Energy crisis – worldwide – autumn 2021

Skyrocketing energy prices (electricity, gas, oil, coal) as well as the growing lack of sufficient energy production capacity have created looming doom’s day scenarios, not only for the EU but worldwide altogether.

Global view – overall statistics

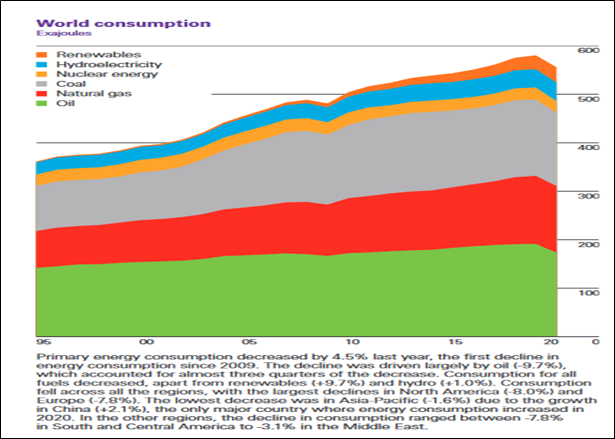

World energy consumption has been based, during the last hundred years or so, mainly on hydrocarbons and will be based that way far in the future, despite the hype of “Green Agenda”.

As seen in Statistical Review of World Energy, 2021 | 70th edition, primary energy consumption decreased by 4,5% last years, due to covid-pandemic. This year, the recovery has increased the consumption and caused substantial problems in production, worsening bottlenecks in supply chains and skyrocketing energy prices.

The wholeness of the world energy management is a multicomplex system of productions, supply chains and usages, developed and grown in multifaceted global processes. All the parts of this whole system are interconnected and mutually dependent so that big enough change in some part, automatically cause effects (positive or negative) elsewhere.

If any major player tries abruptly to change in some part of the processes, as in the case of rapid run-down of coal and nuclear power combined with the sped-up utilization of renewables, automatically cause negative effects on productions, supply chains and prices. The energy management is, by nature, a very long-term branch, where major changes shall be well-balanced and -planned in order to avoid fatal errors.

Market review – autumn 2021

Prices for all energy commodities jumped during the past month, some by record margins, as a global energy shortage set off a scramble for gas, coal and oil. Brent crude has doubled in the past year, Newcastle coal has quadrupled, and Netherlands natural has risen seven-fold.

There are many reasons for the global energy squeeze but one big one: Investment in hydrocarbons has collapsed under pressure from the Green Agenda adopted by international consensus.

Energy investments in the US and Europe have decreased as large institutional investors boycott fossil fuel investments. China’s critical electricity shortage is the result of draconian regulation of coal mining, exacerbated by Beijing’s punitive ban on Australian coal imports.

Global prices for crude oil (now over $80 per barrel) have been surging in autumn 2021, extending seven-year highs as the energy crunch affecting major economies shows no signs of easing amid the post-pandemic recovery. Crude prices have soared amid a major pick-up in economic activity across nations that managed to boost Covid vaccinations to lift lockdowns. Meanwhile, supplies from major oil producers have been restrained, pushing prices even higher.

At the same time, the global economic recovery provoked an enormous increase in prices for coal and gas. Coal shortages caused electricity blackouts in several states in India. Chinese coal miners were reportedly ordered to ramp up production as power prices keep soaring. As rising coal prices make oil more attractive as a fuel for power generation, the surge in demand is pushing crude prices higher.

Last week, US drillers added five new oil wells in an attempt to take advantage of the growth in prices, marking the fifth straight weekly increase in oil and gas rigs. At the same time, the Organization of the Petroleum Exporting Countries (OPEC) and allied producers led by Russia turned to a steady and gradual increase of output.

Gas prices in Europe have topped a new record high, soaring over $1.200 per 1.000 cubic meters. While increasing demand from households and businesses has coincided with pandemic-related underinvestment in global drilling, the EU continues to delay the launch of gas supplies from Russia via the newly constructed Nord Stream 2 pipeline. The EU certification process is expected to drag on into next year.

Annual inflation in the euro zone in September accelerated to 3.4% from 3% a month earlier, hitting a 13-year high (Eurostat). This is the highest level for the index since the economic crisis in September 2008, when inflation stood at 3.6%. German consumer prices rose by 4.1% in September to their highest level in nearly 30 years. Analysts forecast inflation could hit 4% by the end of the year, which is twice the target for the euro zone set by the European Central Bank (ECB).

Goldman Sachs recently updated its oil price forecast for the final quarter of 2021, expecting Brent crude to reach $90 per barrel by the end of December. Meteorologists are predicting a cold winter, which could send oil prices soaring past $ 100. The Bank of America (BofA) said oil could hit $100 per barrel because of the energy crunch that has now gone global, with US Energy Secretary Jennifer Granholm saying this week the department could release oil from the country’s emergency reserve to lower gasoline prices.

“If all these factors come together, oil prices could spike and lead to a second round of inflationary pressures around the world,” BofA analysts wrote or putting differently “we may be just one storm away from the next macro hurricane.”

Europe

The most important fact in this context is this: the prevailing energy crisis in Europe is mainly ensuing from the biased and over-ambitious energy policy of the EU.

European energy crisis has been brought on by premature retirements of hundreds of coals and natural gas power plants & Germany’s far too rapid nuclear power down-run, in favor of massive over-reliance on renewables (wind and solar power).

There has been also a speculative element to the gas price crisis in Europe. Despite rising prices for LNG on the spot market, flows of the fuel to both Asia and Europe were steady. In other words, Europe was in no particular rush to top up its gas reserves at the time and neither was Asia. Europe was importing LNG at a normal monthly rate over the second quarter. There was no crisis until September.

But something else happened this year in Europe as well: the wind did not blow as much as everyone expected. Major wind power facilities suffered profit drops because of that and utilities suffered output drops. Demand, however, did not drop and apparently, solar farms could not compensate the rest, so it was gas that had to be used… and the prices of gas and electricity started increasing.

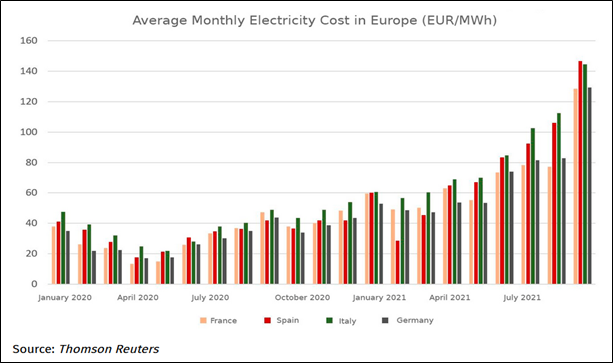

The picture below is very revealing, telling how quickly the electricity price crisis escalated. Massive over-reliance on wind farms in electric power production may turn out to be fatal, when the wind is not blowing. The sufficient regulating energy capacity must be secured, be it based on nuclear, coal, gas or any other conventional and reliable, highly-usable primary energy sources.

In the “Great Illusion” of the EU leaders, imaging to save the humanity from the climate change (demonized CO2 threat), the transition of EU energy management has been gullibly sped up too fast away from conventional (coal, oil, nuclear) but reliable and stable energy production swooping to renewables production, which are unstable, low-usable and expensive production formats. In addition, the European electrical grid is facing great, even fatal difficulties in adapting intense production changes.

The rapid shift to renewable energy sources and their low stability will lead to regular “price shocks during times of power shortages.” With great probability and certainty, one can forecast an energy future for Europe with sharp fluctuations in prices, longer high-priced periods, unstable electricity production including fatal pan-European outages. The old proverb, “you get what you pay for”, is valid in this case as well.

In this way, the whole EU energy management is becoming very vulnerable and, at the same time, the secure energy base for the European manufacturing industry, especially for energy-consuming heavy industries like metal, forest and petrochemistry industries, is weakening continuously predicting only gloomy future for the industrial backbone of the EU. No wonder, when the heavy industry will actively start seeking after new production locations globally. Rapid decarbonization process is threatening Europe’s energy security and the whole industrial structure.

It is not just the energy bill of people that risks going high up thanks to Europe’s energy crisis; EU agriculture ministers are now warning that the power price surge means the food will be more expensive in the coming months too. Increasing energy prices put soaring fertilizer prices that are set to push up the price of food. No doubt, street protests by ordinary people are breaking out across Europe due to spiking bills.

When considering the big picture around the EU, transatlantic relations (the EU – the US) are in turmoil, fundamental political – military changes are taking place around, EU’s energy policy is dangerously off the track risking the whole industrial base of European economy; all these and plenty of other major and minor issues are driving the EU in wrong direction, in the risk of existential crisis.

The United States

Quite many American energy experts have raised the question: “Is America doomed to replicate Europe’s energy crisis?” These experts conclude that quick deterioration in the energy situation in Europe should make anyone planning major energy system overhauls think twice before following the exact same scenario that Europe did.

The official version of events is that rising energy demand coincided with tight energy supply. The unofficial version has to do with Europe’s energy transition agenda and the possibility it may have rushed to it without enough long-term planning. The US has now basically an identical agenda, focusing on boosting wind and solar power generation capacity, reducing demand for oil and gas, and encouraging people to buy EVs instead of “normal” cars. Biden’s massive $ 3.5 trillion package is promoting all these rapid energy revisions like in Europe.

The American energy experts have been using the EU as a cautionary tale of missed energy planning. The energy crisis in Europe and, to a considerable extent in China, is showing the rest of the world how not to do an energy transition at a time when many parts of that rest of the world are planning their own transitions.

The experts of US energy business are keeping carefully in mind the experiences of last winter’s cold and snow season, when blackouts were hitting states from North Dakota to Oklahoma and Texas shortages cut off with millions amid freeze.

To prevent the total collapse of their networks, suppliers from North Dakota to Texas were having to institute rolling power cuts to limit demand. The crisis in Texas highlighted the need for a more balanced grid.

Wind power generators were among the main victims of the cold weather, with turbine blades rendered inoperable due to ice; a phenomenon that reduces efficiency and can ultimately stop them from spinning. Texas estimated that more than half of its wind power capacity had come offline.

Essentially, the current US administration is repeating the mistake that the EU made in its ambition to green itself up and cut emissions both deeply and quickly. The consequences of this rushed transition will begin with higher emissions, by the way, as the continent leans heavily on fossil fuels and supply remains tight because of transition efforts that led to years of underinvestment in new production.

According to the US experts, the quick deterioration in the energy situation in Europe should make anyone planning major energy system overhauls think twice before following the exact same scenario that Europe did. It should motivate the development of alternative paths to net zero or maybe even reconsider the necessity for net-zero commitments. Sadly, this is unlikely to happen anytime soon.

According to Bloomberg, the American electricity utilities are now preparing to turn to more coal because of soaring natural gas prices, even the quarter of utilities are switching to more coal burning. They are also concerned of possible blackouts this winter.

With gas, coal and oil prices all soaring, is a clear signal the green energy transition will take decades, not years. Walking back to fossil fuels from unreliable clean energy, would be a disaster in Asia’s and Europe’s ambitious green energy plans. These power-hungry continents are scrambling now for fossil fuel supplies as stockpiles are well below seasonal trends ahead of cooler weather.

A similar story may turn out to be in the US, where increased demand for coal might not be reached by mining companies, because boosting output might be challenging due to years of decommissioning mines to reduce carbon emissions and transition the economy from fossil fuels to green energy. There is also been a steady decline of miners over the last three and a half decades.

China

China is getting short of thermal coal (coal used for power generation) for power utilities. Power is being rationed to factories in multiple Chinese provinces and winter is coming. In China, a large number of electric energy companies have simply stopped producing, as coal prices have skyrocketed but national price caps prevent energy companies from raising electricity prices accordingly, forcing them to either run at a deficit or shut down entirely. The energy crunch and resulting energy insecurity in these regions has highlighted the extent to which all of these governing bodies, which have made considerable climate pledges, are still reliant on fossil fuels.

China’s supplies are further limited by environmental restrictions on domestic mines and a ban on Australian imports. Indeed, China has now lightened its restrictions on coal mining for the last three months in order to keep the lights on and keep supply chains in motion, meaning that China will burn and import more coal this year than it did last year, risking the nation’s own emissions pledges. Russia has increased to the practical maximum all possible the shipments of electricity, coal, oil and gas to China since the spring 2021.

China’s energy crunch seems to hurt consumers across the globe as energy shortages have forced Chinese production to slow down at a time that demand for Chinese-made goods is surging as consumers start spending again post-Covid. The energy crunch is just the latest in a long series of pandemic-related unfortunate events for global supply chains, including worker shortages, microchip shortages and shipping shortages. This means that globally consumers can expect rising prices on all kinds of goods while inflation is already on the rise in many countries.

On the other hand, Chinese officials are confident that they can ensure sufficient coal and electricity supplies for the coming cold season and energy needed to safeguard people’s basic living standards and stable business operations. Zhao Chenxin, secretary-general of the National Development and Reform Commission, said at a news conference that China is ready to redouble its efforts to ensure safe and stable coal and electricity supplies and sufficient residential heating for this winter and next spring.

With economic activity resuming globally, energy products in international markets have surged since the start of the year and domestic supplies of coal and electricity in China have been tight, Zhao Chenxin said. In response to the situation, coal mines with the potential to increase output will be urged to tap into their production capacity as soon as possible, and approved and basically completed open-pit coal mines will be encouraged to begin operations, he added.

Local governments will be asked to earnestly fulfill their responsibilities in ensuring coal and electricity supplies for residents and businesses, while competent financing and fiscal policies to support coal mines to tide them over through tough times are already in the pipeline.

India

India is seriously at risk of running out of coal, which accounts for 70% of the national energy mix. In particular, thermal coal — coal used for power generation — faces steep restrictions in access to capital for environmental reasons.

Thermal coal supplies in India have dwindled as post-lockdown electricity consumption has eaten into inventories, India’s coal stockpiles are at a four-year low. Coal shortages caused electricity blackouts in several states in India and coal miners were reportedly ordered to ramp up production as power prices keep soaring. As rising coal prices make oil more attractive as a fuel for power generation, the surge in demand is pushing crude prices higher.

State after state in India has been reporting power outages as the second most populous nation in the world is facing a huge energy crisis. If some urgent and appropriate steps are not taken by the Narendra Modi government, many states could have blackouts.

Many political analysts say this is the second time the Modi government has failed to handle a crisis adequately. During the second wave of Covid-19 from April to June, the country was marred by a shortage of oxygen and now a shortage of coal supplies has started to hit the thermal power plants that produce electricity.

Although India’s Ministry of Coal has tried to reassure the public that there is ample stock, no one is buying their statement. The ministry also said that domestic coal-based power generation had grown by almost 24% this year, until September 2021, based on a robust supply from coal companies. The daily average coal requirement at the power plants is about 1.85 million tons per day, whereas the daily coal supply has been about 1.75 million tons per day. Due to an extended monsoon season, supplies have been constrained.

In India, of the 135 power plants that are dependent on coal for electricity, more than 70 are reported to be facing a crisis. According to media reports, 20 have already shut and more will follow in the next few days if coal is not made available.

The situation has become so bad that some states – like the national capital Delhi, Rajasthan, Punjab, Kerala, Maharashtra, Uttar Pradesh, to name a few – have already resorted to electricity cuts or are on the verge of announcing massive cuts in the electricity supply.

Professor Arun Kumar, at Jawaharlal Nehru University (JNU), said about 66% of the electricity in India is supplied by thermal power plants using coal. He added that the main factors underlying the surge in demand for electricity and the crisis in the coal supply is that imports of coal have been impacted due to the pandemic, mines possibly slowed production due to lockdowns and it was likely that heavy rain has disrupted both production and supply.

Kumar noted that the country had also seen a shift to thermal power, whose share has risen from 62% to 68% recently. So, the demand for coal had risen sharply, and the mines were not ready to supply this sudden surge. However, some experts blamed the Modi government for the crisis and said the government was not prepared to tackle this kind of problem. They did not see it coming. They also did not keep enough stocks of coal, which there earlier used to be,” said an energy expert on the condition of anonymity.

Professor Arun Kumar, also said the surge in energy prices and the shortage of power would impact production and demand and slow the economic recovery. “More importantly, the poor who are already hit will be further hit due to loss of employment and a decline in purchasing power.”

According to the Centre for Monitoring Indian Economy (CMIE), a leading business information company, the unemployment rate in India now stands at 7% – 8% in urban areas and 6.5% in rural areas. This is quite high and if the energy crisis deepens this is bound to go up. It is not only the industrial sector which will be hit, but agriculture and domestic consumers will also be badly affected. In India, sowing the winter crops, starts from November, and if the situation does not improve it would be difficult for farmers to water their fields. This in turn, add even more those political difficulties, due to recent farming privatization laws by Modi administration.

Domestic consumers would also face problems as this is festival time in India and the festival of lights – Diwali – is on November 4. During this festival, which usually lasts for five days, people illuminate the interior and exterior of their homes.

There have also been concerns by intellectuals and the media that the entire issue of coal availability and power shortages should not be used as an excuse to privatize the power sector. The Indian government has advocated the monetization of national assets in the recent past.

Russia

Russia’s hand in this energy poker seems to be very promising in short and medium term. Russia has massive energy resources of all kinds; however, distribution and supply chains may turn out to be problematic. Gas, oil, coal, nuclear and all conventional energy forms are abundantly available both for domestic use and for exports.

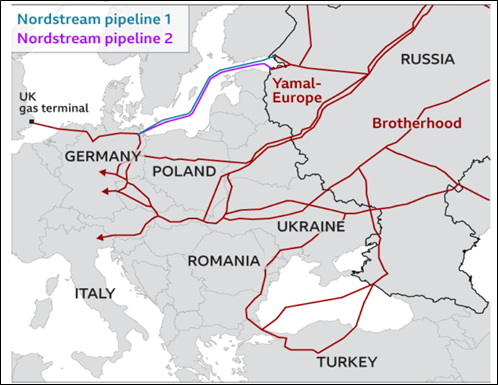

As to natural gas and the distribution to Europe, below is the map of the pipeline network.

Natural gas pipelines from Russia to Europe

CEO of Gazprom Export Elena Burmistrova’s statement crystallized the situation in early October: “Gas demand growth was promoted not merely by the overall recovery of the economic situation and power consumption but also to accelerated abandonment of coal in power generation, supported by emission quotas becoming more expensive, and by decline in generation at wind and hydropower facilities”.

The shortage also caused by redirection of LNG supplies to Asian markets at higher prices also contributed to the gas price spike in Europe.

Gas prices nearly reached $1.400 before the price of gas futures in Europe plunged nearly 22%, below $1.000 ($973) per 1.000 cubic meters, on news that Russia is willing to ramp up supplies to the continent. Gas futures started their decline, when President Putin said Russia would boost supplies to Europe. “You have proposed increasing the supply of gas on the market, on the exchange, in order to bring down speculative demand and the turmoil in Europe. This can be done… on the stock exchange in St. Petersburg,” Putin stated at a meeting on energy development. The president also urged Russian state energy giant Gazprom to continue to fulfill its obligations for gas deliveries to the EU through Ukraine.

According to Bloomberg, the Russian Gazprom that supplies 35% of European gas needs, reiterated that strengthening inventories at home was its top priority and only after it has refilled its own storage facilities by the end of October, would the company look at potentially increasing exports to continental Europe. Gazprom increased its full-year gas-price guidance for exports to Europe and Turkey to a range of $295 to $330 per 1,000 cubic meters. The revised outlook on Gazprom’s average prices in the region is good news for the company’s investors as it signals higher dividends may be coming.

Goldman Sachs maintain its base scenario, which assumes Russian gas flows to Europe through existing pipelines will normalize from November on and that the newly built 55 bcm Nord Stream 2 pipeline will be operational this winter but with only a marginal net contribution to European supplies.

After years of quarrels, crossfire and sanctions regarding Nord Stream 2, it seems to be ironical for a gas-starved Europe that Russia has now emerged as the only source of incremental gas supply which stands between the continent and a very cold winter. Cutting to the chase, Russian officials have said that regulatory approval to permit gas flows through the controversial Nord Stream 2 pipeline to Germany would help solve the crisis.

The European energy crisis had been aggravated by EU’s own regulations that forced Gazprom to supply a proportion of gas to Europe on the freely-traded spot market terms, rather than through long-term contracts, which may provide security of supply and stability of volumes and prices.

Russia’s National Energy Committee head Aleksey Gospodarev told at the Russian Energy Week forum in mid-October that Europe will get as much gas from Russia as it needs to curb energy shortages, while gas prices will inevitably stabilize. However, according to him, the stability lies in long-term contracts, while market trading in the energy sphere is highly volatile.

“Europe deliberately moved towards market pricing in the gas sphere, toward the so-called spot market. Here is the result, since there are a lot of unknowns in the formation of this pricing… a combination of factors that are difficult to predict led to this jump,” Gospodarev said, referring to the recent surge in gas prices in Europe. Long-term contracts are another matter, he said, noting that these deals now put a cap on prices at which countries buy Russian gas. These figures differ significantly from the recent record-breaking prices on the market, he stressed.

World Energy Outlook 2021 by International Energy Agency (IEA), October 2021

The report offers three basic scenarios for the global energy sector, with various scopes of climate-related reforms. The global demand for oil will eventually start to decline in the long-term perspective under any scenario of de-carbonization of national economies.

The moderate Stated Policies Scenario (STEPS) envisages that all governments stick to conservative strategies and not all climate goals are achieved by 2050. It projects that global demand for oil would peak at 104 million barrels per day in 2030s and would start to gradually decline by 2050. The oil price is forecasted to range between approximately $60 and $90 per barrel.

The Announced Pledges Scenario (APS) stipulates that all de-carbonization goals are eventually met, while oil demand peaks at only 97 million barrels per day and starts its gradual decline after 2025, until it reaches 77 million barrels per day by 2050. Here the average oil price is estimated at $67 per barrel by 2030 and at $64 per barrel by 2050.

The Net Zero Emissions (NZE) envisages the global oil consumption to decline to 72 million barrels per day by as early as 2030, reaching 24 million barrels per day by 2050. This scenario also envisages that by 2030, 60% of all cars sold worldwide are powered by electricity, and new cars with combustion engines are no longer sold after 2035. At the same time, the demand for oil in the petrochemical industry will grow, with 55% of all oil extracted worldwide used in petrochemical production by 2050. The global policy of zero emissions may cause oil prices to fall to $36 per barrel by 2030 and to $24 per barrel by 2050. Under NZE scenario, the world will no longer need new oil and gas deposits.

Under the toughest economic de-carbonization scenarios, Russia and OPEC countries are projected to account for at least 60% of the global oil output, as compared to the current 40%, the report says.

UN Convention on Climate Change, October 2021

The energy crisis that is unfolding across the globe in autumn 2021, could set the world back in terms of carbon emissions as coal and gas demand skyrockets. China will burn and import more coal this year than it did last year, seriously imperiling the nation’s own emissions pledges as well as the world’s chances of avoiding the possible worst impacts of forecasted climate change. Achieving net-zero is going to require an extremely delicate balancing act as the world tries to move away from fossil fuels, while keeping the economy running smoothly.

Later this month about 25,000 people will be headed to Glasgow for the 26th annual United Nations Framework Convention on Climate Change (UNFCCC). Conference leaders have also asked for increased monetary contribution to climate adaptation and mitigation funds and have the stated goal of finalizing the regulatory framework for implementing and enforcing the pledges made in the 2015 Paris agreement.

At the same time that the world ramps up for the latest and most robust global climate meeting, an energy crisis is unfolding in Europe and Asia which could set the world back in terms of carbon emissions and which showcases just how difficult the road to decarbonization will be. As global economies have surged back to life in the post-pandemic era, demand for consumer goods and services has increasing and supply chains have not been able to keep up.

In the energy sector, supply has simply been unable to keep up with demand, causing an energy crunch and severe price spikes in the EU, China and India, leading to massive disruptions of supply chains and industries around the globe.

This current crunch is likely just one of many similar hiccups to come. However, if these bumps in the road continue to send energy-strapped countries back to coal, as this current snap has done, that spells out major trouble for the climate change program. The green transition will be not easy or smooth and will certainly continue to hurt severely all people in the process worldwide.