause due to anti-Covid pandemic restrictions.

The conflict in Ukraine has created a new geopolitical situation, in which Europe has been hit harder than Russia, Huang Renwei, the Executive Director of the Fudan Institute for Belt and Road and Global Governance, has told in the conference.

The Russia-Ukraine conflict has created a new geopolitical situation. The most important thing is that supply chains and industry are undergoing changes, which affected firstly energy supplies from Russia. The supply was previously oriented towards Europe but when the conflict started these supplies (oil and gas) were interrupted and Europe and Russia found themselves separated. This was considered a big blow to Russia but Europe was hit far harder.

Russia’s turnaround in energy supplies towards Asia was to China’s benefit. On the other hand, oil producers in Saudi Arabia began to coordinate their moves with Russia more actively, which made it possible to control oil prices. “Keeping prices high has also affected inflation in the US,” the expert said.

Another important change in the world, Huang said, concerns the fact that Russia has employed systems for transmitting financial information alternative to SWIFT. More countries have begun to use yuan for settlements instead of dollar. All these changes are accelerating the decline of the US dollar hegemony. In this regard, the US is afraid of the decline in the use of the dollar, because of the excess dollars on the market,” Huang said, stating that the US hegemony rested on the dollar and the armed forces.

Because of Western sanctions, the center of Russia’s economic life was shifting to the Far East, with its huge resources and great potential for development yet to be tapped. If this trend continues, the Chinese expert predicts the emergence of a new cluster, which he called North Asia, incorporating the eastern part of Russia, Mongolia and China.

Russian oil price cap has largely failed, new CREA report

G7 nations and the EU imposed a $60-per-barrel ceiling on Russian crude oil last December in an attempt to keep oil supplies stable globally while starving the Kremlin’s war chest. But widespread circumvention, gaping loopholes and the ongoing fuel business mean Moscow is still earning billions from its oil business.

An analysis from the Centre for Research on Energy and Clean Air (CREA) think tank reveals that a Western effort to cap Russia’s oil revenues has essentially failed a year since it was first agreed. Moreover, the impact was felt most intensely in the first half of 2023 before beginning to fade. Russian oil now consistently sells for more than the $60 limit. The shortfall is partly due to traders simply ignoring the price ceiling, the report states, and Russian oil is selling for roughly $70 a barrel.

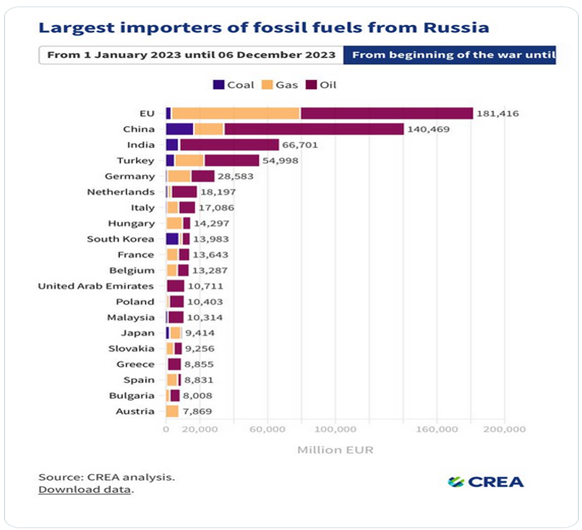

The data and the chart by CREA tell the hypocrisy and double standard of the EU in this business.

A “refining loophole” has also undermined Western efforts. Countries like India are buying huge volumes of Russian crude on the cheap, processing it and then selling it to anyone who wants it, without restrictions. That means European consumers could unknowingly be using petrol, diesel and jet fuel produced from Russian crude, bankrolling Moscow’s armed forces at the same time.

EU attempts to sanction Russian nuclear fuel but Hungary joined by Slovakia to block them

The EU is attempting to introduce sanctions against Rosatom and the Russian supply of nuclear fuel. They previously tried to implement sanctions against them during the tenth package of sanctions and now there is discussion concerning the 12th package.

Slovakia will object to the incorporation of nuclear fuel for nuclear power plants. This is due to Slovak nuclear power plants lacking the ability to convert to an alternative fuel from Russian nuclear fuel.The Slovak Foreign Ministry’s head is confident that the European Union will consider Slovakia’s viewpoint. In the event that the new sanctions package includes Russian nuclear fuel, Bratislava intends to exercise its veto power and oppose this provision. The republic is home to two nuclear power plants, which generate over half of the electricity in Slovakia, with Rosatom supplying fuel for these plants.

The situation is comparable in Hungary. During the last implementation of the 10th sanctions package, Hungary expressed its opposition to such restrictions. Prime Minister of the Republic Viktor Orban stated that Hungary will veto any anti-Russian EU sanctions concerning nuclear energy.

It raises the question: why are certain European countries seeking to impose these sanctions while others are unwilling to do so under any circumstance?

In the past, the Czech Republic, Finland, Bulgaria, Hungary and Slovakia have maintained strong connections with Rosatom. In those nations, nuclear power stations were established during the Soviet era, featuring VVER-440 reactors of the original model. It is noteworthy that all of these power units are completely fueled with Russian fuel. In Finland, Russian nuclear fuel accounts for 36% of the market. If we imagine that the EU continues to block access to Russian fuel for European nuclear power plants, this will inevitably harm the economies of affected countries as it leads to premature shutdowns.

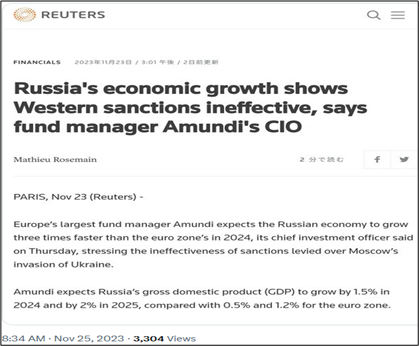

Europe’s largest fund manager Amundi expects the Russian economy to grow three times faster than the eurozone’s in 2024

In late November, Europe’s largest fund manager Amundi expects the Russian economy to grow three times faster than the eurozone’s in 2024, its chief investment officer said, stressing the ineffectiveness of sanctions levied over Moscow’s invasion of Ukraine. Amundi expects Russia’s gross domestic product (GDP) to grow by 1.5% in 2024 and by 2% in 2025, compared with 0.5% and 1.2% for the euro zone. Four weeks later, the latest estimates tell the growth of Russian GDP will over 3% in 2023.

“It means that the United States, Europe, Japan, Australia – the major developed countries – are unable to sanction a country effectively,” Amundi’s CIO Vincent Mortier said at a news conference in Paris on the fund manager’s 2024 outlook. “That’s what it means. We can deplore it, but it’s a reality.” The impact of the sanctions was visible in terms of asset-freezing for a certain number of people, Mortier said, but not so much on Russia’s imports and exports.

Major emerging economies under the BRICS umbrella (Brazil, Russia, India, China and South Africa), as well as countries such as Turkey and Kazakhstan, benefited from the sanctions as Russia managed to move its exports away from western countries, Mortier said. “It’s a reality check.

In the end, if we take stock of the war in Ukraine: Europe has suffered directly and strongly; for the United States the impact is neutral; but Turkey, central Asia and Asia more generally have benefited,” Mortier said.

Wider view of failing Western sanctions

Sanctions are the principal instrument of economic warfare. When they are imposed unilaterally by a country, without the support of the United Nations, they are referred to as “unilateral coercive measures” and are illegal according to international law.

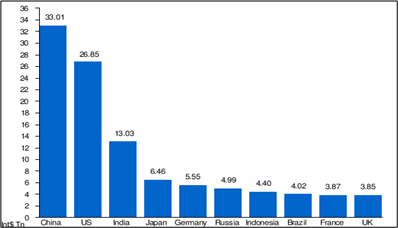

One-quarter of the global population lives in countries that have been unilaterally sanctioned by the United States. The nations sanctioned by the US and Europe represent nearly one-third of global GDP.

The application of sanctions by the United States and its European allies has skyrocketed in recent years. Among the countries sanctioned by the United States are two of the powerful nations: China and Russia. China has the world’s largest economy, measured its GDP at purchasing power parity (PPP) and Russia has the sixth-biggest economy.

The biggest economies in the world by GDP (PPP), according to 2023 IMF data.

Western sanctions are backfiring: The European Union is now importing Russian liquified natural gas at record levels and China has made high-tech breakthroughs despite US export restrictions. Washington’s and Brussels’ economic warfare is, ironically, strengthening the economic sovereignty of Beijing and Moscow while blowing back on Europe.

The world is living through a new cold war, Cold War 2.0, and one of the main ways in which this war has been waged is through economic means.

Geopolitical Economy Report, September 5, 2023

Western sanctions failing: EU imports more Russian gas, China beats US tech war

The US government has made it clear that its goal is to sabotage the economies of China and Russia but Washington has failed. China continues developing state-of-the-art technology, while Russia has only further solidified its role as a global commodities powerhouse, strengthening its own manufacturing sector.

The failure and even blowback of this Western economic warfare shows that, while unilateral sanctions can do significant damage to smaller countries with less developed economies, like Venezuela, Cuba, or Syria, for big nations with a massive industrial base, like China and Russia, their economies may effectively be “too big to sanction”.

In these cases, Western sanctions do economic damage in the short term but in the medium to the long term, the unilateral coercive measures actually help the targets by making them more economically and technologically sovereign. These huge Eurasian economies find alternatives and are no longer dependent on Western corporations. They develop their own high-tech manufacturing sectors, with more value added in the production process.

In order to damage China’s economy and particularly its tech sector, the United States has imposed many rounds of aggressive sanctions, starting first under President Donald Trump and very much continuing under Joe Biden, in a thoroughly bipartisan campaign. However, these sanctions have failed to prevent China from technologically developing; Beijing has continued taking huge strides.

Russia is the most sanctioned country in the world. The US and European Union have imposed many rounds of sanctions on Russia over the NATO proxy war in Ukraine. President Biden made it clear that Washington’s goal with this economic warfare was to turn Russia’s currency, the ruble, into “rubble”.

But sanctions are not a precise instrument – despite the fact that Western governments claim they are “targeted” against specified objects. Sanctions are a brutal instrument of economic warfare, of collective punishment. They often do serious collateral damage and have major consequences for civilians living in targeted countries.

In the case of Russia, the economic sanctions have not done as much damage as the West would have hoped. Initially, the ruble did significantly depreciate against other currencies but it soon rebounded, due to Russia’s massive natural resources.

In fact, not only have the sanctions failed to turn the ruble into rubble and devastate the Russian economy but they have backfired on Europe, unleashing an energy crisis and contributing to high levels of inflation.

In the meantime, the European Union is importing record levels of Russian liquefied natural gas (LNG). The Financial Times reported that, in the first seven months of 2023, EU members Belgium and Spain were the second- and third-largest purchasers of Russian LNG. The only other country that bought more was Russia’s closest ally China. France and the Netherlands have also been importing significant quantities of Russian LNG.

The newspaper added that “the EU did not import significant amounts of LNG before the war in Ukraine due to its reliance on piped gas from Russia”. What happened to that pipeline gas? Well, Europe pledged to boycott it. But furthermore, some of the most important pipelines connecting Russia to Germany, Nord Stream, were blown up in an international act of terrorism in September 2022. Who exactly sabotaged this crucial energy infrastructure is not officially known. But Pulitzer Pitzer-winning journalist Seymour Hersh reported that it was the US government.

Thanks to sanctions, the US earned more than 50 billion euros from gas supplies to Europe. This is evidenced by Eurostat data. The “added value” of anti-Russian sanctions for American gas companies on the European market over 20 months amounted to 36 billion cubic meters. This cost the Europeans 52.2 billion euros, while they paid the Americans two times more per cubic meter of gas than before the war in Ukraine. The US is the largest exporter of LNG to Europe, Russia is now the second-largest exporter of LNG. So, while Europe’s economies suffer, US corporations are benefiting.

At the same time, India has been buying record amounts of Russian oil, below market value, at a neat discount, then refining that crude and selling it to Europe with a fat markup. So, India is handsomely profiting from selling Russian oil to Europe, because Europe refuses to buy the Russian crude directly due to its sanctions.

This suicidal European sanctions-policy has fueled an energy crisis in Europe, pushing economies into recession and causing de-industrialization at breakneck speed. Average working people have shouldered the burden of this economic pain. The real wages of workers in the Eurozone have fallen by 6.5% in this period of sanctions.

China – EU meeting in Beijing, December 7, 2023

“China and the EU bear responsibility for reinforcement of stability in the world. We must provide a greater impetus to the development, to lead the global governance, to provide it with support,” Xi Jinping said during the meeting with European Council President Charles Michel and European Commission President Ursula von der Leyen in Beijing.

Xi Jinping noted that the world is experiencing great changes, while China and the EU contribute to multipolarity and act as key markets, facilitating globalization. The last in-person EU-China summit took place in 2019. Initially, the summit was supposed to last for two days but the growing disagreements within the EU on Ukraine forced the European side to cut the program.

Regarding the trade deficit dispute between the EU and China, there was no solution in sight; China rejected all EU’s trade deficit complaints.

China rejects EU’s trade deficit complaint “If the EU on the one hand imposes harsh restrictions on high-tech exports, and on the other hopes to sharply increase exports to China, that I’m afraid doesn’t make sense,” Wang told a regular press conference.

The Chinese market will continue to open to Europe and it is hoped that the EU will relax its restrictions on the exports of high-tech products to China, said Wang Wenbin, spokesperson for the Foreign Ministry on Friday, one day after the 24th China-EU Summit was held in Beijing. Wang said the current trade imbalance between China and the EU is the result of the joint actions of the macroeconomic environment, international trade conditions and the industrial structure, which cannot simply be attributed to one party or to market access issues.

The European side has repeatedly mentioned that the trade deficit with China surged last year, which was more affected by factors such as the surge in energy prices and geopolitics, and “is of a special nature,” Wang added. China has never deliberately pursued a trade surplus, and China’s ultra-large market will continue to open to Europe. We welcome European companies to share the opportunities and hope that the EU will relax its restrictions on the exports of high-tech products to China, Wang said.

Hodgepodge of currency pot

This “pot” is made up of de-dollarization process; gold production, holdings and price developments; various projects of crypto/digi-currencies; new BRICS-currency project; international payment info/message systems (SWIFT and others);astronomical federal and other debt burden of the US is skyrocketing; other relevant items.

Price level of gold has exceeded $2000 per ounce level and seems to be growing further. China and Russia are both increasing purchases of monetary gold and increasing their gold production. Market rumors speculate that China has secretly accumulated monetary gold about 20,000 tons. Various crypto/digi-currency projects are advancing, particularly private Bitcoin and that of China’s Central Bank.

As to de-dollarization process, BRICS-currency and international payment message systems, I refer to my previous articles on this website like

BRICS Summit – its importance and aftermath, August 28, 2023

New currency system, BRICS and SCO, January 12, 2023

President Putin’s recent visits in Saudi Arabia and UAE as well as the meeting with Iranian President Reisi in Moscow certainly have been especially important in this respect. Petrodollar will be replaced by petroyuan in the near future and the role of OPEC+ will be even more important than before.

China and Saudi Arabia recently signed a local currency swap agreement worth almost 7 billion in dollar terms. China is following the same path with its other trading partners. Swap agreements are being signed around the globe and the dollar is being pushed out of international trade in favor of the national currencies.

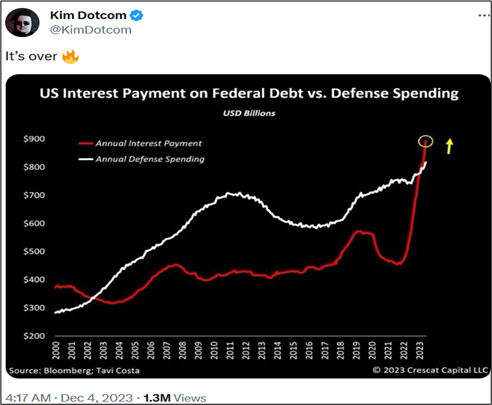

When comparing two great powers, the US and China, regarding the sovereign debt burden, the difference is that China has used the debt to build infrastructure, tech firms, colleges, R&D centers etc. The US debt was used to inflate the stock market and housing bubble, in other words the US debt burden is a giant Ponzi Scheme. The US federal debt was up to $33,9 trillion per December 9, 2023.

The US federal government has borrowed so much money that, over the past year, it has had to spend one-fifth of all the money it collected just on debt interest—which came to almost $880 billion. The next “magic limit” of paid debt interest “a trillion dollar per a year” will be reached in 2024.

Russian Federation is nearly debt-free, debt percentage of GDP is clearly under 20% (the US about 130%, China about 60%).

To Sum Up

Wishful thinking and self-delusion are dangerous: Bad analysis produces bad policies – Russia is decoupling from the West and increasing economic connectivity with the rest of the world. This will have major implications.

Regarding the destiny of the petrodollar, there was a huge development in late November that was under-reported and unnoticed by the market.

The death of the petrodollar is one of the key waypoints in the US dollar losing reserve currency status and while the US dollar used to be the only currency that foreign nations would trade oil in, that has now come to the final phase. Not only is Saudi Arabia trading oil in other currencies than the dollar (notably the yuan), it now appears the UAE is also strategically shifting away from the US dollar in its oil transactions, marking a significant change in the global financial landscape.

This move, involving potential deals with up to 15 countries including China, Russia, Iran and Egypt, is part of the de-dollarization trend, led by the oil sector. Led by the BRICS alliance, the move is redefining global economics and challenging the US dollar’s dominance in international trade.

At the same time, together with massive and skyrocketing US federal debt, these moves will degrade significantly the US military spending and military capability leading to dramatic changes in the balance of power and polarity worldwide. In other words, New World Order is in the making.