Economic outlook among great powers, autumn 2021

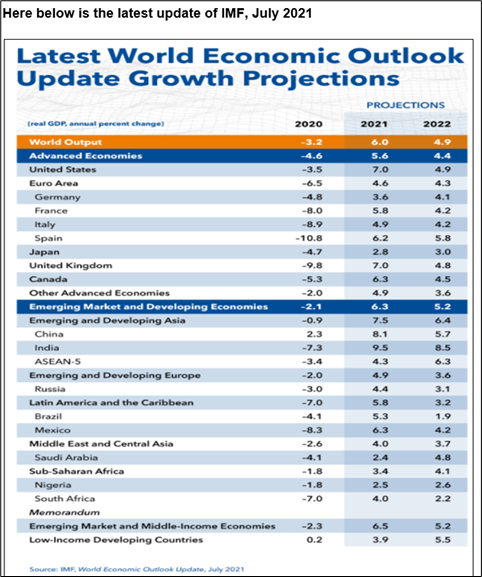

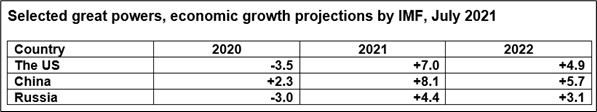

It seems, in September 2021, that the materializing growth estimates for 2021 will be lower than the above-mentioned IMF estimates regarding the US and China but Russia seems to be in place.

The Conference Board forecasts, in mid-September, that the annual growth of US’ GDP for 2021 will come in at 5.9 percent (year-over-year) and the forecast for 2022 will be 3.8 percent (year-over-year). Latest estimates of China’s growth rate are 6.6% for 2021 and 5.7 % for 2022. In Russia those latest estimates by the Ministry of Economic Development and Trade are 4.6% for 2021 and 3.8% for 2022.

The US economy in late summer – early autumn 2021

The US economy is now at a critical point, there was no V-shaped recovery but a partial V or a “truncated” V. There was a severe contraction of the pandemic in March – May 2020, followed by a recovery in July–September 2020. However, the recovery only made up part of the lost ground but not all of it. The economy recovered reasonably in the first half of 2021 but growth is not back to the prior trend, bearing in mind that the prior trend (from 2009–2019) was itself below the long-term trend. Now analysts are expecting slowing growth and metrics in employment and wages that are moving sideways or down without having recovered previous highs.

For the past 18 months, the economic damage of the pandemic has been mitigated with federal subsidies of various kinds, amounting up to several trillions of dollars. Other programs included rent moratoria, eviction moratoria and extended grace periods on repayment of student loans, airline bailouts and similar large-scale bailouts for cruise ships, resorts, casinos and other affected industries. The total tab could easily exceed $10 trillion in relief-type deficit spending before all is said and done.

No doubt some of this spending was needed; especially in the initial March–June 2020 period when there was so much uncertainty and the economy was locked down tight. Still, economists question whether this much relief was actually needed and whether the $4.5 trillion of additional spending still on the drawing boards is needed also. The immediate problem is that the economy is clearly slowing right now, just as many of these programs expire and before new programs come online.

The US economy “downshifted slightly” in August as the renewed surge of the coronavirus hit dining, travel and tourism, the Federal Reserve reported in early September but the economy overall remained in the turbulence of a post-pandemic rush of rising prices, labor shortages and skyrocketing rents. Still the document reported continued strong demand for workers and hiring made more difficult by “increased turnover, early retirements, childcare needs, challenges in negotiating job offers and enhanced unemployment benefits.”

Business activity slows a bit in September 2021 but the slowdown is likely temporary, yet the number of Americans filing new claims for unemployment benefits unexpectedly rose last week. The second straight weekly increase in jobless claims reported by the Labor Department on Thursday puzzled economists. Job growth slowed in August, with payrolls posting their smallest gain in seven months as hiring stalled in the high-contact leisure and hospitality sector. Pandemic-related factors are causing worker shortages, which are constraining hiring. The jobless rate was 5.2% in August.

The Federal Reserve struck an upbeat note on the economy, paving the way to reduce its monthly bond purchases “soon” and signaling interest rate increases may follow more quickly than expected. A survey from data firm IHS Markit, in mid-September, showed business activity grew at its slowest pace in a year in September as companies struggled with ongoing shortages of raw materials and labor.

Stocks on Wall Street were trading higher but the six largest Wall Street banks (Morgan Stanley, Bank of America, Deutsche Bank, Citigroup, Credit Suisse and Goldman Sachs) issued “Market Red Alerts”- warning of the risk of imminent market correction in autumn 2021.

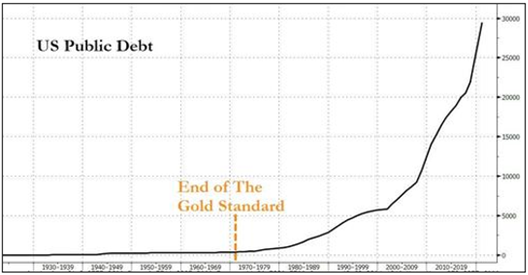

US federal debt

The US federal debt is literally exploding, with no signs of it abating and so does the whole American indebtedness.

With Central Bankers constantly reassuring that there is nothing to fear here – some even pointing to Japan as proof that this can go on much longer before the pin is pulled from the global reserve currency’s grenade – it appears that, back in the real-world, real-life human beings investing their own hard-earned money are much more worried about Washington’s largesse.

The Swiss UBS Group AG disclosed the report that the clients are wondering whether central banks’ massive stimulus could trigger hyperinflation. As Bloomberg notes, the concerns highlight the conundrum facing central banks as they continue to provide ultra-accommodative policy to help economies recover from the crisis. Commodity prices have spiked and other inputs are facing severe supply constraints, driving up inflation rates both in Europe and in the US.

Earlier this year when the US government announced sharply higher inflation for the month of March, the Federal Reserve deemed the inflation to be “transitory”. Inflation has surged even higher since then and it is not hard to understand why. Energy and food prices as well as rent hikes will explode consumer inflation in 2022.

Economists are rather convinced that the Fed is on its way to “normalization”, that is “tapering into mid-2022 then rate-liftoff by end-2022”. American investor Peter Schiff warned that even if the Fed does begin to taper, it will eventually reverse course and ultimately expand QE. The Fed’s easy money policy is the key foundation for this US bubble economy.

The Fed expanded the money supply last year (2020) more than in any other year in US history except for 1943. That is obviously going to have an impact. At the same time, the government forced businesses to close (due to pandemic) and then paid people to stay home and not work.

This has predictably created substantial inflation. The Fed understand that their zero-interest rate policy and their bonanza of money printing (Fed’s bond buying program means $120 billion per month in new money that is flooding the US financial system) are driving prices higher and that inflation is a major concern. However, the Fed is not even going to start the process of terminating this program until mid-next year.

America’s “debt Armageddon”

The US government is right now on course to a $30 trillion debt burden, which is about 130% of the American GDP and twice the size of China’s annual gross domestic product (GDP). The biggest holders of US federal debt are Japan with $ 1.3 trillion and China with $ 1.1 trillion.

Trump’s presidency (2017-2021) gave China’s leadership a lot of reasons to worry about the safety of Chinese savings. Trump’s trade war came on top of his frequent tirades about China “killing” American workers with an undervalued exchange rate. During his time in office, Trump’s inner circle mulled canceling portions of the debt the US owed Beijing. Trump also considered a dollar-to-yuan devaluation of the kind Vietnam or Argentina might suddenly announce.

The Treasury Department invoked emergency cash-saving measures in August to stop the United States from defaulting on its federal debt, with Congress failing to extend the suspension of the debt ceiling before departing for a six-week vacation and Republicans refusing to raise it after returning to Washington. Treasury Secretary Janet Yellen has warned that a failure by Congress to raise the debt limit will “plunge” the US into a financial crisis. Technically, the US government blew past the previous debt ceiling several months ago. Treasury Department officials employed a variety of cash-balance maneuvers to pay Washington’s bills month to month. Now, the Treasury is reaching the limits of this strategy.

Lawmakers were able to pass an emergency temporary funding bill (“continuing resolution”) by the end of September to avoid a government shutdown but the reality is facing the Capitol lawmakers again in November. Congress has raised America’s debt ceiling roughly 80 times since the Sixties, with federal debt rapidly approaching $29 trillion and total liabilities, which include federal debt plus other public and private obligations amounting to more than $85 trillion or more than four times the US’ GDP. The materialized failure to raise the debt limit could be “more catastrophic to the economy than the 2008 failure of Lehman Brothers” and would be a real financial Armageddon.

The Chinese economy in late summer – early autumn 2021

China’s economy maintained the trend of recovery in August despite disruptions from the COVID-19 epidemic and natural disasters, showing the resilience of the world’s second largest economy. The country’s industrial output showed stable growth in August, with the value-added industrial output, a key indicator reflecting industrial activities and economic prosperity, expanding 5.3 percent year on year, according to the National Bureau of Statistics (NBS). The figure was up 11.2 percent from the level in August 2019. In the first eight months, industrial output gained 13.1 percent year on year, resulting in an average two-year growth of 6.6 percent, NBS data shows.

China’s retail sales of consumer goods went up 2.5 percent year on year in August, down by 6 percentage points from the previous month. The sporadic outbreaks of COVID-19 and natural disasters such as floods hindered travel and held back consumption during the summer holiday. However, the cumulative growth for the last eight months showed that retail sales gained 18.1 percent year on year, which means consumption remained generally stable and the recovery trend was unchanged.

The future consumption activities seem optimistic, considering the upgrading demands of the large middle-income group of over 400 million people, the stable job market and the increasing profitability of enterprises.

China’s job market remained generally stable, with the surveyed urban unemployment rate standing at 5.1 percent in August, unchanged from that in July. During the first eight months of this year, the country created 9.38 million new jobs in its urban areas, achieving 85.3 percent of the annual target. The unemployment rate of those aged between 16 and 24 was down by 0.9 percentage points from that in July to 15.3 percent, NBS data shows.

China’s fixed-asset investment went up 8.9 percent year on year in the first eight months of this year, with the average growth rate over the past two years standing at 4 percent. Investment in the manufacturing sector stood out, with a 15.7-percent yearly increase during the period.

China may be about to face a major financial crisis, when China’s property boom is coming to an end and that Evergrande is over-indebted and in danger of default. The world’s most indebted property developer, Chinese Evergrande with about US$305 billion of debt and $355 billion of assets amid slowing world growth, stands as a microcosm of China’s biggest challenges. Evergrande’s troubles, described “a Chinese Lehman-Brothers”, are no Lehman moment, but they do pose a significant risk of international contagion across finance markets worldwide. As analyst Sikand at Gavekal Research says, “China’s authorities have a very clear motive and the necessary means, to contain any threat of a systemic crisis in the country’s domestic financial system.”

Over the past decade, China’s debt has grown significantly and has become one of the biggest challenges for the Chinese administration. Beijing considers the growing level of debt liabilities to be a potential threat to economic stability. China has tried to reduce its dependence on them but the work in this direction had to be suspended because of the coronavirus pandemic.

The pandemic affected all businesses and the Chinese authorities were forced to make it easier for companies to receive loans. As a result, in the third quarter of 2020, the level of debt broke a historical record and amounted to almost 290 percent of GDP, according to the Bank for International Settlements. However, the structure of China’s debt is very different: nearly 170%-units from the above-mentioned accounts for the corporate, the government sector accounting just about 60%-units and the consumers the rest.

As the economy recovers from the pandemic, China has returned to debt-containment efforts. According to UK’s Barclays Bank, the credit growth will slow to 10-10.5 percent by the end of this year, as compared to 13.3 percent in late 2020.

According to Bloomberg’s analysis, China is facing “Lower growth, higher inflation and less stimulus.” That is the most-likely scenario over the coming months and possibly years, if the ruling Communist Party presses on with its “common prosperity” drive to transform China’s economy. The phrase “common prosperity” means, inter alia, higher wages for workers, lower profits for corporations and efforts to control home prices and rent. The recent crackdown on real estate and tech, combined with efforts to raise working-class pay, will support the development of a healthier and more balanced economy, along with Party’s policy. However, analysts of Western banks remain optimistic on the prospects of China’s long-term economic growth.

The Russian economy in late summer – early autumn 2021

Russia’s gross domestic product (GDP) increased by 4.6% year-on-year level in the first half of 2021, exceeding expectations, the Economy Ministry has announced. The forecast GDP growth will be the fastest that Russia’s economy has seen since 2012, as the average annual growth in 2014-2019 was less than 0.5%, with a dramatic 3% decline in 2020.

According to the ministry, in June the country’s GDP reached the pre-pandemic level corresponding to the fourth quarter of 2019, growing by 8.5% in annual terms. In the second quarter of 2021, GDP growth amounted to 10.1% compared to the same period in 2020.

The country’s GDP has been mostly driven by non-energy sectors, including the agriculture (export of agriculture over +30% in the first half of 2021), manufacturing and construction industries. Domestic demand remained the main driver of the economy in 2021, the ministry stated. It also revealed that the average incomes of the population at the end of the second quarter this year were close to the level of the same quarter of 2019. Energy sector is getting more momentum in the autumn 2021.

Russian oil exports to the United States have surged 23% this year, overtaking Mexico and making Russia the US’ second-biggest crude supplier after Canada. According to Russia’s Federal Customs Service records, the United States bought almost one-fifth of the country’s total heavy-oil exports during the first five months of 2021, making the US Russia’s largest buyer of heavy-oil products. The US is increasing purchases of Russian crude while at the same time continuing to target the country’s energy sector with sanctions. However, Washington has not issued any sanctions that would ban US companies from buying Russian crude, which effectively allows them to boost purchases.

Russia’s statistics agency, Rosstat, has improved its estimate of the country’s GDP growth in the second quarter of 2021 to 10.5% in annual terms. The volume of GDP for the first half of 2021 in monetary terms amounted to 57.6 trillion rubles ($786 billion) at current prices. GDP growth in annual terms was estimated at 4.6%.

According to the agency, nearly all sectors of the economy saw an increase in production in the first half of 2021 compared to the corresponding period last year.Value-added tax increased most notably in such areas as hotels and restaurants, water supply, sewerage, waste collection and disposal, as well as culture and sports, wholesale and retail trade, transportation and storage.

Interesting economic news come from rapidly growing tech giants like Yandex, Mail.ru and Sberbank (especially bank’s non-financial activities). Boosted by last year’s lockdowns, e-commerce is increasingly becoming a Russian success story. All companies in this sector are reporting very strong business results in the first half of this year.

Russia’s Ministry of Finance is projecting steady GDP growth of more than 4% in 2021, while raising the outlook for inflation to more than 5%, Vedomosti newspaper reported in early August, citing officials. “The trajectory of recent months indicates even more optimistic recovery dynamics and a possible acceleration of economic growth rates above 4% per annum,” the newspaper states, quoting a letter by Russia’s Deputy Finance Minister Vladimir Kolychev.

Consumer prices in the country have already seen a 4.6% increase from January to July this year. With this in mind, along with a number of other remaining pro-inflationary factors, such as surging global food prices and a steady post-pandemic recovery in demand, the finance ministry predicts inflation will surpass the 5% mark. Inflation in Russia in 2020 was 4.9%, according to Russia’s statistics agency Rosstat.

Russia’s forex reserves (gold, foreign currency, highly liquid foreign assets and SDR assets) have risen to a record high of $618.1 billion as of September 1, 2021, according to data published by the country’s central bank. At the same time, Russia has one of the lowest public debts, only about $ 470 billion making debt-to-GDP ratio by far under 20%. When taking into account the increasing energy prices worldwide, the general economic outlook for the giant energy producer like Russia seems quite promising.

Regarding the long-term future, in the context of “the world is moving to east”, harmonizing Russia’s EAEU and China’s BRI under the patronage of the SCO, will likely open interesting views for the Russian initiative of the Greater Eurasian Partnership.

“New Economics”

Even bigger questions hang over the global financial system

The US dollar and US Treasuries are still the linchpin of the global trading system. Yet the political shenanigans on display in Washington could change that – and quickly. The efforts by China, Russia, Saudi Arabia and other major economies to de-dollarize world trade is a work in progress. The “empire is crumbling” and the dollar is “slowly losing its sheen,” says Peter Koenig at Renmin University of China. Slowly, but surely, he says, the dollar “is losing its weight in the international financial market.” Russia has been very active in ditching the US dollar.

Technological change is accelerating the timeline, particularly as China outpaces the US in the race to bring a central bank-issued digital currency to market. With the explosive proliferation of cryptocurrencies, including China’s introduction of a digital renminbi, it is not surprising to hear panicked warnings about the looming decline of the dollar. Yet the dollar is at the mercy of politics and politics can be highly toxic. If the current squabbling in Washington devastates trust in the core asset of the global financial system, current obsessing over China Evergrande will become a mere side show.

Deficit spending

There is good practical evidence that debt-to-GDP ratios in excess of 90% produce less growth than the amount of new debt itself. In fact, the present US debt-to-GDP ratio is now approx. 130%. In other words, there is no stimulus and only an increasing debt-to-GDP ratio that makes the situation worse. Biden administration’s deficit spending, which will approach $6 trillion of new authorizations in fiscal 2021, is continually claimed as stimulus.

The government deficit spending as such is not a problem but the disagreement is with the abuse and waste of it. Usually, the lack of an essential component what is required for deficit spending to be beneficial is a “return on investment.” Even classic John Maynard Keynes was correct in his theory that in order for government deficit spending to be effective, the payback from investments being made through debt must yield a higher rate of return than the debt used to fund it.

Using deficit spending for projects that have a “return on investment” such as power production or broadband, all of which users pay a fee to consume, is valid. Such is because the long-term revenue generated by these projects repays the debt over time. Using deficit spending to fund social welfare and similar programs, as is the case in majority of Biden’s various stimulus packages, has a long-term negative multiplier to economic growth.

Characteristics of a new great depression… and more recessions

A recession is technically defined as two or more consecutive quarters of declines in GDP. A depression is not technically defined but is understood as a prolonged period of growth that is either below the long-term trend or below potential growth. Technical recessions can occur during depressions.

There were two technical recessions (1929–1933 and 1937–1938) during the Great Depression (1929–1940), yet the entire period was characterized by below-trend growth, high unemployment and deflation. Stock markets and commercial real estate prices did not recover their 1929 highs until 1954, a full 25 years later.

New Depression is loomingagain in the US. Growth declined in 2008 and the 2009–2019 recovery averaged annual growth of about 2.2%, well below the long-term trend of 3.5–4.5%. GDP declined again by 3.5% in 2020, the steepest one-year decline since 1946. Annualized growth for the first half of 2021 is 6.4%, but that is slowing quickly; the latest estimate for the third quarter of 2021 from the Atlanta Fed is annualized growth of 3.7%.

The December 2019 level of output was not recovered until July 2021. Interest rates have been declining sharply. That is a sign of disinflationary expectations and may be an early warning of a new recession in 2022. This is characteristic of a new great depression that can last for many years. Once the inflation narrative fades and the disinflation narrative comes to the fore, we can expect a stock market correction as asset prices adjust to the return of an era of slow growth. Most financial panics or recessions are followed by recovery within a year or less. Pandemics, however produce different patterns. Looking out even further ahead, the effects of the pandemic on the economy will be intergenerational.

A recent study from the Fed in collaboration with outside academics showed that after the pandemics, the average time needed to return to normal levels of interest rates, growth and employment is more than 30 years. This pattern of recovery from extreme events was seen in the aftermath of the Great Depression (although that was an extreme economic collapse, not a pandemic). While the Great Depression was over in 1940 (partly because of war spending as the US moved toward World War II), the behavioral changes it produced did not fade until the late 1960s. The 1950s were a period of peace and prosperity in the US Still, Americans maintained high savings rates, mostly avoided conspicuous consumption and lived frugally as they had learned to do in the 1930s and during World War II. Based on this Fed study, it seems that the US will not recover from this pandemic fully until 2045 or later in terms of savings, consumption, disinflation, low interest rates and low growth.

Central Banks of Russia and China as well as many Western banks like Deutsche Bank have been “going Apocalyptic”, in the first half of 2021, by forecasting that inflation is about to explode in next couple of years “Leaving Global Economies Sitting on A Time Bomb”. In fact, they all are expecting drastic corrections in “Everything Bubble” worldwide and the coming of Great Depression with multiple recessions in one way or other within next few years, at the latest by 2025.

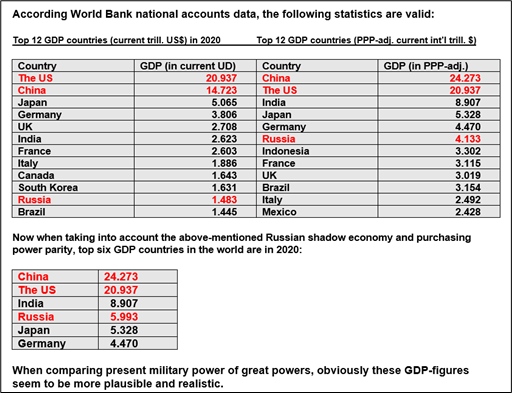

Revised and renewed GDP-statistics

Many economists and other experts have frequently pondered the question of the real size of Russia’s national economy. This question becomes particularly acute, when comparing the military expenditures and military capabilities of great powers.

In the case of Russia, the apparent contradiction between the massive, high quality military force and top-level weapons development and on the other hand Russia’s rather small-size national economy, has been under active discussion. How is it possible that such a “small economy” is able to maintain and develop such a massive, high quality military apparatus?

The explanation is that the actual size of the Russian economy is highly likely far bigger than official statistics indicate. The official numbers, inside and outside Russia, do not take into account the country’s considerable “shadow economy”. A recent Swedish-backed study estimated the off-the-books share of the Russian economy at a whopping 45% in 2018. This number would make Russia Europe’s largest real economy, in terms of purchasing power parity.

The recent study of “shadow economy” in Russia, “Shadow Economy Index in Russia 2017- 2018” was conducted by Prof. Talis Putnins and Prof. Arnis Sauka of Stockholm School of Economics in 2020. Shadow economy in Russia accounts for almost 45% of the yearly GDP in 2017-2018. This study can be found here: https://www.sseriga.edu/shadow-economy-index-russia .