BRICS Summit – its importance and aftermath

BRICS is a formal alliance of Brazil, Russia, India, China, and South Africa. Its Summit 2023 scheduled to be held on 22-24 August in Johannesburg, South Arica. Western media has been very reserved and “tight lipped” in reporting on the BRICS Summit and has tried to downplay the meeting both in advance and afterwards.

South Africa is hosting this summit at a time of acute tensions between the United States and its great power rivals China and Russia. But another context for the meeting is the increased salience of the Global South, most sharply revealed by the nuanced reactions in Asia, Africa, and Latin America to the Ukraine war.

The multiple failures of the US-led world order to substantially support two core requirements of Global South states—economic development and safeguarding sovereignty—are creating a demand for alternative structures for ordering the world. The BRICS and the Shanghai Cooperation Organization (SCO) are two major responses to these failures. They are bringing the East and the South together in rooms in which Washington and its core allies are not exactly welcome.

Organizations and Ideas of New World Order

BRICS and BRICS New Development Bank (NDB). BRICS is the acronym coined for an association of five major emerging national economies: Brazil, Russia, India, China and South Africa. Originally the first four were grouped as “BRIC” before the induction of South Africa in 2010. The BRICS members are known for their significant influence on regional affairs, all are members of G-20. Since 2009, the BRICS nations have met annually at formal summits. The New Development Bank (NDB) is a multilateral development bank operated by the BRICS states. The bank’s primary focus of lending is infrastructure projects with authorized lending of up to $34 billion annually. The bank will have starting capital of $50 billion, with capital increased to $100 billion over time.

Shanghai Cooperation Organization (SCO). The SCO is the successor to the Shanghai Five, formed in 1996 between the People’s Republic of China, Kazakhstan, Kyrgyzstan, Russia, and Tajikistan. SCO was announced on June 15, 2001 and its charter was entered into force on September 19, 2003.The current full membership: China and Russia, Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan, India, Pakistan and Iran. The current observers: Afghanistan, Belarus, Mongolia. The current dialogue partners: Armenia, Azerbaijan, Cambodia, Egypt Kuwait, Maldives, Myanmar, Nepal, Qatar, Saudi Arabia, Sri Lanka, Turkey, United Arab Emirates

Belt and Road Initiative (BRI) and Asian Infrastructure Investment Bank (AIIB). The massive Chinese initiative, which was announced by President Xi Jinping in 2013, aims to boost connectivity and cooperation between East Asia, Europe and East Africa. China will expand the use of the Chinese currency (renminbi / yuan) in countries and regions related to the BRI by improving cross-border payment and settlement facilities for the currency. BRI includes 71 countries that account for half the world’s population and a quarter of global GDP. At the centre of the plan are two physical routes. The Silk Road Economic Belt, stretching from Asia to Europe and the Maritime Silk Road that begins in China and passes along the Indian Ocean littoral to East Africa and then Europe. AIIB is a multilateral development bank that aims to support the building of infrastructure in the Asia-Pacific region. The bank currently has 87 member states from around the world.

Eurasian Economic Union (EAEU). The Eurasian Economic Union (EAEU) is a political and economic organization of states located in central and northern Eurasia aiming for regional economic integration. The treaty for the establishment of the EAEU was signed on 29 May 2014 by the leaders of Belarus, Kazakhstan and Russia and came into force on 1 January 2015. Treaties aiming for Armenia’s and Kyrgyzstan’s accession to the Eurasian Economic Union were signed on 9 October and 23 December 2014, respectively. Armenia’s accession treaty came into force on 2 January 2015. Kyrgyzstan’s accession treaty came into effect on 6 August 2015.

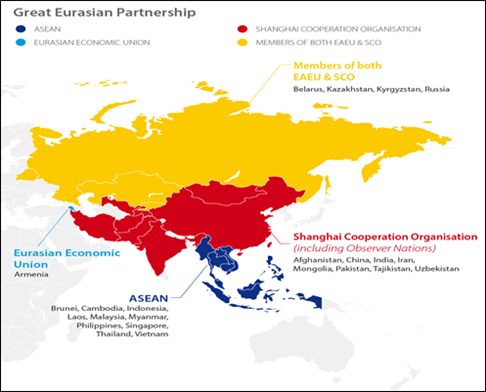

Great Eurasian Partnership. Both Chinese President Xi Jinping and Russian President Vladimir Putin have openly discussed the possibility of uniting Eurasia and developing something wholly new entity, known as the Great Eurasian Partnership. This concept brings together the members of the Eurasian Economic Union (EAEU), Shanghai Cooperation Organization (SCO), and ASEAN as a huge free trade bloc (Picture below).

Great Eurasia Partnership is set to integrate them all – from the SCO, EAEU, and BRICS to emerging new currencies – in order to replace the ‘rules-based order.’

It is essential to recall and realize that China’s BRI is globally the most awesome economic-political project, around which all other “non-western” endeavours are spinning. By January 2023, up to 150 nations had already signed up to the BRI; No less than 75 percent of the world’s population that represents more than half of the global GDP. Included in the Chinese Constitution since 2018, BRI constitutes the de facto overarching Chinese foreign policy framework all the way to 2049, marking the centenary of the People’s Republic of China.

The BRI advances along several overland connectivity corridors, BRI gives more political clout to the Global South and new international finance institutions (NDB, AIIB) get more “dealing power” via Chinese project. From this viewpoint, it is important to understand that the US/NATO proxy war against Russia in Ukraine is simultaneously a war designed to interrupt the progress of China’s Belt and Road Initiative (BRI).

De-dollarization

The status of US dollar as the main international reserve currency has been and is today even more than ever the most important single factor behind the great power competition and changes in the polarity of the international system. The reserve currency status has enabled the US to pile up a towering mountain of federal debt of over $32 trillion — without having to worry about its own financial stability or repayment, at least until now. The US debt-to-GDP ratio exceeds 130%, bringing the US in “banana-state category”.

This “limitless running into debt” has enabled the US nearly “limitless military spending” as well as setting different arbitrary sanctions worldwide, according to its political purposes. The US military budget is accounting for more than the combined next ten in the world and representing approx. 40% of the annual world total.

At the forefront of the world de-dollarization process are America’s main economic competitors and political rivals: China, Russia and Iran. Moscow is dropping the US dollar in major arms and energy deals and switching to the Russian ruble and the national currencies of its partners. The euro is currently an alternative to the dollar, with US currency used only, when there is no other way. Now, among BRICS countries, there is a serious attempt to speed up the process of de-dollarization within the internal trade of the block.

I have analyzed this process several times in my articles, the latest “De-dollarization goes on, April 2023”, April 12.

Premonitions of the summit

The upcoming BRICS Summit on August 22 – 24, 2023, in Johannesburg, South Africa, is significant for many reasons. BRICS host South Africa has invited 69 countries to attend the upcoming summit. The invitation has been sent to all African heads of nations and the Global South bodies.

The forthcoming summit holds significant implications for global geopolitics, with its central agenda revolving around the launch of a common currency among the BRICS nations. Another key issue is the expansion of BRICS and the new members.

The Geopolitical Significance. TheUS Dollar has reigned supreme in global trade and transactions, affording the United States unparalleled economic and geopolitical leverage. The US has weaponized its Dollar & Economy as tools to coerce and pressurize its adversaries and imposing sanctions against its rivals to achieve political goals. The proposed launch of a BRICS common currency or de-dollarization aims to alter this status quo, potentially diminishing the American influence and power.

Russian Stance. Russian officials have been vocal in their heavy support for the BRICS common currency initiative. Sergey Lavrov stated, “The BRICS nations possess substantial economic strength. It is only logical that we explore alternatives to the dollar-dominated global financial system. A common currency could enhance economic cooperation among our nations and contribute to a more balanced world order.”

Chinese Stance. China, as a major global economic player, has also thrown its weight behind the common currency initiative. President Xi Jinping emphasized, “The BRICS nations must pool their resources to challenge the existing financial architecture. We have the economic prowess to establish an alternative currency that will foster multipolarity in the global economy and curtail unilateral dominance.”

Brazilian Stance. Brazil, too, stands in favor of exploring alternatives to the dollar-centric financial system. Brazilian ex-President, Jair Bolsonaro, expressed, “Our partnership within BRICS offers an opportunity to challenge the existing norms that disproportionately favor a single currency. A common currency could bolster economic cooperation and ensure a fairer representation of our collective strength.” The incumbent President Lula da Silva also strongly favors the de-dollarization.

South African Position. The South African Ambassador revealed that BRICS will discuss the use of native currencies for cross-border transactions. He indicated that a decision to ditch the US dollar for global trade could be taken at the upcoming summit.

Indian Stance. India’s stance on the common currency initiative has been marked by caution. Indian Prime Minister Narendra Modi articulated, “While the idea of a BRICS common currency is intriguing, we must thoroughly evaluate its implications for our economy. Any such move should prioritize our national interests and stability.”

Expansion and New Members Expected. Forty-four countries have shown interest in joining the BRICS alliance, with 23 formally applying. It is expected that Saudi Arabia, the UAE, and Argentina are rumored to be the first inductees. Many other nations will follow soon, once this trend is initiated. The upcoming BRICS Summit in South Africa holds the promise of significant geopolitical changes.

Progress and Decisions of the Summit

The Johannesburg-hosted BRICS Summit was running from August 22 to 24, with the leaders of China, India, Brazil and South Africa in attendance. Russia is represented by Foreign Minister Sergey Lavrov, while Russian President Vladimir Putin is taking part in the event via videoconference.

The BRICS group of nations is no longer an alternative to other international associations but a bulwark of global politics, External Affairs Minister of India Subrahmanyam Jaishankar has said. “BRICS is no longer an “alternative,” it is an established feature of the global landscape. The message of reform that BRICS embodies must permeate the world of multilateralism.” According to Jaishankar, “BRICS is not only an expression of multipolarity but of the many and diverse ways of meeting international challenges.”

This Summit can be characterized by the following short expressions: Block Expansion, Voice of Global South, Drift Away from US dollar, the UN reform.

Expansion and membership

Today, there are nearly up to 50 countries indicating interest in the block but 23 nations have submitted their application to BRICS.

Decision of new members. The BRICS leaders have decided to invite Argentina, Egypt, Iran, Ethiopia, the UAE and Saudi Arabia to join the group, South African President Cyril Ramaphosa said on Thursday, August 24.

“We have decided to invite the Argentine Republic, the Arab Republic of Egypt, the Federal Democratic Republic of Ethiopia, the Islamic Republic of Iran, the Kingdom of Saudi Arabia, and the United Arab Emirates to become full members of BRICS. The membership will take effect from January 1, 2024,” Ramaphosa said. He added that the admission of new members to the BRICS is the first phase of the group’s expansion process.

Chinese President Xi Jinping said at the briefing that the BRICS expansion is historic and a new starting point for BRICS cooperation. It demonstrates the determination of the BRICS countries to unite and cooperate with other developing countries, meets the expectations of the international community and serves the common interests of emerging markets and developing countries.

The expansion of the BRICS not only demonstrated the vigorous trend of the BRICS mechanism but also served as a powerful response to West-led hegemony and promote multipolar order.

India welcomes the invitation of new countries to join BRICS and this will serve to strengthen the organization, Indian Prime Minister Narendra Modi said. “India has always fully supported the expansion of BRICS membership. India has always believed that new members will further strengthen BRICS as an organization and give a new impetus to our common efforts. I am glad that our teams have jointly agreed on the guidelines, standards, criteria and procedures for expansion and based on this we have agreed to invite Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE to BRICS.

The six new members who have been invited to join come from Asia, Africa and Latin America. They are all regional countries with a certain scale and important influence. With their participation, the representativeness and influence of the BRICS cooperation mechanism will further increase, making it one of the largest representative organizations for emerging markets and developing countries to actively participate in global governance. It has great potential for promoting the development of global governance in a more just and fair direction.

Use of Local Currencies, New Payment Systems and New BRICS Currency as Alternative to Dollar

Besides BRICS expansion, reducing the dependence on the US dollar has also been the focus of the summit, especially after Russian President Vladimir Putin criticized Western sanctions in an address on Tuesday, saying “de-dollarization” is an “irreversible” process and “is gaining pace.”

The more the United States insists on using the dollar’s dominant status in the global monetary system to punish countries Washington does not like through sanctions, the more a number of countries mull creating a new currency that may challenge the dollar’s status. BRICS countries are considering introducing their own currency that may help bypass the US dollar in international trade.

However, introducing a BRICS currency will require overcoming significant challenges of building trust and acceptance over time. The currency market is already dominated by established currencies such as the US dollar, euro and yen.

Mohammed Saqib, secretary-general of the India-China Economic Council, said that this new BRICS currency could become an alternative reserve currency that would help mitigate potential economic sanctions, vulnerability and dependence on US monetary policy. “A BRICS currency would provide an elevated status for emerging economies to exert greater control over global economic affairs, enhance their bargaining power in international trade negotiations and challenge the dominance of Western-led financial institutions,” he pondered. In order to materialize this vision, the BRICS members would have to tackle a number of challenges such as their divergent economic structures, income disparities and geopolitical differences, Saqib observed.

The official announcement on the development of this new currency is speculated to be made in this Summit. While the common currency concept was not discussed in detail during the 15th summit, Russian Finance Minister Anton Siluanov disclosed on August 22 that BRICS member states are continuing to discuss the creation of a “single unit of account.” Siluanov explained that it is not actually a single currency (akin to the euro in the EU), but an instrument “in which the cost of commodity deliveries and benchmarks for some goods can be expressed in order not to depend on a single currency or its issuing center.” The proposed single unit of account would become an alternative to the US dollar, said the minister.

BRICS stressed the importance of encouraging the use of local currencies in international trade and financial transactions between members of the group as well as their trading partners. The concept has taken on a new significance given the West’s weaponization of major reserve currencies in order to achieve its geopolitical objectives.

The leaders of the BRICS countries believe that the time has come to use local currencies and alternative payment systems, President Ramaphosa said. “There is global momentum to use of local currencies, alternative financial arrangements and alternative payment systems.

Leaders of the BRICS countries have tasked their countries’ finance ministries and central banks with considering the possibility of launching national currencies-based payment instruments and platforms. Also, the leaders stressed the importance of encouraging the use of local currencies in international trade and financial transactions between BRICS as well as their trading partners and encouraging the strengthening of correspondent banking networks between BRICS countries and enabling settlements in local currencies, according to the declaration.

Johannesburg II Declaration

The leaders of the BRICS countries (Brazil, Russia, India, China, South Africa) have adopted the final declaration of the 15th Johannesburg II summit. The 94-point document is devoted mostly to economic issues and cooperation, while Ukraine is mentioned once. The decision to expand the group was the summit’s main outcome.

The member states committed to strengthening the framework of mutually beneficial BRICS cooperation under the three pillars of political and security, economic and financial, and cultural and people-to-people cooperation. They also committed to enhancing strategic partnership for the benefit of their people through the promotion of peace, a more representative, fairer international order, a reinvigorated and reformed multilateral system, sustainable development and inclusive growth.

BRICS expansion. Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE will become full members as of January 1, 2024. The BRICS foreign ministers were instructed to draw up a list of likely partner countries. A report on this issue should be presented at the next summit to be held in Russian city Kazan in 2024. The admission of new members to BRICS in this summit is just the first phase of the group’s enlargement process.

The participants of BRICS have also agreed that the name of the group will not change after the new countries join it, as this will demonstrate continuity, as Russian Foreign Minister Sergey Lavrov specified on the same day. It is expected that the expansion of BRICS will enable an increase in mutual investments between the member states and deepen further collaboration.

Economic cooperation. Commitment to strengthening macroeconomic coordination and deepening economic cooperation was reaffirmed. The participants in the association announced plans to enhance cooperation in agriculture to ensure food security. It is noted that the BRICS countries account for a third of the world’s food production. BRICS advocates the use of national currencies in trade and financial transactions between the countries of the association. The association is against trade barriers, including those imposed by a number of developed countries under the pretext of combating climate change.

BRICS called for maintaining the “open, transparent, fair, predictable, inclusive, equitable, non-discriminatory and rules-based multilateral trading system with the World Trade Organization (WTO) at its core. Previously, BRICS leaders placed special emphasis on the rising role of the New Development Bank, founded by the group in 2015 to facilitate funding new infrastructure projects and various endeavors by developing nations.

Call for reforms. The UN is seen as a cornerstone of the system of international relations. The BRICS members reaffirm their commitment to multilateralism and international law. At the same time, the BRICS support the idea of reforming the UN, including the Security Council and support wider representation of the developing countries in the Security Council. The World Trade Organization and Bretton Woods financial institutions, including the International Monetary Fund, should also be reformed.

Commitment to dialog. The BRICS countries are concerned about conflicts around the world and advocate their peace resolution through talks. The association supports diplomatic solutions to conflicts in Niger, Libya and Sudan on the basis of the UN and the African Union. BRICS also welcomes all efforts to promote a political and negotiated solution to the Syrian crisis. The resolution of the Iranian nuclear issue should be peaceful and diplomatic.

Ukrainian conflict. BRICS members noted with appreciation the “mediation proposals” aimed at a peace settlement of the Ukrainian crisis, including an African peacekeeping mission.

G20. G20 maintains its leading role as a multilateral forum for international economic and financial cooperation, bringing together industrialized states, emerging market economies and developing countries alike, where the leading economies jointly seek solutions to global challenges. The BRICS countries are committed to a balanced approach aimed at strengthening and integrating the voice of the Global South into the G20 agenda during the Indian presidency in 2023 and the Brazilian and South African presidencies in 2024 and 2025.

Confronting pandemics. The unbalanced global economic recovery after the pandemic is increasing global inequalities. The BRICS countries are committed to intensifying efforts in pandemic prevention, preparedness and response. In this regard, the BRICS members consider it important to continue supporting the virtual BRICS Vaccine Research and Development Center.

Fighting corruption and terrorism. There is a need to enhance international cooperation to combat illicit financial flows as well as to increase joint counter-terrorism work. The BRICS countries called for the early adoption of a Comprehensive Convention on International Terrorism by the UN members, as well as the launching of negotiations on an international convention on the prevention of acts of chemical and biological terrorism on the platform of the Conference on Disarmament.

Conclusions and implications

Expanded “BRICS 11” will create a powerful bloc with a strong say in international politics

BRICS’ decision to expand will lead to the creation of a strong grouping that will be able to influence the international situation, by defending the interests of developing countries. An expanded BRICS is a challenge to Western countries. Time will show, whether this will be a historical turning point but obviously the decision was “a victory for Beijing and Moscow.” Now, the developing nations know that they will be able to turn to an institution, other than the World Bank (WB) or the International Monetary Fund (IMF), called BRICS 11.

BRICS leaders decided to invite Argentina, Egypt, Iran, Ethiopia, the UAE and Saudi Arabia to join the group, with the admission of the new members just the first phase of the expansion process. Integration of new members into BRICS will facilitate the advent of a new world order. With two of the new countries located in the Middle East, two in Africa, and the rest – previously neighbors of the association of five nations that incorporates Brazil, Russia, India, China and South Africa, this expansion is a significant event on the international scene.

Obviously, Africa is emerging and that is very important but the main news is Saudi Arabia and the UAE. Basically, this will change the balance of power in the world and it will the beginning of the end of the petrodollar. Saudis will begin to price more and more oil only in local currencies, in yuan, and less in dollars and other currencies.

Taking Saudi Arabia and the UAE in the block, their own contribution to the global economy could accelerate the de-dollarization of this part of the world, with all the ensuing geopolitical consequences that could actually accelerate the creation of a multipolar economic system at global level.

The admission of six new members as well as the shift to new payment systems could have a substantial impact on the global balance of power. In particular, the aggregated gross domestic product of BRICS 11 and the group’s aggregated population account for significant share of the world total. The first priority for those countries is to challenge the US dollar hegemony, to bypass the dollar and to go through a clearing system that would secure an independence of those countries. They want to regain their sovereignty, because the dollar has been weaponized by the US.

At the same time, BRICS’ commitment to inclusion will give voices to those emerging economies of the Global South which have long been underrepresented in Western-centered international organizations. In the UN Security Council, there is no African countries. Maybe BRICS could be the new foundation for the future UN.

These are the sorts of things that reflect the changing world order, in which US power must adjust to losing some of its imperial allies like Saudi Arabia and possibly also Egypt and the UAE. Ethiopia has also embraced a more independent foreign policy, despite the country’s longstanding ties with the West. Ethiopia also wants to drift away from the dollar and participate in the creation of a multipolar system of international relations.

The historic 15th BRICS Summit has apparently become a watershed, showing the Global South a new alternative model of development and offering freedom of choice.

BRICS 11 – a powerhouse with oil/gas trade & strategic corridors and initiatives

It can be called “BRICS 11” and that’s just the beginning. Starting with the rotating Russian presidency of BRICS on January 1, 2024, more partners will be progressively included and most certainly a new round of full members will be announced at the BRICS 11 summit in Kazan in October next year. The block may soon become a BRICS 20 and even more.

It is historically interesting to realize the BRICS Summit 2023 as a kind of counterpoint to the 1973 oil shock, after which Riyadh made a secret agreement with the US and started the era of petrodollars. Now Saudi Arabia under MBS is operating a tectonic shift, in the process of becoming strategically aligned with Russia-China-India-Iran. This is the second stage of the Russian-initiated and Chinese-finalized rapprochement between Riyadh and Tehran, recently sealed in Beijing. The Russia-China strategic partnership is working effectively.

From the strategic viewpoint, BRICS 11 is now on the way to dominate over the strategic corridors and initiatives like the Arctic Sea Route, the International North South Transportation Corridor (INSTC), BRI’s East West Corridors, the Persian Gulf, the Red Sea and the Suez Canal.

That blends several overland corridors with several nodes of the Maritime Silk Roads, nearly a complete integration in the “Heartland” and the “Rimland” (Mackinder-Spykman theories). All with just a single strategic move in the geopolitical/geoeconomic chessboard.

The top geopolitical and geoeconomic breakthrough is, how BRICS 11 is about to “break the bank” on the energy and commodities market fronts. By incorporating Iran, Saudi Arabia and the UAE, BRICS 11 instantly constitutes a global oil and gas powerhouse. BRICS 11 now controls about 40% of global oil exports, about 45% of proven reserves and nearly 50% of all oil produced globally. With BRICS 11 possibly including Venezuela, Algeria and Kazakhstan as new members as early as in 2024, it may control as much as 90% of all oil and gas traded globally.

By choosing Ethiopia, BRICS expands its African reach on mining, minerals and metals. Ethiopia is rich in gold, platinum, copper, niobium and offers vast potential in oil and natural gas exploration. Saudi Arabia and the UAE, incidentally, are also involved in mining. Egypt and Ethiopia are finding completely new regional and bilateral opportunities for cooperation. This all spells out fast, progressive integration of North Africa and West Asia.

Inevitable corollary from this factual situation is that trade operations are settled in local currencies bypassing the US dollar. This will lead to unavoidable conclusion: rapid declining of petrodollar.

Already in the horizon, direct BRICS 11 & OPEC+ symbiosis is likely and OPEC+ is effectively run by Russia and Saudi Arabia.

Political-economic tectonics are in staggering move and a ground-shaking geoeconomic reorientation is at hand, involving everything from trade routes plied by global supply chains and new BRICS roads to the progressive interconnection of BRI, the Saudi Vision 2030, massive port expansion in the UAE and finally covering “Great Eurasian Partnership”.

Worldwide process of de-dollarization and the use of national currencies

The single BRICS currency is a long way to go but what really matters, in short and medium term, is expanding intra-BRICS trade in their national currencies. That was stressed by New Development Bank (NDB) president Dilma Rousseff in her report to the Summit – even as Brazilian President Lula once again emphasized the importance of setting up a work group to discuss a BRICS currency.

Russia understands how India is worried of secondary sanctions by the US, in case its BRICS role gets too ambitious. New Delhi’s support for a new BRICS currency would be interpreted in Washington as all-out trade war and sanctions would follow. Saudi Arabia’s MBS does not care, he’s a top energy producer, not consumer like India and one of his priorities is to fully court his top energy client, Beijing and pave the way for the petroyuan.

With major oil exporters joining BRICS, local currency settlements rather than US dollar become more natural, states the leading Chinese media, Global Times, on August 25.

With Iran, Saudi Arabia and the United Arab Emirates joining BRICS, the multilateral mechanism now includes major global oil producers and importers. Analysts said that a wider adoption of local currencies for trade among BRICS countries, rather than using the US dollar, seems more natural.

BRICS leaders stressed the importance of encouraging the use of local currencies in international trade and financial transactions between BRICS countries as well as their trading partners and encouraging the strengthening of correspondent banking networks between BRICS countries and enabling settlements in local currencies, according to the Summit Declaration.

When oil and other commodities are traded directly in non-dollar currencies, the function of US Treasury bonds as foreign exchange reserves will be irreversibly weakened, as oil, the most important energy commodity traded, has always been linked to the status of the global reserve currency. The out-selling of US dollars and US Treasuries will be accelerated and in fact, a trend of reducing holdings of US Treasuries has gradually emerged.

Analysts noted that the de-dollarization trend is actually the bitter fruit of the US’ own making. In recent years, the US’ successive unilateral financial sanctions have reminded more and more countries of the necessity and urgency for de-dollarization, which has now become a general consensus.

Meanwhile, the US dollar has long been propped up by global trust in US debt. But the US has damaged the rest of the world’s economy through unlimited quantitative easing and sharp and massive interest rate hikes. The status of the dollar is affected by political and economic instability in the US. The high level of US government debt and uncertainty over the growth of the US economy will lead to a decline in the value of the dollar.

Once the new BRICS currency comes online, all those excess dollars being held all over the world, will start to come back to the US. Thus, the value of dollar will drop against those other currencies, because nobody will want or need dollars anymore and therefore the price level will skyrocket in the US causing a hyper-inflation. Once this gets done and the oil/gas sales begin in the new BRICS currency, the US will economically collapse and nothing can stop it. BRICS expansion can be seen as “main catalyst of New World Order”, which also means “End of Petrodollar”. The worldwide conflagration is looming.

Pathetic destiny of the EU

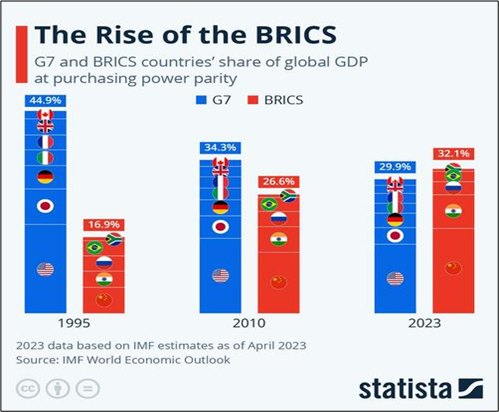

Now compare the above-mentioned with collective West’s “strategies”, such as the G7-imposed oil price cap on Russian crude imported by sea.

The result is that G7 countries had to start buying more oil products from Global South nations, which ignored the price cap and duly increased their purchase of Russian crude. By the way, those countries were/are the two top BRICS members: China and India.

G7 countries are fooling themselves and in Europe, particularly in the EU, this significant progress and expansion of BRICS has been experienced by the elite of EU as personal losses. Europe and particularly the EU has once again shown itself to be a vassal of the US and once again, Europe is left with nothing from this game. The African policy of the EU has failed thoroughly.

The global world order is on the verge of a radical transformation.

Thirty years ago, Western powers saw in the collapse of the Soviet Union, which resulted from its internal weaknesses and mistakes, an unprecedented opportunity to dominate the world by way of deterring possible competitors by any means. The unipolar moment of the US is irreversibly over now.

Perhaps one of the most important features of the current times is the new dawn of the so-called Global South.

As President of Eritrea, Isaias Afwerki said recently: they (= collective west) understand that the instruments of the western deterrence have been “demonization, isolation, interference, political sabotage, development of provocations and crises, sanctions, flagrant violations of international law, including overt military invasions.”

The new and strengthening trend in today’s world is manifested in the desire of many developing countries to join BRICS or to agree with this association on joint actions. At the same time, the most attractive idea is the de-dollarization of the world trade, the transition to international trade settlements in national currencies. The idea of creating a new joint currency is being discussed more and more actively among the members of BRICS.

No doubt that in the near future the humanity will witness fundamental changes in the balance of power on the world stage and no doubt that Russia’s obvious successes in its special military operation in Ukraine will accelerate this process.

The West’s involvement in the war in Ukraine is reviving anti-Western sentiments, not only in the BRICS countries but in the Global South in general. It is becoming clear to growing number of countries that the war was provoked by NATO’s excessive eastward expansion and unbalanced security situation in Europe besides the increasing inflation afflicting the societies worldwide, which is due to the western extreme sanctions policy.

For further reading:

Geopolitics: BRICS De-dollarizing Emerging New World

Global Research, August 24, 2023

BRICS 2023: The Africa Roadmap, Opportunities and Way Forward

By Prof. Arnold Boateng and Kester Kenn Klomegah

Global Research, August 25, 2023

How BRICS Is Looking to Challenge the Western Order in the Middle East

Arab countries are lining up to join the bloc, in a shift away from a unipolar world where Washington held sway

By Elis Gjevori , Global Research, August 25, 2023, Middle East Eye 24 August 2023

BRICS expansion: new challenges and opportunities

Posted August 25, 2023 in Blog, NEW! by Yaroslav Lissovolik

PS. Thank you all readers for that positive and encouraging feedback I have received during the summer.