De-dollarization

selection of links to articles studying international currency market, de-dollarization and other events and processes regarding currencies

US debt moving toward $50 trillion isn’t whole story

As the real figure far exceeds that, Washington will make it easy for Global South states to sideline the dollar

Asia Times, article by William Pesek June 21, 2024

WASHINGTON – The most disturbing thing about forecasts that the US national debt will hit $50 trillion by 2034 is that the true figure surely will be much bigger.

The Congressional Budget Office noted that the federal debt will hit 122% of gross domestic product a decade from now, dwarfing America’s fiscal position after World War II. Funding the biggest drivers – defense, social safety net outlays and giant tax cuts unmatched by revenue increases – will only become costlier over time. Never mind if a deep recession or serious military conflict further alters this trajectory.

Petrodollar Dead? Rumors Swirl as Moneyed Powers Go All in for the Final Roll

Some really interesting developments are happening apropos the banking and financial situation in Russia and the world.

Firstly, to set the stage: there’s the rumor going around that Saudi Arabia has allegedly declined to renew its purported “50-year Petrodollar deal”, signed—again, allegedly—on June 9th, 1974.

USD, Bitcoin, and Gold: What Saudi Arabia’s End to Petrodollar Agreement Means

June 14, 2024 By NEWS WIRE

The established financial world order of the past 50 years is now transitioning to a new and unknown paradigm as the petrodollar agreement between the U.S. and Saudi Arabia was allowed to expire this past Sunday.

The term ‘petrodollar’ described the U.S. dollar’s (USD) role as the currency used for crude oil transactions on the world market. It traces back to the early 1970s when the United States and Saudi Arabia struck a deal shortly after the U.S. went off the gold standard – and the agreement has had far-reaching consequences for the global economy.

Escobar: De-Dollarization Bombshell – The Coming Of BRICS+ Decentralized Monetary Ecosystem

ZeroHedge by Tyler Durden Thursday, May 16, 2024 – 06:40 AM

Welcome to The Unit – a concept that has already been discussed by the financial services and investments working group set up by the BRICS+ Business Council and has a serious shot at becoming official BRICS+ policy as early as in 2025. According to Alexey Subbotin, founder of Arkhangelsk Capital Management and one of the Unit’s conceptualizers, this is a new problem-solving system that addresses the key geoeconomic issue of these troubled times: a global crisis of trust.

Why Gold Is Flowing From West To East

Video by GoldCore, Thursday, May 16, 2024 – 18:15

The BRICS Currency Project Picks Up Speed

Mises Wire, July 17, 2023 by Thorsten Polleit

https://mises.org/wire/brics-currency-project-picks-speed

On Friday, July 7, 2023, news broke in the financial market media that the “BRICS” (that is, Brazil, Russia, India, China, and South Africa) will implement their plan to create a new international currency for trading and financial transactions, and that this new currency will be “gold-backed”.

Most recently, on June 2, 2023, the foreign ministers of the BRICS – as well as representatives from more than 12 countries – met in Cape Town, South Africa (interestingly at the “Cape of Good Hope”). Among other things, it was emphasized that they wanted to create an international trading currency. Undoubtedly, this is an undertaking that could have consequences of epic proportions.

After all, the BRICS countries represent about 3.2 billion people, approximately 40 per cent of the world’s population, with a combined economic output nearly the size of the economy of the United States of America. And there are also many other countries (such as Saudi Arabia, United Arab Emirates, Egypt, Iran, Algeria, Argentina, and Kazakhstan) that might want to join the BRICS club.

The goal of the BRICS countries is to reduce their economic and political dependence on the US dollar, challenging “US dollar imperialism”. To this end, they want to create a new international currency for commercial and financial transactions, replacing the US dollar as the means of transaction unit.

The reason is obvious. The US administration has on many occasions used the greenback as a “geopolitical weapon” and engaged in a kind of “financial warfare”: Washington sanctions enemy countries by denying them access to the US dollar capital market, but above all, it shuts them off from the international US dollar-centric payment system.

The freezing of Russia’s currency reserves (the equivalent of almost 600 billion US dollars is currently at stake) has set off alarm bells in many non-Western countries. It has reminded a number of them that holding US dollars comes with a political risk. This, in turn, has prompted many to restructure their international foreign reserves: holding fewer US dollars, switching to other (smaller) currencies, but above all, buying more gold.

But how might the BRCIS manage to swim away from the US dollar? While no details are available yet about how the new BRICS currency might be structured, it should not stop us from speculating about what lies ahead.

The BRICS could establish a new bank (the “BRICS-Bank”), funded by gold deposits from BRICS central banks. The physically deposited gold holdings would be shown on the asset side of the BRICS bank’s balance sheet – and could be denominated, for example, “BRICS-Gold”, where 1 BRICS-Gold represents 1 gram of physical gold.

The BRICS-Bank can then grant loans denominated in BRICS-Gold (for example, to exporters from BRICS countries and/or to importers of goods from abroad). To fund the loans, the BRICS-Bank makes a credit contract with the holders of BRICS-Gold: The holders of BRICS-Gold agree to transfer their deposit to the BRICS-Bank for, say, one month, or one or two years, against receiving an interest rate. What is more, the BRICS-Bank, and it can also accept further gold deposits from international investors, who can hold (interest-bearing) BRICS-Gold deposits this way.

BRICS-Gold could henceforth be used by the BRICS countries and their trading partners as international money, as an international unit of account in global trade and financial transactions. Incidentally, the new de facto gold currency would not even have to be physically minted but could be and remain an accounting-only unit while being redeemable on demand.

The exporters from the BRICS countries and the other member countries would, however, have to be willing to sell their goods against BRICS-Gold instead of US dollars and other Western fiat currencies, and the importers from the Western countries would have to be willing and able to pay their bills in BRICS gold.

How do you get BRICS-Gold? Those demanding BRICS-Gold must either get a BRICS-Gold loan from the BRICS-Bank or purchase gold in the market and deposit it with the BRICS-Bank or a designated custodian, and the gold deposit is then credited to his account in the form of BRICS-Gold.

For example, in payment transactions, the goods importer’s BRICS-Gold deposits (held, for example, at the BRICS-Bank) are credited to the account of the exporter of goods (also held at the BRICS-Bank or at a correspondent bank or gold custodian).

However, the transition, the use of BRICS-Gold as an international trade and transaction currency, would most likely have far-reaching consequences:

(1.) It would presumably lead to a (sharp) increase in the demand for gold compared to current levels, with not only gold prices measured in US dollars, euros, etc. but also in the currencies of the BRICS countries increasing (substantially).

(2.) Such an increase in the gold price would devalue the purchasing power of the official currencies – not only the US dollar but also the BRICS currencies – against the yellow metal. Also, the prices of goods in terms of the official fiat currencies would most likely skyrocket, debasing the purchasing power of presumably all existing fiat currencies.

(3.) The BRICS countries would build up gold reserves to the extent that they run, or will run, trade surpluses. They would presumably be the winners of the “currency switch”, while the countries with trade deficits (first and foremost, the US) would lose out.

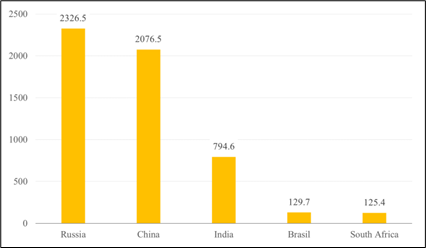

BRICS official gold holdings, in billion US dollars, Q1 2023

These few considerations already show how disrupting the topic of “creating a new gold-backed international trading currency” could be: The BRICS could well trigger landslide-like changes in the global economic and financial structure. Still, it will be interesting to see how the BRICS countries intend to proceed at their August 22-24 meeting in Johannesburg, South Africa.

Author:

Dr. Thorsten Polleit is Chief Economist of Degussa and Honorary Professor at the University of Bayreuth. He also acts as an investment advisor.

Russian Ruble relaunched linked to Gold and Commodities – RT.com Q and A

Bullionstar, By Ronan Manly, April 1, 2022

With Russia’s central bank having just profoundly altered the international trade and monetary system by linking the Russian ruble to both gold and commodities, the journalists at RT.com in Moscow asked me to write a Q and A article on what these developments mean, and the ramifications of these changes on the Russian ruble, the US dollar, the gold price and the global system of currencies. This article has been published on the RT.com website.

The Coming Global Financial Revolution. Russia Is Following the American Playbook

The Unz Review, By Ellen Brown • April 5, 2022

No country has successfully challenged the US dollar’s global hegemony—until now. How did this happen and what will it mean?

Michael-Hudson.com, By Michael Hudson, Thursday, April 7, 2022

It is now clear that today’s escalation of the New Cold War was planned over a year ago. America’s plan to block Nord Stream 2 was really part of its strategy to block Western Europe (“NATO”) from seeking prosperity by mutual trade and investment with China and Russia.

Russia calls for integrating BRICS payment systems

Reuters , April 9, 2022

April 9 (Reuters) – Russia, hit by Western sanctions, has called on the BRICS group of emerging economies to extend the use of national currencies and integrate payment systems, the finance ministry Siluanov said on Saturday. Sanctions have cut Russia off from the global financial system and from nearly half of its gold and foreign exchange reserves, which stood at $606.5 billion in early April. On Friday, Finance Minister Anton Siluanov told a ministerial meeting with BRICS, which consists of Brazil, Russia, India, China and South Africa, that the global economic situation had worsened substantially due to the sanctions, the ministry’s statement said.

ZeroHedge April 10, 2022

The dollar reserve system is facing its greatest threat yet. Russian Finance Minister Anatoly Siluanov said on Saturday that the five BRICS countries – Brazil, Russia, India, China and South Africa – could mitigate the backlash of Western sanctions against Russia on their economies by pooling their efforts and using a range of financial instruments at their disposal.

Financial war takes a nasty turn

By Alasdair Macleod, Goldmoney Staff May 05, 2022

The chasm between Eurasia and the Western defense groupings (NATO, Five-eyes, AUKUS etc.) is widening rapidly. While media commentary focuses on the visible side of the conflict in Ukraine, the economic and financial aspects are what really matter.

By imposing sanctions on Russia, the West has effectively lined up its geopolitical opponents into a common cause against an American dollar-dominated faction. Russia happens to be the world’s largest exporters of energy, commodities, and raw materials. And China is the supplier of semi-manufactured and consumer goods to the world. The consequences of the West’s sanctions ignore this vital point.

In this article, we look at the current state of the world’s financial system and assess where it is headed. It summarizes the condition of each of the major actors: the West, China, and Russia, and the increasing urgency for the latter two powers to distance themselves from the West’s impending currency, banking, and financial asset crisis.

China Has ‘Financial Nuclear Bombs’ If West Levies Russia-Style Sanctions, Beijing Warns

by Tyler Durden

Saturday, May 07, 2022 – 05:00 AM

Multiple analysts at Chinese state-linked think tanks and banks have weighed in on the Biden administration’s recent threats to punish the world’s second-largest economy over China’s refusal to condemn Russia’s war in Ukraine, and amid US charges that it could be helping Moscow evade sanctions, or even quietly resupplying Putin’s military machine (charges which at this point have remained without evidence). However, China is taking note and studying its own preparedness and future options in the wake of the US drastic measure of freezing Russia’s central bank assets overseas.

On the Dawn of a New Global Financial System

April 15, 2022, Pepe Escobar; The Cradle / Consortium News

Pepe Escobar interviews the Eurasia Economic Union’s Sergey Glazyev, a man in the eye of our current geopolitical and geo-economic hurricane. Sergey Glazyev is a man living right in the eye of our current geopolitical and geo-economic hurricane. One of the most influential economists in the world, a member of the Russian Academy of Sciences and a former adviser to the Kremlin from 2012 to 2019, for the past three years he has helmed Moscow’s uber strategic portfolio as minister in charge of integration and macroeconomics of the Eurasia Economic Union (EAEU).

Stock plunge could become dollar death spiral

by David P. Goldman May 7, 2022

Stock sales financed soaring US trade deficit

America’s soaring trade deficit, now running at a record $1.32 trillion annual rate, requires the US to sell paper to its foreign suppliers in return for goods. Most of the paper the US sold to foreigners during the past few years was equity in US corporations, rather than government or corporate bonds. Valuations in the US stock market soared as the Federal Reserve forced interest rates lower, by reducing its short-term lending rate to zero and by purchasing $6 trillion of Treasury securities.

Protection From A Currency Collapse

by Tyler Durden

Sunday, Jun 12, 2022 – 02:30 AMWhile markets seem becalmed, financial conditions are rapidly deteriorating. Last week Jamie Dimon of JPMorgan Chase gave the clearest of signals that bank credit is beginning to contract. Russia has consolidated its rouble, which has now become the strongest currency by far. The Fed announced the previous week that its balance sheet is in negative equity. And there’s mounting evidence that we have a nascent crack-up boom.Russia now appears to be protecting the rouble from these developments in the West, while previously she was only attacking the dollar’s hegemony. China has yet to formulate a defensive currency policy but is likely to back the renminbi with a commodity basket, at least for foreign trade. If it is taken up more widely by the members if the Shanghai Cooperation organisation and the BRICS, the development of a new commodity-based super-currency in Central Asia could end the dollar’s global hegemony. These are major developments. And finally, due to widespread interest in the subject, I examine the outlook for residential property valuesin the event of a collapse of Western fiat currencies.

THE ANATOMY OF INFLATION (published print version)

June 21, 2022 by jackrasmus

by Dr. Jack Rasmus

Copyright 2022

The focus of the US media and economists for the past several months has been increasingly on inflation. In recent weeks, however, US policymakers awoke as well to the realization that inflation is chronic, firmly embedded, and growing threat to the immediate future of the US economy.

BRICS Summit

June 24, 2022, The Saker

Vladimir Putin took part in the 14th BRICS Summit, held via videoconference and chaired by China. The meeting’s topic is Foster High-Quality BRICS Partnership, Usher in a New Era for Global Development. President of Brazil Jair Bolsonaro, President of the People’s Republic of China Xi Jinping, Prime Minister of India Narendra Modi, and President of the Republic of South Africa Cyril Ramaphosa are also taking part in the meeting.