Global economy, debt and Covid-19

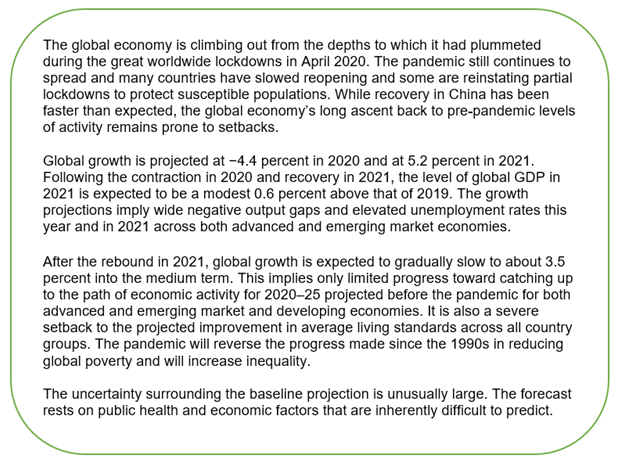

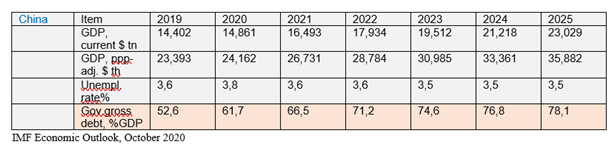

The International Monetary Fund (IMF) projected a deep recession in 2020 in its latest World Economic Outlook (October 2020), saying the growing restrictions on trade and investment and rising geopolitical uncertainty could harm the recovery.

In April 2020, Professor Nouriel Roubini (Doctor “Doom”) made his ominous forecast of economic development: The Coming Greater Depression of the 2020s. He noted that while there is never a good time for a pandemic, the Covid-19 crisis has arrived at a particularly bad moment for the global economy. The world has long been drifting into a perfect storm of financial, political, socioeconomic and environmental risks, all of which are now growing even more acute.

After the 2007-09 financial crisis, the imbalances and risks pervading the global economy were exacerbated by policy mistakes. So, rather than address the structural problems, governments mostly created major downside risks that made another crisis inevitable. The question is of deficits, debts and defaults. The policy response to the Covid-19 crisis entails a massive increase in fiscal deficits – on the order of 10% of GDP or more – at a time when public debt levels in many countries were already high, if not unsustainable. Taking into account the ever-heating up great power competition, the views in the future are not rosy.

The pandemic has caused governments worldwide to pile up large amounts of stimulus/recovery packages in order to kick start their pandemic-plagued economies. Massive packages have been reported in the US (3$ trillion), in Japan and in EU (750 billion euros), globally together up to 12 $ trillion. All this new debt on the previous, record-high indebtedness. The humankind has never been in the history so indebted as right now and the future promises even more the same … debt.

Global trade to contract by 6% this year due to pandemic – UNCTAD

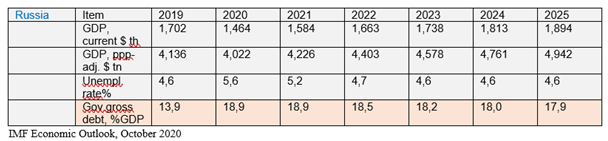

The volume of global trade is set face the sharpest decline since the end of the global financial crisis 2008, falling about 6 percent this year, the UN Conference for Trade and Development (UNCTAD) predicts. Most major economies are set to face contraction this year after the Covid-19 outbreak forced governments to impose restrictions to contain the spread of the deadly virus. China, which was the first to face the outbreak and bring it under control after strict lockdowns, can become the only exemption. The world’s second-largest economy has already started to rebound and its trade is booming.

Coronavirus will drive global debt to $277 TRILLION by end of 2020, IIF projects

While the cost of the pandemic will only be truly known in years to come, Deutsche Bank’s Jim Reid writes that “we can get some good early indications by looking at debt increases around the world.” Looking at the latest debt report by the Institute of International Finance, the IIF suggested that global debt will hit $277 trillion by the end of 2020, up around $20 trillion over the year. That will reportedly account for 360 percent of the world’s annual economic output, amounting to a 14-point rise as a percentage of world GDP. The dramatic surge was triggered by both the economic plunge due to the coronavirus pandemic and the extra borrowing that governments, firms and households have had to fall back upon.

A key element of the “new abnormality” that has characterized both the development of the global economy as a whole and the US economy in particular, is the debt model of economic growth. Investment and business activity have stagnated as interest rates around the world are hovering around zero, while the US dollar (a key reserve currency) stubbornly refuses to depreciate and has even strengthened its value on the forex markets on a number of occasions, despite the fact that the situation notably in the US is worsening.

Bankruptcy trends show East beats West

It seems now that the East (Asia & China) is beating the West (Europe and the US) not just in pandemic containment but also economic stabilization. In China, Hong Kong, India, Indonesia, Japan, South Korea and Singapore, low bankruptcy tallies have confounded the Western analysts – even as the pandemic is slamming business growth and profits worldwide. That’s largely thanks to the roughly $12 trillion in stimulus the International Monetary Fund reckons governments around the globe have thrown at Covid-19.

In the recent interview (Rossiya-24, October 2020), Sberbank CEO Herman Gref believes that the world will never get back to what he described as “pre-Covid life” and that wearing medical masks will be obligatory from now on, forming a basic trait of our culture. Gref believes that business models are undergoing considerable transformations, too. Everybody is encouraged to shift to distance work, to obtain ever-larger amounts of services via the Internet and so forth. It is hard to think of a parallel in terms of such a large-scale impact on all customary features of our life.

The United States of America

The American economic and fiscal situation seems to be nearer a recession than a coming recovery, as IMF and quite many Western economic experts are assuming and telling. The US federal budget deficit hits yearly record level (over 1 $trillion), sovereign debt and all other debt items are already at all-time-high and still going up, public and private debt amounting up to 80 $ trillion in the second quarter of 2020. The unemployment rate is also at the record level, well over 14%. At the same time, new records are emerging in the stock markets, following the news that the US is expected to issue over $5 trillion in debt this year alone and the Fed is expected to monetize all of it. When the results were released, the second-quarter economic data will be the worst on record. With the massive money printing by the US government, public debt has ballooned more than $3 trillion since the lockdown of the domestic economy.

While economic fundamentals ceased to matter in late spring 2020, when “the Fed went nuclear” and not only injected trillions in the bond and repo market but also directly backstopped the corporate bond market (with many expecting it will do the same in equities), there is something utterly surreal watching stock markets surge just as the US reports its worst jobs report in history.

On a broader scale, negative unemployment statistics could bring about devastating fallout for the economy, taking into consideration the fact that consumer spending makes up 70 percent of US gross domestic product, which is predicted to plummet by 40 percent in the second quarter. Retail and home sales have been slumping as the pandemic shows no sign of abating and job loss continues. The United States has failed the pandemic test that disclosed a bunch of chronic illnesses that the nation is suffering from. The country will not recover from the shock soon and America will never be the same either. Coronavirus pandemic is going to break the clay feet of the United States

The $16 TRILLION bug: Pandemic could cost US economy its entire annual output

The US economy may lose a whopping $16 trillion in next couple of years due to the devastating impact of the Covid-19 outbreak, both in output and people’s lives, new research has found. While most studies assess the costs of Covid-19 by its impact on the national gross domestic product (GDP), a paper published in the Journal of the American Medical Association in October 2020, offered a different approach. The authors of the study – former Treasury Secretary Lawrence Summers and Harvard University economist David Cutler – also took into account losses associated with those who have died due to the virus, in addition to the purely economic costs.

The American economist John Williams predicts Covid-19 vaccines are not going to get the economy back to normal anytime soon. A lot of companies and people have suffered and more of that is going ahead. When Biden takes over, he is already promising massive stimulus, even more than Trump or Republicans are going to do. The more Democrats will just print the money the more is going to be a deficit spending. There is no way the US can escape massive stimulus for at least the next year and into 2022.

Economist Williams expects to see some large inflation spiral emerging because of all the stimulus coming and predict: “The more stimulus, the more rapid will be the demise of the dollar. Eventually, it will be a hyperinflation in the United States, evolving into a hyperinflationary Great Depression. Hyperinflation is a form of default and will bring political disruption.” Williams states, “When the Fed finally gets the more than 2% inflation it wants, the real inflation will be 12% to 15%. . . hyperinflations happen quickly.” Just think about the federal budget deficit due to fast rising interest costs.

Sanctions forever

It is noteworthy that the current Covid-19 pandemic is causing severe challenges for the development of world economy and countries should work in solidarity and coordinate their efforts. Under these circumstances, the US sanction practices are a curious phenomenon.

The US is still enlarging sanctions regime in economic and trade policies together with various forms of protectionism and unilateralism, which all have severely threatened the global economy. In last five years, Washington has frequently provoked and escalated trade frictions, weaponized its tariffs and undermined the process of trade and investment liberalization and facilitation. When Covid-19 broke out in early 2020, Washington has still maintained its unilateral sanctions against numerous countries. It may be worth to recall that the US is at odds with the majority of the humankind today.

According to IMF recent report, the indebtedness of the US at federal level has already reached an alarming high. Other recent reports tell that the overall debt burden of the US is even more massive.

Russian Federation

Western experts have predicted in spring 2020 that Covid-19 would lead to Russia’s economic collapse and Putin downfall …they were wrong.

Since the late spring 2020, US/UK media and think tanks warned that the Covid-19 crisis means Russia will face economic ruin. Western Russia-experts like predicting the imminent downfall of the “Putin regime” andthe system he governs. Now, as the end of 2020 is close, it turns out Moscow is in a far better condition than most of its Western rivals.

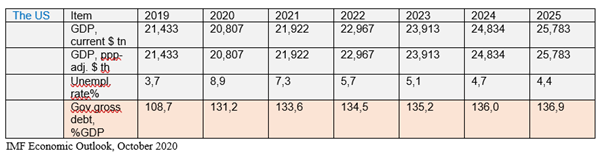

In September 2020, the Russian Economy Ministry predicted that Russia’s GDP would fall by 3.8 percent in 2020. It is slightly better estimate than IMF has made (-4.1). This is, of course, only relatively good news. But it is not the economic “collapse” that was forecasted. Furthermore, compared with most Western countries, Russia’s economic performance during the Covid-crisis does not look too bad. Russian GDP fell by 8.5 percent in the second quarter of 2020. That compares to double digit percentage falls in most members of the European Union, 20 percent in the United Kingdom, 31.7 percent in the United States, and a whopping 38.7 percent in Canada.

The Western pundits got the impact of Covid-19 wrong in part because of their faulty understanding of Russian government and the functioning of the Russian system. Prime Minister Mikhail Mishustin is an example of a talented and effective technocrat like Central bank chief Elvira Nabiullina. Both of them and many other similar types in the Russian Administration can be considered as economically cautious technocrats, which has led them to keep interest rates high and public expenditures relatively low and to stockpile large sums of cash in the bank in expectation of bad times to come. This has led to criticism both in Russia and abroad that the government has been suppressing demand and dampening growth.

Now that the bad times have arrived, the government has been able to draw on its stockpiles to loosen the economic reins and cushion the effects of the Covid-induced recession. This does not mean that a boom is around the corner. But for now, the worst has been avoided and Russia is emerging from the virus crisis in rather good shape compared to many of its Western competitors.

Especially interesting feature is the exceptionally low federal indebtedness, under 20%, which is unique worldwide and gives the Russian administration a necessary leeway to operate.

As might be expected, Russia’s leaders are reaping the benefits. In the latest Levada poll, published in September, Putin’s popularity had rebounded to its pre-crisis level, as had that of his government, with Prime Minister Mishustin achieving his highest rating yet. The predicted economic collapse and the downfall of the regime seem to be as far away.

The People’s Republic of China

In late October 2020, top leadership of the Communist Part of China (CPC) unveiled a steady and bright picture for the country’s future, as CPC confirmed the 14th Five-Year Plan and the Long-Range Objectives Through the Year 2035. It sets social and economic development goals for the next 5 to 15 years that aim to build a modern socialist power by 2035. The leadership did not forget to show off with decisive progress in the past five years and a strategic victory against the Covid-19.

While the communiqué projected confidence in China’s development paths and prospects, certain targets, particularly in economic areas, reflected a cautious and pragmatic sentiment among top officials. The targets for the coming five to 15 years are essential steps in China’s long-term goal for national rejuvenation. Usually, five-year plans have been set but now the long-range goals for 2035 were mentioned for the first time.

Though the document refrained from offering specific empirical targets, those goals could mean that China would double its current GDP of around 100 trillion yuan in 2035 and double current per capita GDP of $10,000. That would require a real GDP growth of around 3.5 percent annually during the coming five-year period (Obs! before the Covid-19 time, the annual growth rate was around 6.5 percent). China will aim for “new achievements” and “sustained and sound growth” based on improvements in quality, domestic market will be further boosted and economic structure would be improved. While the document focused mostly on economic issues, it also touched on a long list of other issues like governance system, security, social fairness, education, healthcare, and environmental protection.

Among the major steps listed in the document is a strategy that has already gained widespread attention – the “dual circulation” model, where the domestic, internal circulation would play a main role in driving growth, though the external circulation would also be boosted. Though China is at a transitory period where both opportunities and challenges are abundant, “fully grasping the dual circulation would turn this into a period of opportunities”.

While China’s exports have already been declining in recent years and are facing a tough situation due to the raging pandemic and China-US tensions, Chinese policymakers are counting on the massive domestic market to ensure economic growth and security. China, which already has a middle-income population of over 400 million, is set to overtake the US as the world’s biggest consumer market in the coming years. Aside from the “dual circulation” strategy, the communiqué also highlighted the country’s focus on technological innovation to drive sustainable growth, calling it an “innovation-driven” development strategy, and aiming to become a global leader in innovation.

However, as the communiqué has made clear, focusing on the internal circulation does not mean China will turn inward and stop its long-standing opening-up policies. China’s economy is the engine for the global economy and China achieving a strategic victory against the epidemic and sustained economic growth is also a dose of confidence for the world.

Summary of latest world economic outlook by IMF