Dollar collapse – a complex issue

Recent market rumors have been telling that late 2020 or early 2021 may bring drastic and explosive changes in the world’s financial system. But such “doomsday” rumors have been floating around every autumn during the last few years, because the US dollar is getting weaker and weaker. There has been no free fall but gradual down slide over time but still the dollar remains a major trading currency and a key world reserve currency. For many economists that is difficult to understand but only discloses that the dollar collapse is a complex, complicated, multifaceted and multidimensional issue. Therefore, it is necessary to understand this US dollar’s reserve currency status and its repercussions in the present world, seen from different dimensions.

Geopolitical dimension

The status of US dollar as the only international reserve currency, after WWII, has been the most important single factor behind the great power game and behind the changes in the polarity of the international system.

The reserve currency status has enabled the US to pile up a towering mountain of federal debt of about $28 trillion (in early 2021) — without having to worry about its own financial stability or repayment, at least until now. The US debt-to-GDP ratio is now amounting over 130%, bringing the US now to the same infamous category of Greece and Italy.

This “limitless running into debt” has enabled the US nearly “limitless military spending” as well as setting different sanctions worldwide, according to its political purposes. The US military budget is accounting for more than the combined next ten in the world and representing approx. 40% of the world total annually.

Now that more and more comments and prognosis on “dollar collapse” are emerging worldwide, it is very important to see and comprehend two basic “totalities” behind this subject:

- structures and factors, which are driving “pro or anti” dollar’s reserve currency status

- essential geopolitical consequences of “collapse – no-collapse” trajectories

When examining the essential geopolitical consequences of a possible collapse, the first and most profound impact is seen in the political-military balance of great powers and its instant, practical ramifications on the international scene worldwide. This is especially actual in hot spots like Taiwan, South China Sea, Middle East and Ukraine. Drastic and dramatic practical and principled changes will take place rapidly in all operational theatres globally. Even the polarity of the international system will transform into some new paradigm.

Economic outlook of the United States

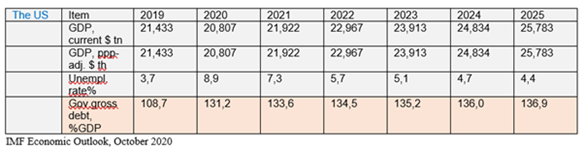

IMF (International Monetary Fund) released its economic outlook in October 2020, according to which the US has entered the “excessively-indebted states” category (Greece, Italy and alike), where the debt-to-GDP ratio exceeds permanently 130%.

In the framework of the US economy, there is a concern of huge and growing US government budget deficits and indebtedness, Fed’s excessive capital injections, dollar debasement and growing societal inequality noticing lurking inflation. It is noticeable that in the past twelve months, the US Government made $3,5 trillion (17% GDP) budget deficit, coupled with injection of $13,3 trillion in global central bank liquidity. All this massive policy stimulus continues to flow directly to Wall Street (making nearly weekly new all-time highs)inciting historic wealth inequality via asset bubbles.

In addition, the US trade deficit in goods worsened by 6% in 2020, to $916 billion, the biggest and worst deficit ever. Exportsof goods plunged by 13.2% to$1.43 trillion, the worst since 2010. Unemployment rate is still at high level (6,3% in January 2021 compared with 3,5% in January 2020 before pandemic) and the economic growth is stumbling due to pandemic lockdowns and recent arctic freezing winter temperatures in Texas and other 13 states, which will constrict effectively possible fragile economic growth.

The economists expect the inflation “mutating from Wall Street to Main Street” (financial inflation turning in real inflation) resulting in a pop in “everything bubble”. The present US situation of 2021 is comparable in many ways with the post-WWI Germany in 1918 (Weimar Republic), where large unemployment, depreciation of savings and even the Reichsbank’s monetization of state debt was similar with the present Fed’s monetary operations.

In late February 2021, some interesting “findings” can be summarized:

- Adding up all of the money the US has ever printed, over 40% of it was printed in 2020 alone

- In three months in 2020, the US increased its budget deficit by more than it had during the past five recessions combined (’73, ’75, ’82, early ‘90s and 2008 – 2009)

- Under Jerome Powell, the Fed bought more treasury bonds in six weeks than it did in 10 years under Ben Bernanke and Janet Yellen

- Agricultural commodities prices are up nearly 40% since August

- The Commodity Research Bureau’s Index is up 75% since April

- More recent indications of inflation: copper (10-year high), nickel (six-year high), lumber (all-time high)

However, the Fed claims that there are no signs of inflation and that some rising prices are due to “optimism” about the growing economy. Fed also claims that inflation expectations may be rising a bit but that no evidence that asset prices are “out of control.”

But now it seems to be getting worse, before it is worsening!

The Fed continues to print $120+ billion every single month and has announced it won’t raise rates for another two years (in 2022 to 2023). Putting it another way, the Fed is going to print another $2.8 trillion ($1.4 trillion per year for two years), while between this and the Biden administration’s $1.9 trillion stimulus program, there will be an infrastructure package and a climate change program of similar size range, thus about $7 trillion being printed in the next two years’ time. This sum, $7 trillion, is an amount equal to 33% of US present GDP.

Based on these staggering quantities, a number of economists see that the coming inflation is going to annihilate and destroy not only most investors’ portfolios but to put in essential danger the whole American society and will wreak havoc worldwide.

How long the US is able to print dollars and not to sink

Economists are hypothesizing the timetable of US dollar collapse in the cross sea of skyrocketing US national debt, pandemic, economic recession, extraordinary unemployment, exceptional climate conditions and massive Fed injections of “quantitative easing”. It seems curious that the greenback does not collapse, how heavily the Fed continues to inflate the dollar at accelerating pace, as if the dollar contradicted basic economic laws.

In about 24 months, Fed has injected in various ways approx. $ 4 trillion in the US economy, however the real inflation has been under 2%. There is no hyperinflation in the US because inflated money, in the end, does not reach the real economy at all. The solution can be found in the capitalization of the stock exchange and in general, the laws of economics are also confirmed. The infusion of massive quantities of dollars (by Fed) still causes inflation and it is quite consistent with the theoretical calculations: about 35% growth in the value of shares – this is exactly the real inflation.

The collapse of subprime bonds in 2008 showed that real estate can no longer be considered a long-term growing asset. The modern stock market is interesting precisely because it has a rather weak relation to the real economy. The share market does not fall, unlike the real sector, when rising prices mean an inevitable decline in consumption, stockbrokers are only happy about inflation. It is just a pleasure for them, it brings money, as it increases the value of their “capital” in the accounting statements.

Since there is no physical limit to growth for exchange rates, they thus become able to absorb almost any amount of “additional liquidity” without any problems. This creates such an amazing effect that the Fed inflates such a bubble that does not seem to burst and in fact Fed is profiting from that bubble. But this does not mean that the US can continue on this casual way forever. The drawing limit for the Fed still exists.

The first limit is the size of the US budget revenues. While the rate of tax collection in the US lags behind the rate of growth of public debt, that will overtake the budget. Debts need to be serviced. Today, more than 4% of the overall expenditure part of the budget is spent on this, which may seem a little. However, in reality the situation is quite different, due to the structure of the budget expenditure. After subtracting all the bound items (in 2020 US federal budget: social programs, military costs etc.) there will be only $ 871billion “free”, 16,9% of which is spent on debt service. The funny thing is that the US government no longer has this money, at all. The budget deficit reached 700 billion level and is going up to 1 trillion.

It is difficult to reduce government spending because of its essential role in the US GDP-formation. Axing here means an immediate loss in taxes, in the amount of GDP and therefore the government is forced to borrow even more. A classic vicious circle is formed.

Fed is trying to minimize the cost of debt service by reducing the cost of borrowing by lowering the discount rate – now equal to 0.25%. It is possible to print even at zero, but the trouble is that the yield of “treasuries” is the main source of money for pension funds and most local budgets of the US. They need a rate of at least 4.75–5.0% to continue fulfilling their obligations. The current 0,25% is far from enough.

To preserve the already contracted payments to current pensioners, the funds are forced to start gradually eating up the fixed capital. This may last for about 7 years but the termination of the acceptance of new contracts will take place already around 2024-2025. The Congressional Budget Office (CBO) has released a report on the results of an analysis of the prospects for public debt, taking into account all these points. The milestone for the beginning of a dollar default is approximately 2028 but for many practical reasons that moment comes much earlier.

Currency markets and exchange rate changes

Calm before the storm

US dollar exchange rates have so far been surprisingly stable during the pandemic since March 2020 but although the current stasis could last awhile, it will not last forever. With alternative assets such as gold and Bitcoin thriving in the pandemic, top US and European economists are predicting a sharp fall in the US dollar (low saving rate and current account deficit imply dollar depreciation) with the presumption is that in a present environment of greater global macroeconomic uncertainty, exchange rates should be shifting wildly.

The most plausible reason (of the calm situation) seems to be that all major central banks’ interest rates are at or near the effective lower bound (around zero) and leading forecasters believe they will remain there for many years, even in an optimistic growth scenario. Many central banks are now setting interest rates far below zero, at minus 3-4%. This suggests that even as the economy improves, it could be a long time before policymakers are willing to “lift off” from zero and raise rates into positive territory.

But the current stagnation will not last forever. Although the US still has enormous capacity to provide relief packages to hard-hit economy, the growing share of US public and corporate debt in global markets suggests growing fragilities. There is a fundamental inconsistency between an ever-rising share of US debt in world markets and an ever-falling share of US output in the global economy. This imbalance is right now growing at alarming pace.

Dollar standard slipping out of control

Market rumors have been telling for some time that something will replace the US dollar in the currency market. The dollar is on the brink of losing its status as the world’s main reserve currency. With a federal debt about $28 trillion, the US is now the largest debtor nation in the known world history and it is getting higher and higher every day.

The Chinese Global Times has told in late 2020 that Beijing may reduce its US debt holdings by 20 percent – from $1 trillion to $800 billion – amid the current tensions with Washington. China might even go as far as to sell all of its US bonds in an extreme case like a military conflict. If Beijing really decides to drop a fifth of its American debt holdings, it is going to put pressure on interest rates in the US. On the other hand, it will help Chinese authorities to strengthen the yuan, by selling US debt they sell dollars and therefore their currency goes up.

Major central bankers have been worrying for years about the US asset bubbles, which are now turning into “everything bubble”. The Fed is throwing money to keep it from popping but such bubbles are highly vulnerable to psychology. Investors believe that the Fed dare not let it implode – that the Fed has absolutely no option but go on throwing more and more money at it. Bubbles are one factor, but there are also emerging real concerns around the longevity of the US dollar as a reserve currency. Today, many expert bankers are really speculating that the dollar might lose its reserve currency status, which kind of discourse never took place five years ago.

There has been, even within certain US circles, some contrarian discussions. In 2014 (NYT article 28.8.2014), Jared Bernstein, Obama’s former chief economist said that the US dollar must lose its reserve status and he explained why: “New research reveals that what was once a privilege is now a burden, undermining job growth, pumping up budget and trade deficits and inflating financial bubbles. To get the American economy on track, the government needs to drop its commitment to maintaining the dollar’s reserve-currency status.”

Today, US explosive debt accumulation has created such a situation, where this disconnect should be done. There is already over $100 trillion in dollar-denominated debt worldwide, on which the US cannot default nor will it ever be repaid. It can therefore only be inflated away. That is to say the debt can only be managed through debasing the currency. This indicates that the present monetary system is ending, the US is no longer able to manage an economy with this much debt – simply by printing new currency and with its hands tied on other options like “eternal global warfare”. The debt situation already is unprecedented – and the pandemic is accelerating the process. It seems quite clear that things are starting to spin out of control.

Should confidence in the dollar begin to evaporate, all fiat currencies will sink in tandem – as G20 Central Banks are bound by the same policies as the US. China’s situation is complicated. It would in one way be harmed by dollar debasement but in another way, a general debasement of fiat currency would offer China and Russia the crisis (= the opportunity), to escape the dollar’s choke.

De-dollarization process

Ever since the dollar cemented its role as the world’s dominant currency in the 1950s, it has been clear that America’s position as the sole financial superpower gives it extraordinary influence over other countries’ economic destinies. But under presidency of Donald Trump, the US has used its powers routinely and to their full extent, by engaging in financial warfare. They have in turn prompted other countries to seek to break free of American financial hegemony. This topic has been closely studied in the section of “dollar and de-dollarization” on this website.

Warning events to remove the US dollar as a reserve currency

As generally known, for every action, there is an equal and opposite reaction. In the case of international trade and global payments, the US has made large and aggressive use of sanctions and tariffs. Now,a series of equal and opposite reactions are occurring as nations move to remove the role of the US dollar at the center of global trade and finance.

This trajectory will have a long-lasting structural impact in ending the dominance of the dollar as the world’s reserve currency. The US sanctions regime has caused, directly or indirectly, a number of governments around the world taking countervailing steps to remove their reliance on the dollar-based global trade and finance system. This matter has been studied in details in the section of “sanctions and trade wars” on this website.

In November 2020, fifteen Asian countries, comprising 30% of global GDP, signed the Regional Comprehensive Economic Partnership (RCEP), creating a world’s largest free-trade zone among the signatories. Beyond the obvious benefits for economic growth in the region, a more-subtle byproduct of this agreement is to focus on bilateral settlement of trade, effectively removing the dollar as the standard unit of transaction for regional trade. Under RCEP, currency choices for regional settlement in trade, investment and financing will increase significantly for the yuan, yen, Singapore dollar and Hong Kong dollar.

Asia is not the only region taking steps to disentangle itself from the US dollar standard in global trade and payments. The European Commission, the executive branch of European Union (EU), released a communication explicitly stating the goal to strengthen the “international role of the euro.” This document outlines specific action items to help move the EU in this direction of more autonomy from the current dollar-centric system. The implementation of a digital finance strategy will be a key component of this new EU strategy.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT), the largest global payment settlement network, has already experienced drop-off in dollar transactions in its most-recent readings. It is interesting that this occurred after the implementation of RCEP (since late 2020), although the timing also comes in the wake of the COVID-19 pandemic and resulting economic disruptions.

An additional element to watch will be the allocation of global central banks’ foreign currency reserves to the dollar. Non-dollar currencies recently have strengthened as the dollar has sold off. Historically, the bulk of international reserves has been in the dollar. Data published by the European Central Bank (ECB) and the International Monetary Fund (IMF) show a decline in the dollar as a percentage of total currency reserves since 2016.

Russia’s multi-year drive to reduce exposure to US dollars has pushed the share of gold in Russia’s $583 billion international reserves (in late 2020) above dollars for the first time on record. This is in alignment with President Putin’s strategy to de-dollarize Russia’s economy. The yellow metal is now the second-largest component of the central bank’s reserves after euros, which make up a third of its reserves. Chinese yuan reserves make up 12 percent. China as well understands what is at stake and has increased its gold holdings and has instituted controls to prevent gold from leaving China. Officially Russia’s gold holdings are ranked as the fifth in the world and China’s as the sixth, both countries are actually stockpiling their physical gold bullions in their domestic vaults, while the Western countries typically own derivatives of gold, whereupon the real physical gold may be at large anywhere.

The increase in the value of gold comes as a victory for Moscow’s gold policy, which moved vast sums away from fiat currency and toward the commodity. In the last five years, the country has spent more than $40 billion building up a massive pile of gold, protecting state finances from currency volatility and external sanctions. In September 2014, Russia’s gold holding was just 10 percent of the country’s entire forex reserves, now the proportion stands at 23 percent, with 2.299,9 metric tons. In March 2020, Russia’s central bank announced that it would stop buying gold, leading some analysts to believe the country’s mining operations would start selling their metal abroad while the price is high and going up. The prediction turned out to be correct, as the second quarter of 2020 saw the value of gold sales to foreign buyers overtaking gas exports for the first time since at least 1994.

The dollar is already contending with structural headwinds. One is the large stock of international savings on deposit and invested in the US and here a decline in the value of the dollar risks creating a negative feedback loop where hedging and capital outflows can exacerbate the dollar’s decline. Another is the weakening fundamental picture for the dollar due to America’s widening of the current account deficit and a growing budget deficit. These headwinds are likely to persist for the foreseeable future – not to mention being exacerbated by the aforementioned regional trade agreements and international policy actions.

The pendulum is swinging in the direction of a new, multipolar world

The implementation of more regional trade agreements with local currency settlements means that the dollar’s once-dominant role in global finance likely will continue to erode. The share of national currencies in Russia-China trade is steadily increasing. In the first quarter of 2020, the share of the dollar in trade between the countries fell below 50 percent for the first time, while just four years ago the greenback accounted for over 90 percent of their currency settlements. The 54 percent of non-dollar trade is made up of Chinese yuan (17 percent), the euro (30 percent), and the Russian ruble (7 percent). The parties inked an intergovernmental agreement to switch to national currencies in bilateral trade in early 2019. The two nations also announced the ambitious goal of doubling the volume of trade to $200 billion by 2024.

Movement away from the dollar can also be seen in Russia’s trade with other parts of the world, such as the European Union. Since 2016, trade between Moscow and the bloc has been mainly in euros. Russia has called on the members of the BRICS trade alliance (Brazil, Russia, India, China, and South Africa) to increase the volume of settlements in national currencies to be more independent from the dollar. The trade in national currencies is a key aspect of the cooperation of the five-nation alliance, which can utilize the BRICS’ New Development Bank (NDB) specifically created for these purposes.

China, Russia and many of the Shanghai Cooperation (SCO) countries have been trading for many years already in their local currencies, or in yuan, especially cross-border trading but they are also promoting currency swap arrangements with other countries, eager to escape sanctions of the United States. China and Russia have enlarged the use of their national currencies and other financial arrangements and organized several other countries along with their scheme. In early 2020 the following countries are at least partly applying “de-dollarization procedures”, besides China and Russia: EU, Iran, Turkey, Malaysia, South Korea, India, Qatar, South Africa, Venezuela, Japan, Nigeria, Cuba and EAEU countries.

The central banks of China and Canada have renewed a bilateral currency swap agreement for a five-year period, in mid-January 2021. China is organizing various bilateral currency and financial arrangements, in the context of BRI, with tens of African countries as well as with some Latin American countries. Movement away from the dollar can also be seen in Russia’s trade with other parts of the world, such as the European Union. Since 2016, trade between Moscow and the bloc has been mainly in Euros, with its current share sitting at 46 percent.

With the dollar facing collapse, what are the candidates to replace it?

The US economy has been hit hard by Covid-19, with the Fed pushing for quantitative easing and nearly-zero interest rates to help American society and companies offset the pandemic’s impact. But the flipside of America’s economic slide is that the stability of the dollar as a global reserve currency is now being called into question. The world’s financial system has been dependent on dollar since the 1944 Bretton Woods accord that cemented its role as the global currency, while pegging others to it. But with many global reserve managers now ditching the dollar, what are the most realistic alternatives to the greenback?

Euro, led by the European Union

The Euro remains the second-most held currency in foreign exchange reserves, making it a real competitor to the dollar. It is a multilateral medium of exchange with its own central bank, which is used in nearly a third of all foreign exchange transactions. However, following the European debt crisis in 2009, the euro has remained in a rather weak position. Attempts to mitigate the consequences of the economic slowdown have been offset by disagreements between Northern European countries and those nations in the south and east of Europe over the most appropriate stimulus package to use. Even with the overarching power of the European Central Bank over monetary policy, the EU still lacks a shared fiscal approach.

Asian currencies

Some economists suggest that the Japanese yen and Chinese yuan (renminbi) can now be seen as potential alternatives to the dollar. The Japanese currency has remained one of the world’s most popular reserve currencies for a long time, making up nearly 6% of official foreign exchange reserves in 2019. However, it remains a victim to massive asset purchases by the Bank of Japan which owns nearly half of the country’s huge national debt. With persistent deflation, the country may not be willing to actually see the yen rising much in value, analysts note, in order to keep Japanese companies competitive in international markets.

China is a growing challenger to the United States as an economic power. According to IMF estimates, it may have already overtaken the US in terms of its massive GDP (in PPP terms yet). Despite the yuan’s advances, the currency is still too closely dependent on the monetary policies of the People’s Bank of China, something which prevents it from going truly global, analysts suggest. So far, the yuan accounts for just 4% of foreign exchange transactions, according to recent estimates. However, with the dollar’s mounting decline, and China’s rise as a leading economic power, the role of its currency may contribute to its position as a universal store of value in the future.

China is also projected to dominate the whole 21st century, like the US did after World War II, according to many analysts. The US now resembles Great Britain after World War I, when the dollar took the place of the British pound. The yuan can be seen as the major currency of the world and the dollar becoming the pound, getting pounded down

The People’s Bank of China has agreed a partnership with the global interbank settlement organization SWIFT, as part of an effort to internationalize the yuan and develop a digital Chinese currency. The new entity, Finance Gateway Information Service, was registered in Beijing on January 16, 2021. SWIFT is the largest shareholder (with 55 percent) while the Chinese side owns the rest. The joint venture emerged after concerns were raised that the US might cut off China or Hong Kong from the SWIFT financial payment network as a result of the Trump administration’s sanctions over the Hong Kong autonomy issue. One of the main goals of this joint venture is to help internationalize the yuan.

Gold – an ultimate and eternal measure of value

As the world grapples with Covid-19, precious metals’ prices are pushing higher. Market speculators bet on the US dollar’s collapse and when it does, gold is going to take its place. The yellow metal will resume its role at the center of the monetary system and the world is going back to a gold standard whether the Federal Reserve wants it or not.

The price of gold indeed has been rising to new heights during coronavirus pandemic. For many pundits, it is gold that is set to take dollar’s place as the global reserve currency. Gold has real and intrinsic value but is also a physical object that is not going to fall victim to central banks printing money for funding needs, risking hyperinflation. Instead, the process of gold extraction is expensive and complicated, signaling stability in inflation rates. However, in the modern digitalized world, the “eternal”, physical measure of value, seems not to be suitable for a generally accepted flexible, modern measurement of the value.

Special Drawing Rights (of IMF)

Known as SDRs, these supplementary foreign exchange reserve assets have been created and maintained by the International Monetary Fund (IMF) since 1969. Not a currency per se but a claim to one, SDRs are based on an adjustable basket of key currencies and are easily accessible to all nations. They can act as a universal reserve asset but not as a direct measure of exchange though. On a downside, with its strong position in the IMF, Washington still has the primary power to veto all allocations of SDR it does not approve of.

The official Beijing position is that the US dollar should be replaced by an IMF-approved Special Drawing Rights (SDR) basket of currencies (dollar, euro, yuan, yen). That would eliminate the heavy burden of the yuan as the sole reserve currency. But it seems that this Chinese statement is only a tactical position in the long run political game, run by Beijing.

Cryptocurrencies

Following a recent scandal with fake gold bars in China, many crypto enthusiasts argued that such a scenario would have never happened with digital currencies such as Bitcoin, Bitcoin Cash, Ether or Tether. They are decentralized, have no physical back-up and cannot be counterfeited. But these same arguments are often used against them – cryptocurrencies are prone to manipulation and are extremely volatile, critics say. These doubts prompted global investment bank Goldman Sachs to declare in May 2020 that cryptocurrencies should not be even recognized as an “asset class”. A recent bitcoin scam on Twitter also did not quite add to crypto reputation around the world. It seems that Bitcoin is to majority of people a more like “pyramid scheme” than seriously taken means of payment or investment object.

Chinese solution – a digital yuan or renminbi (RMB)

In late spring 2020, the People’s Bank of China (PBOC) governor Yi Gang confirmed the on-going trials in electronic payment in four different Chinese regions using a new means of payment, the digital yuan. The PBOC is developing the system with four top state-owned retail banks as well as major payment companies and the mobile app is already circulating on WeChat. Moreover, some 20 restaurants and retail establishments are part of the pilot testing. There is no timetable yet for the official launch of what is officially called the Digital Currency Electronic Payment (DCEP) but it may be offered to the public in 2021 and the new sovereign digital currency might be ready in time for the 2022 Winter Olympics. The digital yuan or renminbi (RMB) is not a cryptocurrency like Bitcoin but an experimental currency issued and run by China’s central bank and projected to replace paper money.

Analysts say it may even shift the global balance of economic power. DCEP should be interpreted as the road map for China leading to an eventual, even more groundbreaking replacement of the US dollar as the world’s reserve currency. China is already ahead in the digital currency sweepstakes: the sooner DCEP is launched the better to convince the world, especially the Global South, to tag along. China is advancing fast on the whole digital spectrum. A Blockchain Service Network (BSN) was launched not only for domestic but also for global trade purposes.

The beefsteak of this matter is that the digital, sovereign yuan may be backed by gold, in one way or other(technically). That is not confirmed yet but that is a generally accepted “best estimate” by economic experts. According to “certain market rumors”, China has a massive unconfirmed monetary gold-holding, even up to 20.000 metric tons (officially China’s quota is 1.948 metric tons). Once Beijing announces a digital currency backed by gold, it will be like the US dollar being struck by lightning.

Anyway, the digital yuan will be effectively backed up by the massive amount of “Made in China” goods and services and the value of the digital yuan will be decided by the market as it happens with bitcoin. This whole process has been years in the making, part of serious discussions started already in the late 2000s inside BRICS summit meetings, especially by Russia and China – the core strategic partnership inside the BRICS.

A key advantage of a sovereign digital yuan is that Beijing does not need to float a paper yuan. The digital yuan, using blockchain technology, will automatically float, thus bypassing fully the US-controlled global financial structure. The number of digital yuan is fixed, which in itself eliminates a plague: quantitative easing (QE), as in helicopter money and that leaves the digital currency as the preferred medium for trade, with currency transfers unimpeded by geography and the icing on the cake, without banks charging outrageous fees as intermediaries.

The digital yuan has the potential to be a gamechanger when it is rolled out fully. By ending the world’s reliance on the dollar, it will alter the geopolitical landscape forever. China will create a digital currency system that can be entirely out of reach for US authorities, meaning America’s financial sanctions would have little effect. If the digital yuan gets widely adopted across the world, many countries could opt for renminbi as an alternative to the dollar for international clearing and settlement services.

If the US sanctions a company or individual, it effectively cuts them off from the global financial system. The banks who serve these individuals rely on the dollar and thus face penalties if they violate the sanctions. This demonstrates the global strength of the dollar, but also shows how the digital yuan may change the current landscape. The creation of a new international medium of transaction means that financial institutions, companies and governments now have a new avenue to do business without having to use dollar transactions. For countries like Iran and Venezuela, heavily targeted by US sanctions, it is an obvious way out.

Experts say China’s plans have triggered concerns about a new threat to US financial dominance. It might be possible to transfer the digital currency across borders without going through dollar-based international payment systems. The digital yuan could encourage other countries and people overseas to get on board with China’s technology and currency. It is possible that other countries adopt the China framework and then a first-mover advantage turns into a strong network effect, which is the best-case scenario for China.

In his article, “Towards a New Gold Standard? Or a Currency War with China? Peter Koenig analyzed meritoriously the present and emerging situation in the currency market, in October 2020. Here below the excerpts of the article.

It is unlikely that the collapse of the dollar will come overnight, as still too many countries depend on the dollar. On the other hand, China’s foreign exchange reserves have just increased to $ 3,1trillion equivalent, of which about 1.3 trillion denominated in US-dollars. The Chinese yuan (renminbi, RMB) could become the world’s third largest reserve currency, after the US-dollar and the euro, surpassing the Japanese yen and the British pound by the end of 2021. According to Morgan Stanley, at least 10 regulators (Central Banks and similar institutions) added the yuan to their reserves in 2019, bringing the total to 70 – and the number is rising. According to the Fed, the US economy could lose in excess to one third of its GDP up to mid-2021, while China’s economy is expected to grow by 1.3% (IMF) in 2020, and by China’s own estimate up to 3.5%.

Given the dismal Covid-related world economy collapsing and with China being the only major economy expected to grow this year, the number of yuan reserve holders may increase drastically by the end of 2020 and especially through 2021, suggesting that central banks around the world realize that for their financial stability, they must increase their yuan holdings significantly in the foreseeable future. This means shedding other reserve currencies, like the Japanese Yen, the British Pound but especially the US-dollar. For example, Russia has dumped the dollar reducing the dollar debt-holdings by 96%.

Many American economists like Stephen Roach of Yale University says coronavirus may cause a dramatic decline of the US dollar value in the near future, even a 35% drop of the dollar against major international currencies. In this situation China is preparing to launch a new international currency, the digital, possibly gold-backed, digital yuan (RMB) as an international means of payment and reserve currency, completely outside the dollar-dominated SWIFT system.

The People’s Bank of China recently revealed plans to have its sovereign digital currency ready in time for the 2022 Winter Olympics. The international rollout could actually happen much earlier, possibly in 2021, if warranted by international monetary events. In any case, the new trading currency may very likely find an astounding attraction by many countries that are eager to de-dollarize and get out from the threats of sanctions by Washington.

Any fiat money or legal tender that will grow into a major international trading and reserve currency needs to be backed by a strong economy. Backing of a strong economy is fully commensurate with the yuan. China’s economy today in real and solid output and long-term stability can easily be assessed as the world’s strongest.

Comparing the Chinese GDP with the US GDP is like day and night: The Chinese GDP consists of more than two thirds of tangible and solid production and construction of infrastructure, housing, transport, energy and so on, while the US GDP is almost the reverse, more than half is consumption and service industries. Most hard US production is outsourced. This undoubtedly distinguishes the yuan (RMB) from other fiat currencies, as are the dollar and the euro – which are backed by nothing. Simply put, China’s economy and her currency attract a lot of international trust and confidence.

These are good reasons for the new digital yuan/RMB to grow fast as a primary trade and reserve asset for many countries. Not only would the number of countries holding the Chinese currency in their reserve coffers increase rapidly but the total amount of yuan reserve holdings might skyrocket faster than analysts expect, signaling clearly the end of the US-dollar hegemony. This might undoubtedly shift the global balance of economic power.

“Looking back years later, the two defining historic events of 2020 would be the coronavirus pandemic and the other would be China’s digital currency,” Xu Yuan, a senior researcher with Beijing’s University’s Digital Finance Research Centre told recently in the South China Morning Post.

These developments are not ignored by Washington. The US is not going to give up its dollar hegemony which means largely control over the world’s economy and financial flows. Although the times of total dollar-control of the world economy are irreversibly gone, Washington intends to slow down the power shift as long as possible. Though a hot war is not excluded, more likely is a currency war, which is then presented by Koenig in a scenario.

In order to avoid such a scenario, a possible currency war, China, as a holder of large direct and indirect gold reserves, may consider establishing a “gold commodity” market priced in yuan / RMB and invite other large gold producers, like Russia, Venezuela, South Africa and others not in the US orbit, to join in an alternative currency, a yuan-denominated gold market. This alternative currency denominated gold would be strengthened by the power of the respective economies which would back it.

In the end game, the international trust in the respective economies and their currencies – gold backed or not – will determine the outcome of a possible currency confrontation. China, already engaged in cross-border trading in local currencies and expanding yuan-trading arrangements internationally, for example, with currency swap measures in place with Russia, Iran, Venezuela and many others, would be well placed to break the US-currency hegemony. The final goal should not to be replacing one hegemon with another domineering power but to establish a balanced world with several regional hubs or financial centers which would promote a monetary equilibrium in the multipolar currency world.

When looking now (end of February 2021) around, it is obvious that “something is really occurring”. Political tectonics are moving rapidly, not the least in the Middle East, where also all minor pieces are moving, impacting on political relations of different countries as well as on economic relations including currencies. The Gulf Arab states are taking distance from the US. Perhaps China’s grand strategy is to watch and wait while the US goes bankrupt. China may have smelled for that there seems to be a heavy order for “petroyuan & digital yuan”. Let’s see!

Fiat currency as a reserve currency

Fiat currencies, especially in the case of reserve currency status, thrive for one key reason: because of trust. They are trusted to be reliable stores of value and unquestioned as to their role in payment for goods and services. In the case of reserve currency, the role of safe heaven is also very important. But the problem of any fiat currency – the US dollar included – is that you can print so long as your counterparties go on trusting. Lose the trust and the Fed loses the power to “buy now, pay later,” even if gradually.

Loss of trust in a fiat currency may not happen overnight but once happened, you do not need a fancy econometric model to predict the consequence: higher inflation! Were inflation to re-appear and rates to move higher, the Fed might regret the careless way dispersing trillions.

So, just how long can the current monetary regime last with the US dollar as a reserve currency?

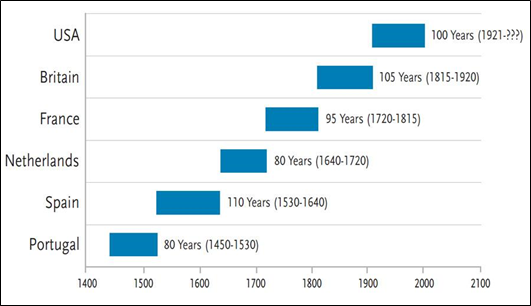

According to the historical observations, the answer is a hundred years approximately.

Source: Monetary Gold, www.stansberryresearch.com , www.zerohedge.com

What is your assessment on this situation?

How long can the current monetary system last with the US dollar as a reserve currency?

When the collapse of US dollar may happen … or will it happen at all?

Please, do not hesitate to email me your short, witty comments. I can also publish those comments (on your permission, of course) or make some combined summaries.